2019 Mid-Year Review & Commentary: Touch of Grey

2019 Mid-Year Review & Commentary: Touch of Grey

July 10th, 2019

I would like to open by welcoming Meridian’s newest team member, Managing Partner Brian Noonan. Brian joins us from UBS Wealth Management where he served as trusted advisor to a select group of high net worth and ultra-high net worth clients for nearly a decade. Brian brings deep experience and a passion for providing comprehensive wealth advisory services, including investment management, financial planning and tax and estate advisory services.

This is an exciting time for Meridian as we continue to expand our depth in talent and expertise while maintaining focus on what is ultimately most important- our clients.

Welcome aboard Brian!

2019 Mid-Year Review & Commentary: Touch of Grey

Occasionally we find ourselves in a financial environment with clear black and white signals as to the health and direction of the economy and markets. More often than not, however, analyzing the financial environment is more akin to differentiating shades of grey. Entering the second half of 2019, we definitely see a touch of grey in the environment.

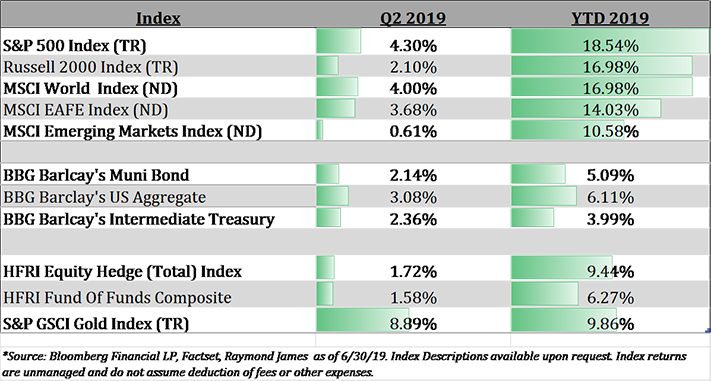

The first half of 2019 was very good to investors, despite signs of a softening global economy, slower earnings growth, persistent concerns over US-China trade relations and mounting geo-political concerns. In reaction to an abrupt swing by the federal reserve to a more dovish monetary policy stance, equities rebounded sharply in the first quarter. After a quick pause and retracement in May, markets once again resumed the march higher reaching a new all time high in June. Meanwhile, the ten-year treasury yield dropped substantially, bottoming at 2% and pushing bonds prices higher.

The FOMC & Monetary Policy: A New Dilemma?

