2017 Year End Summary & 2018 Outlook

2017 Year End Summary & 2018 Outlook

January 17th, 2018

Before we dig into our year end summary and 2018 outlook, we are very excited to announce the addition of two new team members! Kirk Price, Managing Partner, and Angela Cruz, Client Relationship Manager both come to us from Raymond James and add over 40 years of combined experience and deep expertise to Meridian Wealth Advisors. Meagan and I both worked alongside Kirk and Angela for many years at Raymond James, and could not be more excited and honored to have them as part of the team. We not only welcome Kirk and Angela to the Meridian Family, but also the many wonderful clients that have followed them.

2017 Recap: Let’s Reminisce for a Minute

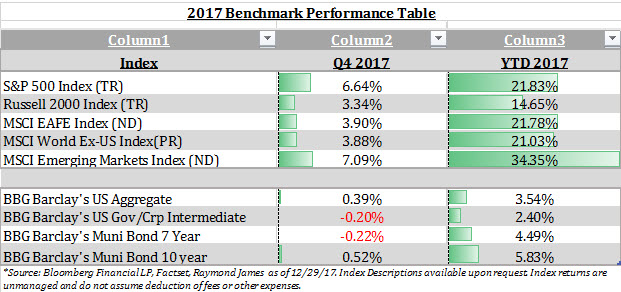

2017 was a year that surprised many in terms of both economic and financial market results…and what a year it was! Spurred by slow but steady improvement in most economic indicators (both domestically and abroad), optimism surrounding tax reform, low inflation and continued accommodative global monetary policy, equity markets around the world delivered exceptional returns. Fixed income markets remained stronger than expected despite the Federal Reserve raising rate three times, while gold and oil both quietly rallied double digits.

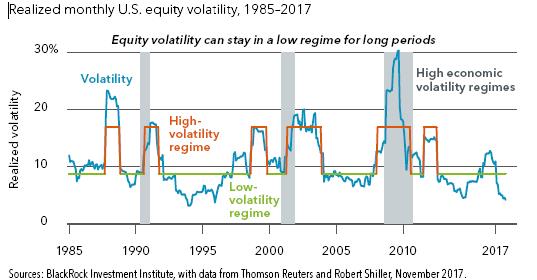

Surprisingly, domestic equity markets experienced extremely low volatility throughout the year, with the VIX index recording nine of the ten lowest readings on record and the S&P 500 Total Return Index rising every single month of the year (and fourteen months in a row). Large capitalization companies led the march upward, with the FAANG stocks (Facebook, Amazon, Apple, Netflix and Alphabet) once again leading the way with an average return of 48.6%.

Globally, the MSCI World Ex-US index rose 21.03% on price return basis, as international economies on the whole continued to improve. Japan rose 19%, Hong Kong’s Hang Seng 36%, Emerging Markets 34% and Europe 26%.

Fixed Income assets also delivered positive returns for the year as the 10-year treasury yield stayed in a tight range of 2.06%-2.63%, with the yield curve flattening as the year progressed. The Barclay’s US Aggregate returned a net 3.54% while global bonds returned approximately 7% net.

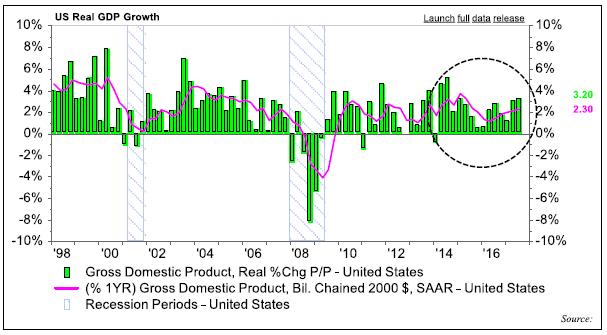

The US Economy delivered above expectation results in 2017, including two consecutive quarters of 3% plus growth. Full year GDP growth came in at 2.7%, while unemployment rates dropped to near 4%, nearly a 50-year low. Manufacturing, housing starts, auto sales and consumer confidence shows positive indicators as well. Meanwhile, inflation in the US and around the world remained tame.

Source: FactSet, RJ Technical Strategy Group

Additionally, we continue to see strong economic readings outside of the United States, with positive economic surprises round the world throughout 2017. The globally synchronized expansion, which we first discussed in our 2017 market outlook, was the primary driver of risk assets in 2017.

We began to see in US monetary policy diverge from other major central banks in late 2016, and that process continued in 2017 with the Fed raising rates three time over the course of the year while reducing the size of its balance sheet. While the Fed is certainly moving towards tighter monetary policy with the intent to “normalize” rates over time, US monetary policy remains quite accommodative. Other major central banks, such as the ECB and BOJ remained even more accommodative, a trend we do not envision changing substantially any time soon.

