Q3 2020 Commentary

Risk Assets Add to Q2 Gains in the Face of Uncertainty

October 9th, 2019

Despite rising uncertainty, the third quarter provided investors with positive returns across most global asset classes. Markets shrugged off fears surrounding the pandemic, the global economic recovery, and US political and social tensions, continuing a recovery that has many people scratching their heads. The remainder of 2020 will be defined by these issues, with investors grappling over the impact of the Presidential election, additional fiscal stimulus (or lack thereof), the direction of COVID-19 containment and the possibility of a vaccine.

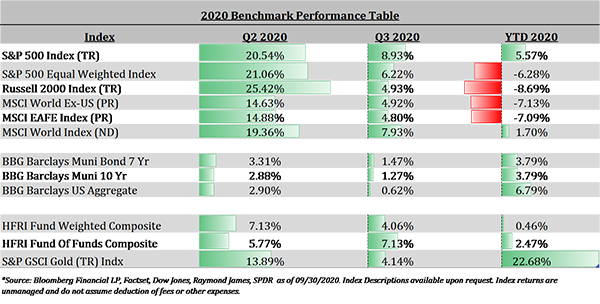

US Large Cap Equities continued their ascent after a record second quarter recovery from the March lows. While the S&P 500 Total Return Index has delivered positive returns YTD, most of the positive performance has been derived from the largest of the large, specifically in the technology, consumer discretionary and communication services sectors.

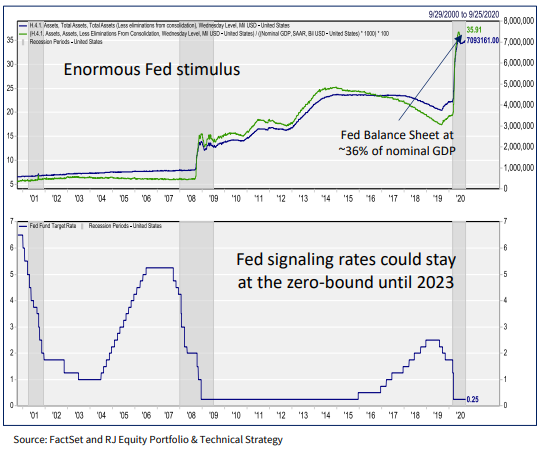

Interest rates remain near record lows, driving positive performance across core fixed income in both the taxable and tax-free municipal sectors. The ten-year treasury remained mostly unchanged over the quarter, at roughly .70%.

Gold also delivered positive returns for the quarter, delivering the strongest performance year to date of the asset classes listed below.

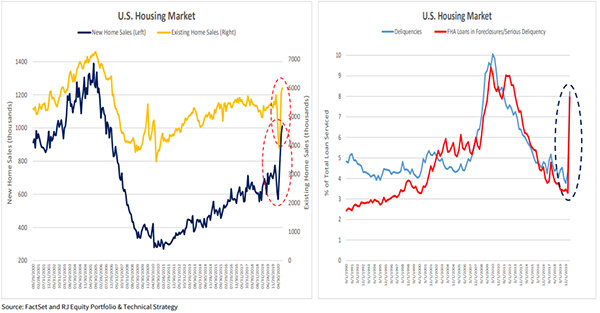

On the economic front, the backdrop remains choppy, but a recovery is underway. Although the chances of another round of fiscal stimulus before the election appear very low at this point, monetary policy support remains firmly in place. Recent data reflects softer consumer numbers as the positive effects of fiscal stimulus are beginning to fade. Several companies have announced layoffs in recent weeks, slowing the recovery in jobs. Meanwhile, global manufacturing has improved, and the US housing market has been on fire, driven by limited inventory and low interest rates.

We agree with the consensus that another round of fiscal stimulus will be necessary to support the recovery, specifically aimed at small business, the airlines, and the consumer. Despite President Trump’s recent comment that he would cease negotiations on a new package until after the election, we believe a deal will be struck prior to the end of the year.

On the Election:

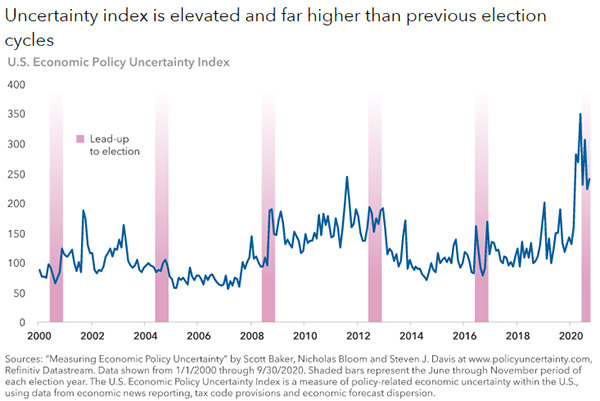

We have received several questions recently regarding how we expect the upcoming elections to impact the market and the economy. Investors are clearly concerned with the extreme policy differences between Republicans and Democrats as well as the general divisiveness we are experiencing throughout the country. Many are saying this will be the most important election of our lifetime, and perhaps it will be. But we have heard the same statement about previous elections and will hear it again about future elections. It will almost certainly be the most unique election to date. Not only are we dealing with a pandemic and the resulting economic crisis, but also civil unrest and a hotly contentious Supreme Court appointment. Oh to be back in the days of the hanging chad….