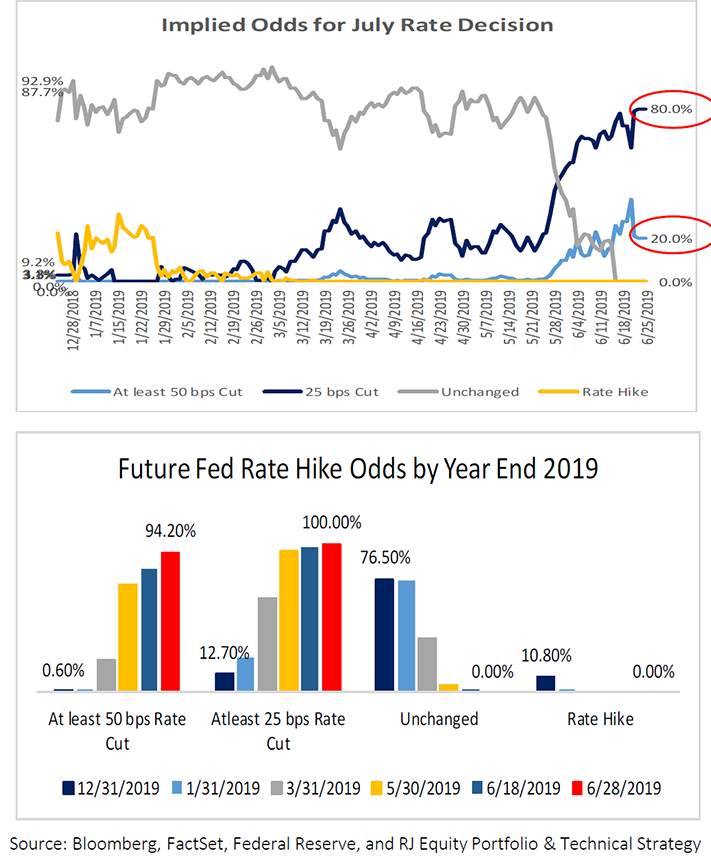

Perhaps the most significant change in financial markets in the first half of the year was the Federal Reserve’s shift in policy stance to a more dovish tone. As data showed signs of a slowing economy (see our Q1 commentary) and global growth continued to struggle, the Fed put the brakes on efforts to tighten monetary policy and clearly signaled a willingness to maintain an accommodative position if data remains weaker than expected. The Fed’s shift provided an immediate boost to investor sentiment, spurring equity prices higher. As the second quarter progressed, the Fed went so far as to signal possible rate cuts in 2019, further buoying investor confidence and pushing US equity prices to all time highs. As the quarter came to a close, the market was pricing in a nearly 100% probability of a .25% rate cut, and a 20% probability of the Fed going so far as to cut rates by .50%.

Clearly the elevated expectations of a rate cut make the July FOMC meeting pivotal to the short-term direction of the markets. Should the Fed disappoint investors and hold rates steady, we find it likely that a period of consolidation in the equity markets could follow. Conversely, if the Fed were to surprise at the upside with a .50% rate cut, we would expect to see markets respond positively and potentially set the stage for new all-time highs to be reached before year end.

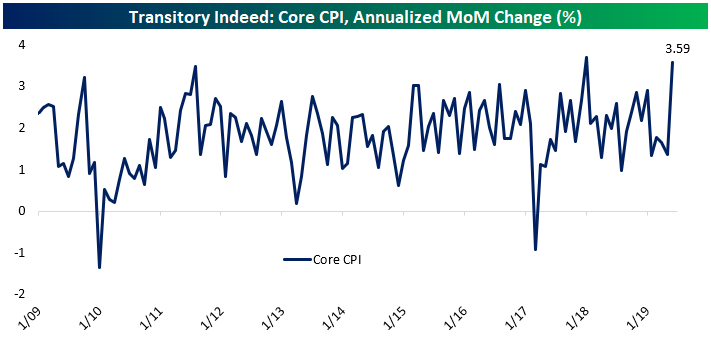

However, very recent data has muddied the waters somewhat for the FOMC. June Core CPI rose 3.6% annualized, the second largest month over month advance for core prices during this economic expansion. This upside surprise confuses the outlook for the Fed in our opinion, as the focus on below target inflation being transitory or persistent is likely to pick back up.

*source: Bespoke Investment Group

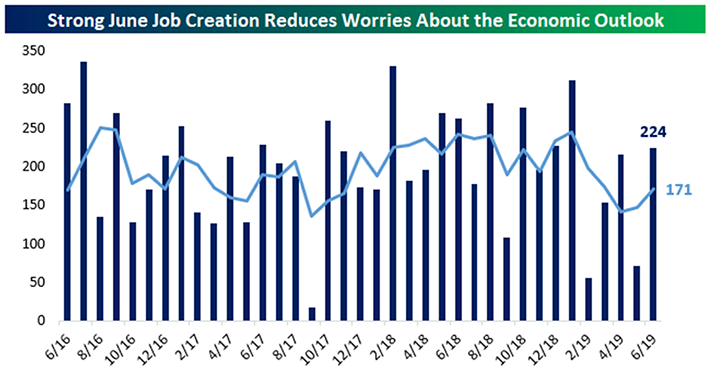

Further complicating matters for the Fed outlook, the most recent (July 5th) non-farm payrolls number came in stronger than expected as well. 224,000 new jobs were added vs. the consensus estimate of 160,000. While these numbers can be choppy quarter to quarter, the upside surprise coupled with near all-time low unemployment rates complicates the rate decision as the Fed considers its dual mandate of target inflation above 2% and low unemployment.

*source: Bespoke Investment Group

We believe the likelihood remains high that we will see a rate cut in July, as it could be difficult for Fed Chairman Powell to backtrack on his recent comments strongly implying such a move. However, we shouldn’t forget the abrupt shift in policy tone earlier this year that caught investors by surprise and ignited the strong first quarter equity rally. This chairman may just be cut from a different mold and full of surprises.