2017 was a (another) politically charged year to say the least. After failing in their bid to repeal the Affordable Care Act, the Republican led House and Senate passed the highly anticipated tax reform act in December. While the final product was a far cry from the “so simple you can do your taxes on a post card” rhetoric of late 2016, it none the less represents a political victory for the GOP. Republicans are likely to quickly shift their attention to addressing the country’s infrastructure needs, an issue that we believe can find some level of bi-partisan support.

We will be producing a summary of the new tax act in a separate commentary, as we don’t want to put any of our readers into a boredom induced coma just yet. On the whole we believe the “tax reform” package will provide a short term tailwind to the economy, with the positive effects diminishing over time. The reduction in the top corporate rate from 35% to 21% should add a meaningful positive increase to corporate earnings in 2018, with some analysts calling for as much as a 10% increase versus pre-tax reform estimates. It is important to note that we believe the markets have priced in some, but likely not all, of the tax act’s impact on corporate earnings.

2018 Outlook: What May Be in Store for The New Year

The attempt to look forward and “predict” what may transpire in the economy and financial markets is a tricky business. Even the most of admired of strategists, economists and investment managers are fortunate if their forward looking assumptions prove to be directionally accurate. As always, our observations below are not an attempt to predict the eventual outcomes over the next twelve months, but represent our core convictions based on the information we have today that we will use to guide our allocation and investment decisions moving forward.

On The Economy:

As previously noted, we enter 2018 with the US economy on firm footing, with 2017 being the strongest year of the recovery to date, with economies around the world delivering positive economic surprises on a regular basis. Looking forward, we see few reasons to believe that the wheels are about to come off and see a low risk of recession in 2018. Solid unemployment gains, relatively low interest rates, sufficient liquidity and fiscal stimulus in the form of tax reform and possibly infrastructure spending should keep the US economy humming along at a pace similar to what we experienced in 2017. We also anticipate global economic growth to remain healthy this year, although we do not expect to see the positive surprises that became commonplace in 2017.

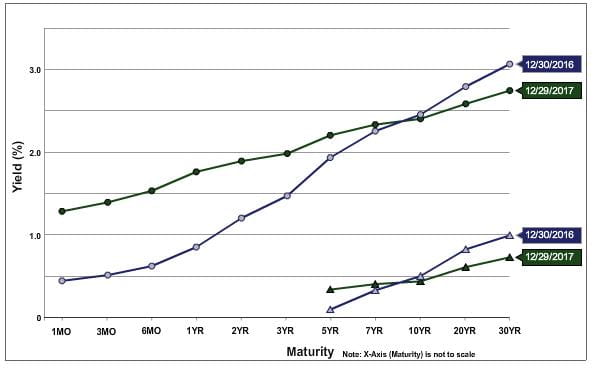

One factor that has justifiably been discussed a great deal in the financial press lately is the flattening yield curve. The yield curve measures the spread between short term interest rates (3 month US Treasuries) and long term rates (30 Yeas US Treasuries). Historically, when the yield curve inverts (short term rates higher than long term rates), it has been a nearly perfect predictor of recession. This is a metric we are following closely to be sure. While the yield curve flattened over the course of 2017, it is still a far cry from inverting, as you can see from the chart below. Said flattening has been driven primarily by higher short term rates (driven by fed increases) rather than drops on the longer end spurred by concerns over weaker growth and higher inflation.

Source: United States Treasury Department / www.treasury.gov

On the whole we see the synchronized global expansion with room to run, albeit without the benefit of upside surprise. Inflation is likely to begin to creep into the picture, particularly in the US, and the Fed should continue on its path of tighter monetary policy.

On Equities:

There are few if any investors that would argue US Equities are inexpensive right now. US equities closed 2017 at some of the highest valuations on record, with the S&P 500 trading at 20.8x trailing 12 month earnings (vs. the 15-year average of 16.1). In fact, nearly all commonly used valuation metrics are at or near all-time highs. Price to Book, Price to Sales, Price to Cash Flow, dividend yields and earnings yields are all trading at historically rich metrics.

This would probably be a good time to point out that 1) it is not at all unusual for valuations to become stretched in a bull market and 2) valuations have historically proven to be a poor predictor of corrections or bear markets. Momentum tends to be a more important factor at this stage of the cycle, and market valuations can remain stretched for years at time.

We believe that synchronized global growth, earnings growth, accommodative monetary policy, tax reform and fiscal stimulus remain supportive of equities. Valuations will be a significant headwind for US equities, and we find it hard to imagine multiples expanding much beyond their current levels (and may in fact contract). Therefore, continued earnings growth from revenue growth, operational improvements and tax reform will be needed if the US markets are to continue their ascent.

