2019 3rd Quarter Review and 4th Quarter Outlook

2019 3rd Quarter Review and 4th Quarter Outlook

October 15th, 2019

The conflicting signals we referenced in our 2nd quarter commentary remained at odds in the 3rd quarter, prolonging a murky backdrop heading into the 4th quarter. On the negative side of the coin the US trade conflicts with China, Mexico & other trading partners remained a focal point for investors and economists. US and global manufacturing are slowing, oil prices spiked sharply and then plunged following the attack on Saudi Arabia all while the launch of an official impeachment inquiry is creating additional uncertainly on the political front. Brexit issues dragged on throughout the quarter, with a tentative agreement between the EU and UK finally emerging early in the 4th quarter. The agreement must be ratified by Parliament, which is by no means guaranteed. On the positive side of the ledger, the US consumer remains resilient, unemployment remains near all-time lows, consumer confidence is solid, housing data turned positive and global monetary policy remains supportive.

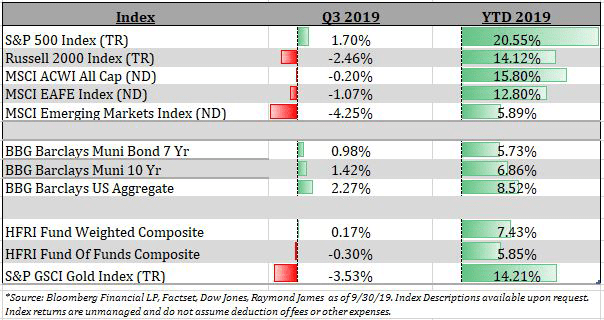

The conflicting signals led to more volatility in the 3rd quarter, while delivering mixed results in financial asset returns. Year to date returns remain predominantly strong across the board in the major equity and fixed income indexes.

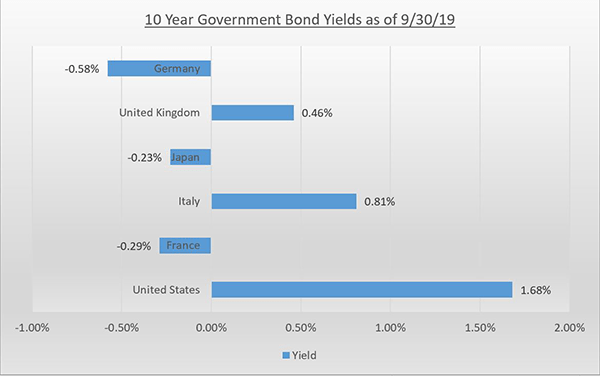

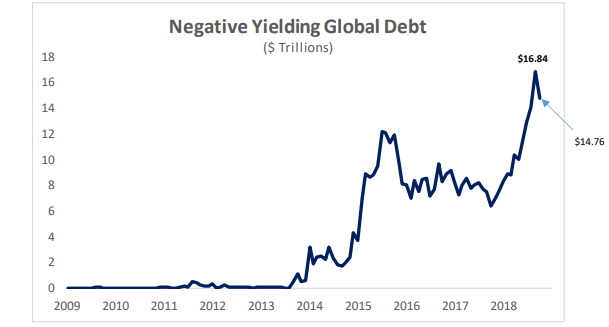

Global sovereign yields are persistently low as global monetary policy remains accommodative, led by the US Federal Reserve’s shift to a more dovish stance earlier in the year, rate cuts in June and July and increased demand for sovereign debt in the face of increased uncertainty in the global economy and geo-political front. At the end of September, the total amount of global debt trading at negative yields topped $15 trillion, serving as anchor for low yields. While the US 10-year Treasury moved near historic lows during the quarter, the quarter ending 1.68% yield ranks as one of the highest globally despite the US economy remaining stronger than most other parts of the world.

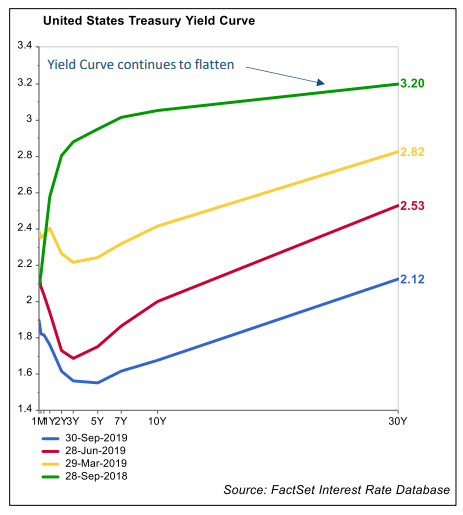

As we have discussed in previous commentaries, an inverted yield curve (when short term rates are higher than longer term rates) has historically been a strong indicator of recession. During the 3rd quarter we saw each of the major yield curves invert. At this point, the only curve that remains inverted in the 3-month to 10-year curve. While many pundits and economists have been writing that the most recent inversions are different than previous occurrences for various reasons, we continue to monitor the situation closely. It is true that not all inversions lead to recession, and that much of the economic data in the US remains expansionary. However, we have yet to hear a completely convincing argument that “this time is different”.