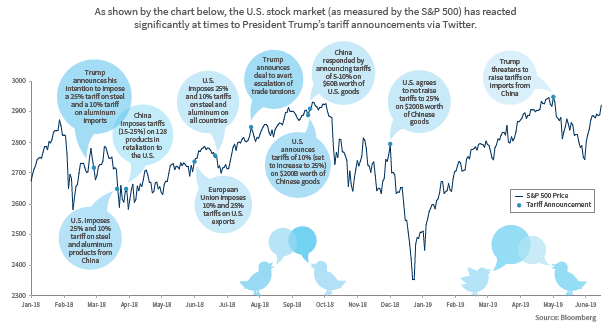

US-China Trade: Yes, The Tweets are Still Impacting the Markets:

Trade tensions with China have been a persistent theme during President Trump’s time in office and have had significant influence on market and economic expectations. For much of the year the trade conflict has been escalating, as President Trump has increased tariffs on $200 billion worth of Chinese good to 25% (from 10%) and threatened more. Not to mention the implementation of non-tariff barriers, such as the US ban on Huawei Equipment. Tensions have temporarily cooled as Presidents Trump and Xi are scheduled to meet at the G20 meeting in Japan. The result of their last meeting was a “kick the can” approach, delaying further tariff hikes by three months. While we continue to find it very unlikely that a sweeping agreement will be reached anytime soon, it is likely that the result of the G20 meeting will be similar to the December 2018 meeting.

We continue to believe that the US-China trade dispute is one of the most significant factors facing investors this year, particularly considering the softening economic conditions around the globe. It appears that markets are pricing in another delaying in tariff increases, making any negative surprises from the G20 meeting a significant short-term risk. Longer term, we believe an agreement will eventually be reached between the US and China, but the question (and risks) remains.

Equities vs. Bonds: Diverging Signals?