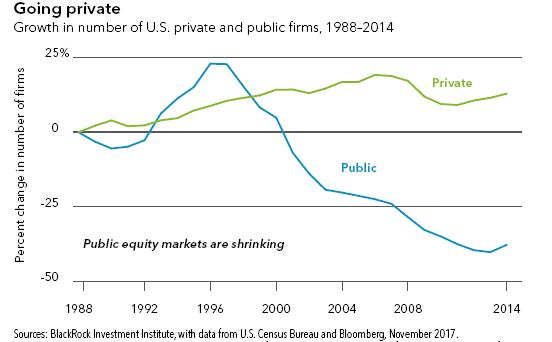

An interesting phenomenon that we feel has been supportive of public equities is the shrinking universe of public companies relative to private companies. This metric has been somewhat under reported, but as you can see from the chart below robust merger and acquisition activity and lower IPO activity during a sustained period of easier access to private capital has had a significant effect.

Volatility has been scant over the last year to say the least; 2017 was one of the least volatile years on record. While periods of low volatility can persist for long periods of time, we are likely to see higher levels in 2018 as inflation is likely to pick up and the economy is likely to deliver fewer positive upside surprises. The convergence of high valuations, low rates and low inflation makes the market more susceptible to corrections if we see disappointing data unexpectedly.

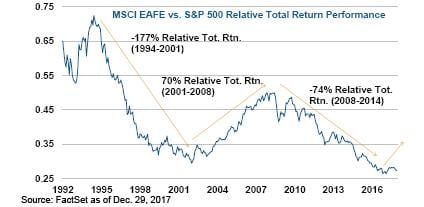

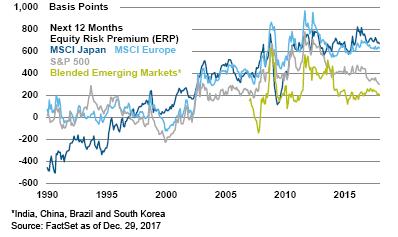

We remain positive on international equities, particularly developed markets. On the whole, international equities remain favorably valued relative to the US and their long term averages. Developed economies such as Japan and the major Eurozone countries continue to experience economic expansion that should persist into 2018, although again without as many positive upside surprises as last year. While the consensus has shifted in line with our international preference, we have actually seen relatively little evidence that investors have adequately increased their overseas exposure. We expect to see international markets outperform US markets again this year.

On Fixed Income:

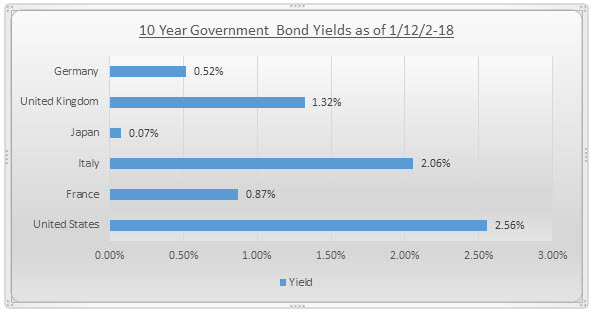

Many investors were surprised that fixed income delivered positive results in the face of the Fed tightening interest rates and better than expected global growth. Continued low inflation, along with the continued demand for income by investors around the world supported prices and kept yields trading in a relatively narrow band throughout the year. As previously discussed, we see the Fed continuing the path to normalization, and expect them to raise rates at least three times in 2018. The pace of balance sheet reduction will pick up as well, reducing liquidity. While the US is poised to tighten monetary policy, other major central banks remain very accommodative. We expect to see long term rates move up gradually over the course of the year, but demand should keep rates from running away from expectations, with the wild card being inflation.

It is also important to note that while we remain in a very low interest rate environment, US sovereign debt continues to trade at higher yields than virtually all of their major counterparts. As the US is still considered the highest of credit qualities, this dynamic serves to further increase the appetite for US Treasuries.