One thing is certain, the level of uncertainty around this election is at unprecedented levels.

While it is beyond our scope to predict political outcomes, we do want to share a few thoughts around how election results typically impact the economy and financial markets.

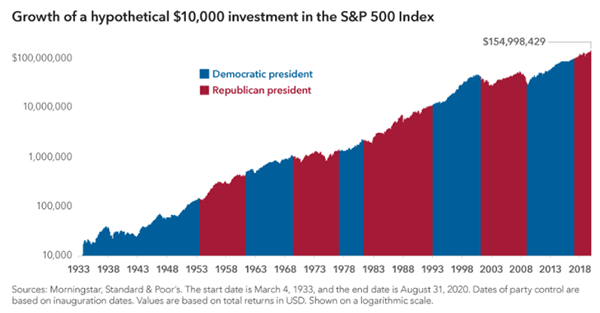

1) Politics tends to bring out emotional responses, but historically speaking long-term equity investment results have not been materially impacted by which party holds the White House. We have had seven Democratic and seven Republican presidents over the last 85 years and have experienced bull and bear markets under both. The general long-term direction of the market has always been positive.

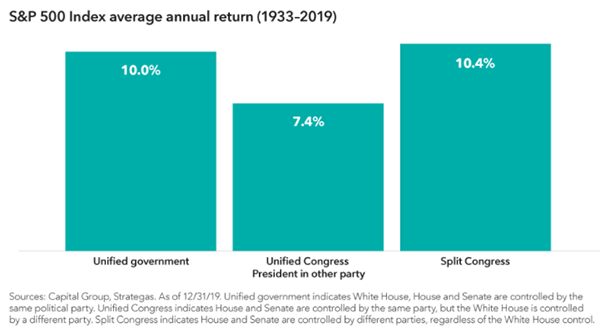

2) But what if there is a Democratic sweep? If we do see a “blue wave” it will certainly bring a new policy agenda that is very different from our current administration. Tax reform and the reversal of recent deregulation, among other items will be on the table. Again, we must look at history as our guide. History shows that equities have performed well regardless of the make up in Washington.

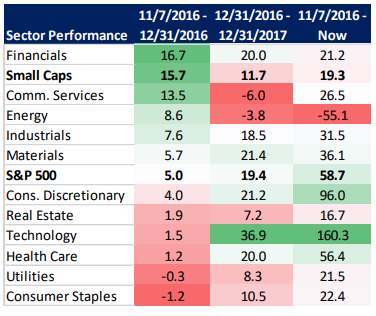

3) Dramatically shifting portfolio allocations in response to election result expectations has not been a winning strategy. While our expectation is for heightened volatility heading into and immediately after the election, we would caution against any dramatic allocation decisions based solely on the election. For example, below you will see that in many cases the performance of several sectors immediately following the President Trump’s election significantly changed course during his term in office.

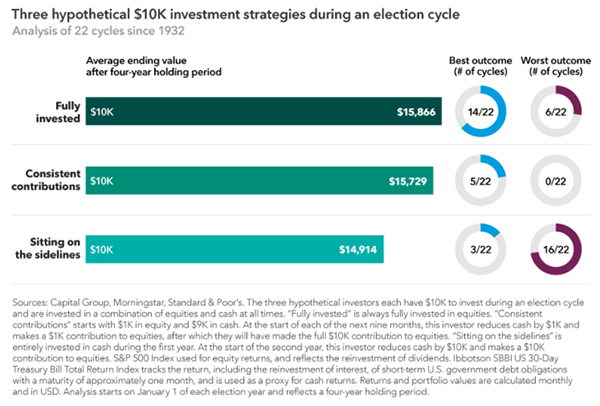

Additionally, a study performed by the Capital Group conducted a study on three hypothetical investors with different investment approaches over the last 22 election cycles. The investor that “sits on the sideline” experienced the worst investment results in 16 out of 22 cycles.

In Conclusion:

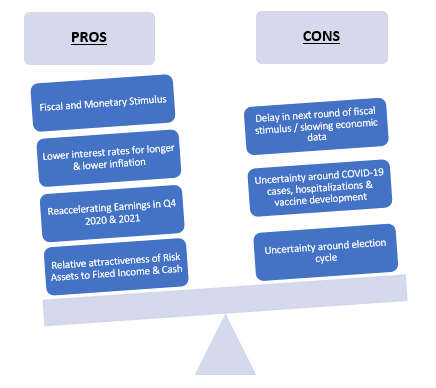

Overall, we reiterate the position we stated in June. While we find it advisable to be cautious in this environment, we feel it would be a mistake to the overly pessimistic about the path that lies ahead. While multiple headwinds are still in play for the foreseeable future, we also believe that there are several positive forces at play that slightly outweigh the negatives. Prudent asset allocations focused on high quality assets have performed admirably in both the Q1 downturn and the ensuing recovery. We have confidence in the long-term sustainability of a US led recovery and are positioned accordingly.

We leave you with a quote from Mr. Warren Buffet that we last referenced on November 9th, 2016 following the last Presidential election:

“For 240 years it has been a terrible mistake to bet against America, and now is no time to start. America’s golden goose of commerce and innovation will continue to lay more and larger eggs.” -Warren Buffet, February 16th, 2016

As always, please feel free to reach out to our team directly for further discussion. Thanks for taking a look!

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.