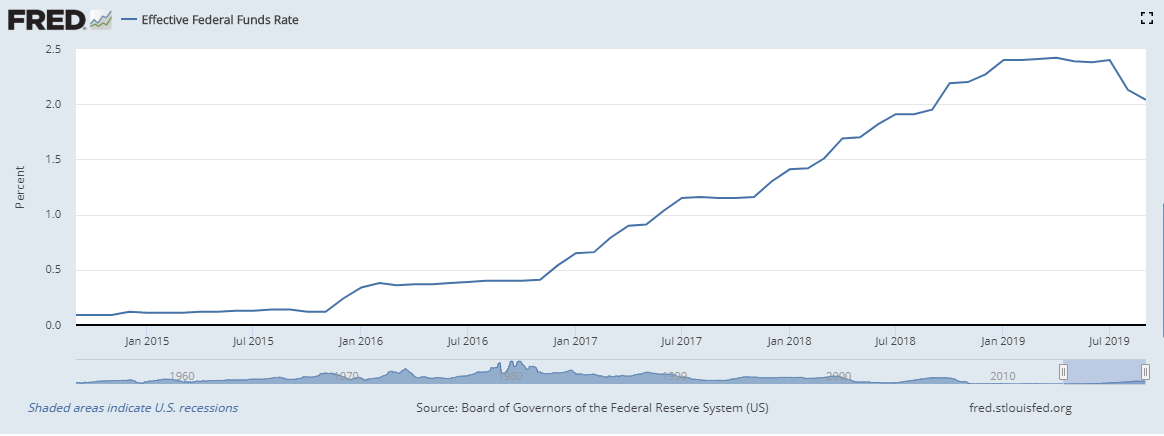

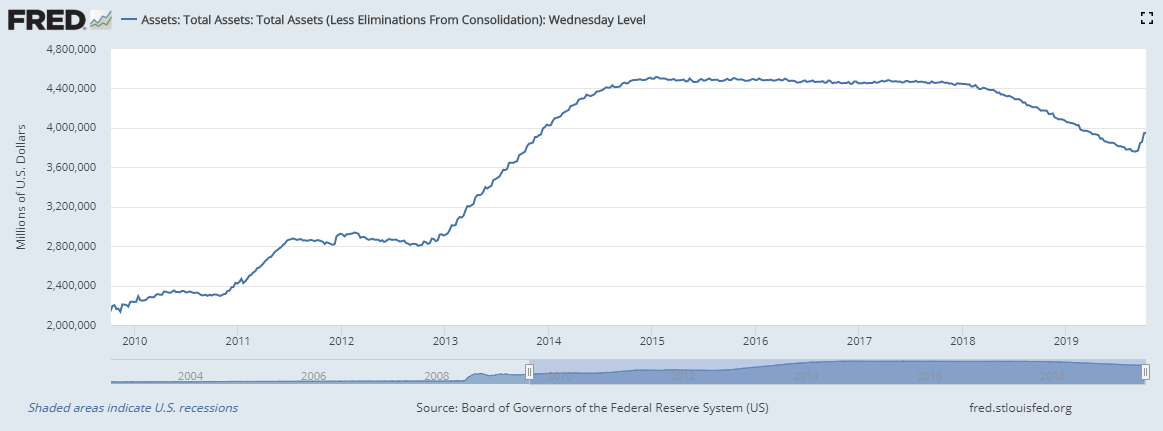

Apparently, the Federal Reserve shares our skepticism, as they began a shift to a more dovish stance earlier in the year after raising rates into the end of 2018. Most recently, we saw rate increases in June and September as well as an expansion of their balance sheet in September to provide additional liquidity in the overnight lending markets.

The Fed has taken some heat for their decision to raise rates heading into the end of the year, a decision which was almost immediately reversed. Others have been critical of the 2019 rate cuts as being aimed at “propping up the markets and the economy”. We have a slightly different take on the recent Fed actions. The Fed has a dual mandate (price stability and maximum sustainable employment). They don’t care about the markets, but they absolutely care about supporting the economy within this dual mandate. Maximum sustainable employment has likely been reached for some time now, while the price stability (inflation) has remained stubbornly below the Fed’s 2% target. Late in 2018 GDP was tracking at 3% (before being revised down to 2.6%) and the economy was swallowing the reduction in the Fed’s balance sheet in stride. We believe the rate hikes were preemptive in nature and intended to put some ammunition away for future use. Similarly, when the Fed recognized the slowing nature of the economy in 2019, they quickly reversed course and dropped rates in a preemptive manner. Frankly, we find this to be potentially more effective than waiting to act until after poor data emerges on the consumer (the most significant and important part of our economy).

Heading into the fourth quarter we continue to believe that the primary driving force behind the direction of the markets will be trade. The US-China trade dispute is getting most of the headlines, but the issue is much broader than is generally understood. Intellectual property rights will likely have a much more significant impact in the long term than trade deficits or surpluses. Also, it is important to note that while the US-China trade dispute is front and center today, our trade policies with Mexico (an agreement has been reached but not ratified) and Europe are equally if not more important. In the short term we believe it is likely that a superficial deal will be reached. China will feel more pain from a prolonged tariff tit for tat, and we find it unlikely that President Trump wants to go into the 2020 election cycle with the issue hanging over his candidacy, which will likely focus significantly on the strength of the US economy and getting “deals” done on trade, taxes and regulation.

The relative strength of the US economy, accommodative global monetary policy (low interest rates) and depressed earnings expectations remain generally supportive of equities. Valuations are not significantly above their five-year averages and seasonally the 4th quarter tends to be positive for equity markets. While we remain cautiously optimistic, in the short term, we expect to remain generally range bound, with upside potential becoming somewhat more significant if a trade deal with China is inked. While bond yields will start to creep up eventually, in the short term we believe they too will remain range bound as easy monetary policy around the globe and negative yields on a significant portion of global sovereign debt remain in place. Given the current low rate environment and inverted 3-month to 10-year spread we believe a defensive position in fixed income is warranted, favoring the very short end of the yield curve.

As a side note, thanks to our friend Jeff, we were fortunate to have the opportunity this week to hear from Dallas Federal Reserve President Robert Kaplan. Mr. Kaplan gave a very engaging and interesting speech on the Dallas Fed’s economic outlook for the US and what he believes to be the four key structural drivers impacting the economic outlook. You can find the article here.

Thanks for taking a look!

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.