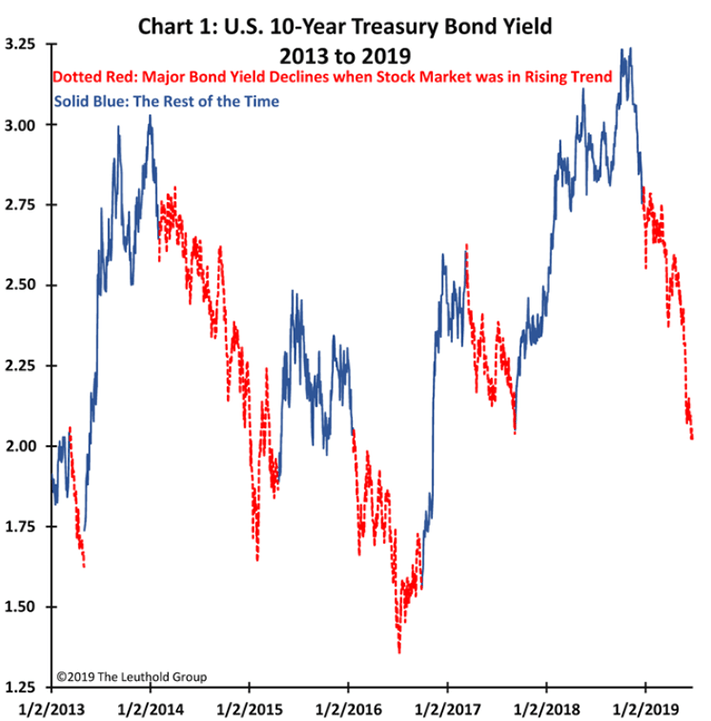

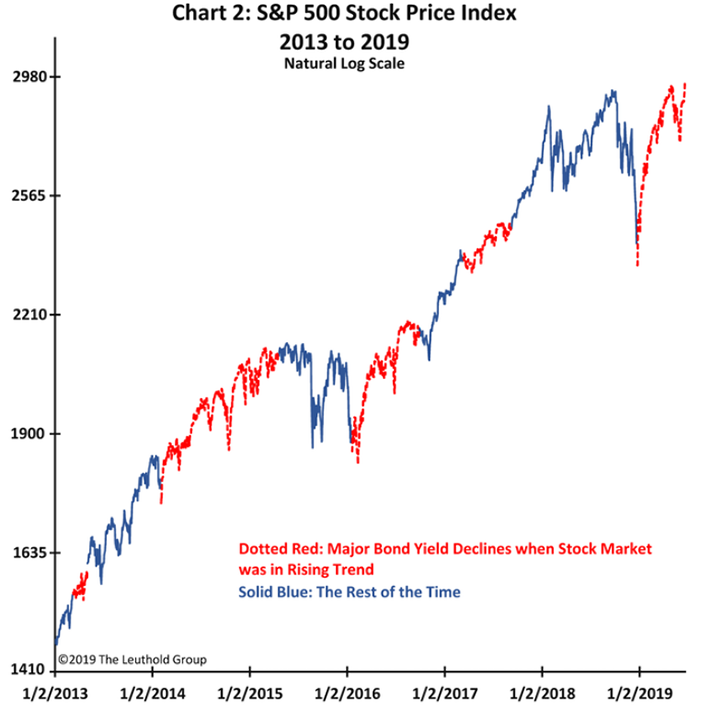

While US equites moved significantly higher in the first half of 2019, US bond yields have been trending lower for most of the year. This divergent action implies that the stock market is optimistic about the future of the economic cycle and recovery, while the bond market appears increasingly skeptical. It begs the age-old question, what does the bond market know that the stock market doesn’t? Are equity investors too optimistic and discounting the risks of the trade war negotiations, possible recession or other calamity? Perhaps, but when digging a little deeper one finds that it has not been uncommon during this recovery for equity prices and bond yields to diverge. In fact, it has been rather common, this is the fifth time since 2013 that we have seen the ten-year treasury yield decline in the face of a rising stock market.

*Source: 2019 The Leuthhold Group

*Source: 2019 The Leuthhold Group

During the four previous instances, this phenomenon did not foretell calamity, but was reflective of a temporary slowdown in the economy within the ongoing recovery. In each instance, once bond yields bottomed, financial markets witnessed rising yields alongside a rising equity market. What could be different this time? The inversion of the yield curve, which you have all heard us comment on ad nauseum, certainly adds a new element of concern. But overall the data remains mixed, and we continue to believe that barring a policy error or significant escalation in trade tensions, the US economy is unlikely to fall into recession this year.

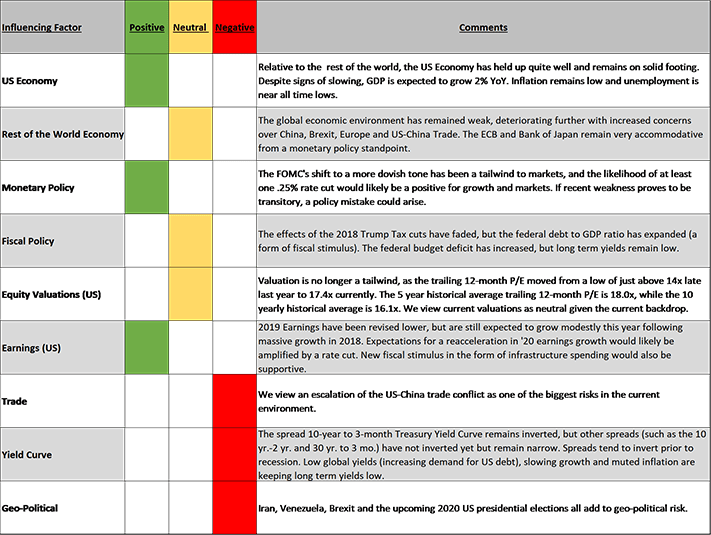

Summary: The Good, The Bad & The Ugly

There is no question that we are witnessing multiple conflicting signals across financial markets and the economic data. From diverging equity and bond yield trends to inverted yield curves vs. a spike in CPI, the tea leaves are increasingly hard to read (not that it is ever easy). We believe that underlying fundamentals of both the economy and equity markets remain relatively positive, while at the same time being concerned with elevated geo-political risk (China trade, Brexit, 2020 election etc.) and the softening global economy. Over the last decade plus we have witnessed one of the longest economic recoveries and equity bull markets on record. The length of the recovery does not necessarily portend a recession or bear market by any means. We could make a compelling argument in fact that the characteristics of both the trajectory of the economy and the equity market, particularly if the FOMC cuts rates once or twice this year, could extend for quite some time.

However, we are not in the business of making gutsy market calls nor are we economic forecasters. We are first and foremost concerned with assessing the potential risks and opportunities across the global financial landscape and positioning our clients accordingly. The current environment offers a plethora of both positives and negative influences, which we have outlined below.

While we remain constructive in the long term, we view short term risks as elevated and worthy of patient attention. With US equities at all-time highs, bond yields near all-time lows and impactful policy decisions on interest rates and trade in the offing, we feel content with our neutral view and feel confident that our current portfolios allocations position us appropriately for near term, whether that includes upside or downside surprises.

As always, if you would like to discuss any of the enclosed commentary in more detail or how it affects your portfolio specifically, please feel free to reach out to us directly.

Thanks for taking a look!

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.