Source: Thompson Reuters 1/12/2018

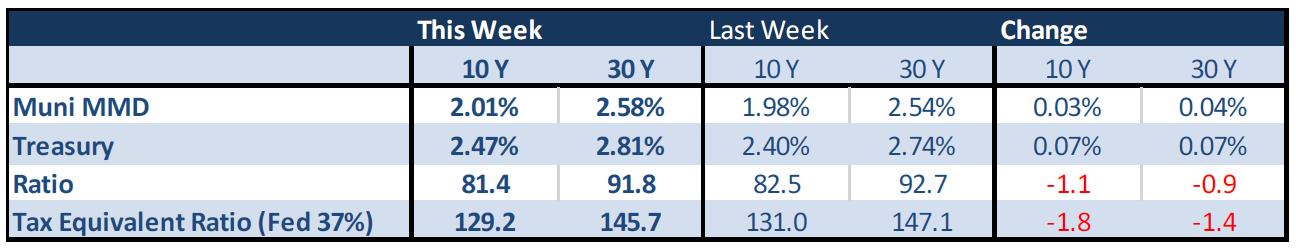

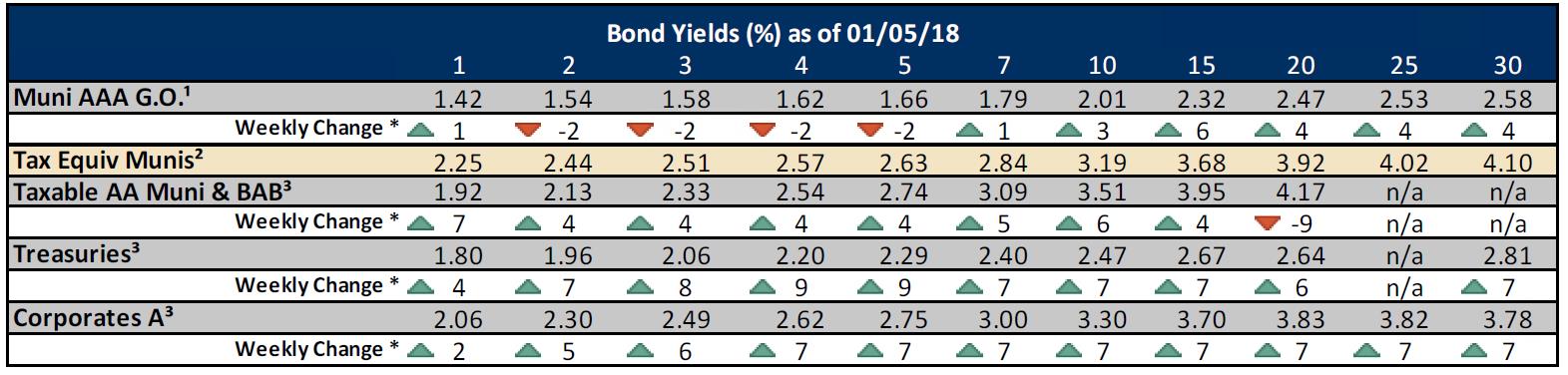

We still favor high quality tax-free Municipal bonds for high net worth investors, both on a relative valuation basis and credit quality basis. The revamped tax code remains favorable to muni investors, and tax adjusted yields remain attractive across the yield curve for high income earners. While the new tax code reduces the attractiveness of municipal bonds for some banks and property and casualty insurance companies, increased demand from individuals and a growing number of foreign investors is likely to face smaller supply.

Source: Municipal Market Data, Bloomberg, Raymond James. Tax equivalent yield based on 37% tax rate.

Tax reform should be positive for US corporate debt, although some of the benefit will be offset by the reduction in interest expense deductibility. With US corporate debt and treasuries trading at historically tight spreads and the anticipation of higher inflation, it is unlikely that we will see much, if any, relative outperformance in credit.

Conclusion

Overall, we feel the good outweighs the bad coming in to 2018 and believe the globally synchronized expansion has room to run. Accommodative global monetary policy, low inflation and fiscal stimulus in the form of tax reform should keep the global economy expanding, albeit not with the positive surprise factors we experienced last year. We think it is unlikely we will see an end to the bull market in 2018, as risk of recession seems low and earnings growth should be healthy and augmented by tax reform. Even with US equity markets reaching new highs, we see few signs of the type of euphoria we witnessed before the 2000 and 2008 bear markets. However, we anticipate volatility to increase and the convergence of high valuations, low rates and low inflation makes the market more susceptible to corrections if we see disappointing data unexpectedly. International equities are likely to outperform again this year, as valuations appear attractive relative to US stocks. Sustained above-trend economic expansion in developed markets, supported by accommodative monetary policy, remain in play. Emerging Market growth appears to be sustainable, even as we anticipate a slowdown in China. Interest rates should rise steadily throughout the year, with the tighter Fed policy pushing on the short end of the yield curve while higher inflation measures pull on the longer end. As such, we expect fixed income to deliver modest overall returns.

As always, please do not hesitate to reach out directly with any questions. We have begun our year-end review process and will be reaching out to you individually to discuss 2017 and 2018 as it relates to your personal portfolio and situation. Happy new year!

Josh Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Meagan Moll, CIMA®, CFP®, CPWA

Partner

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.