The Race is On

The Race is On

April 23rd, 2021

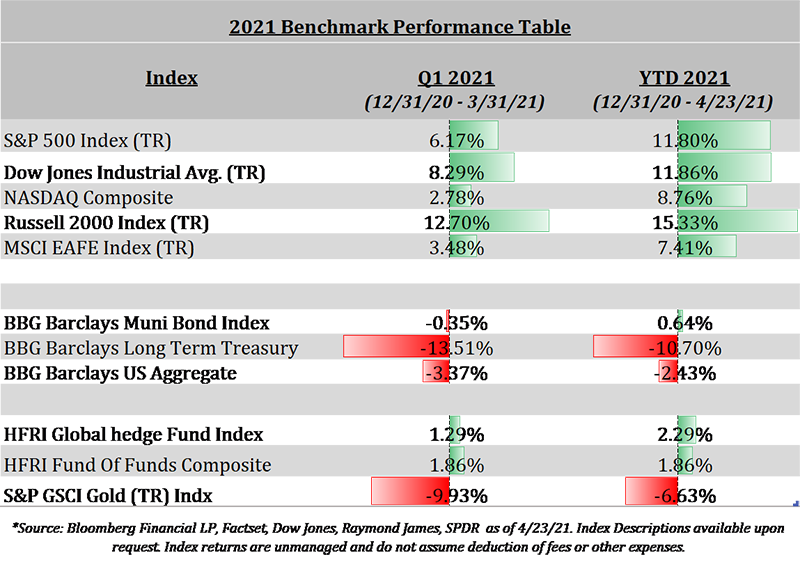

Equity Markets around the globe have soared in 2021 based on consistently strong economic indicators, optimism around post-pandemic “re-opening”, dovish monetary policy and potential fiscal stimulus in the form of President Biden’s proposed infrastructure package. The Ten-Year US Treasury yield has rallied sharply, leading to negative total returns in nearly all fixed income sectors (the notable exception being High Yield Debt), while gold has fallen sharply despite growing concerns of an uptick in inflation.

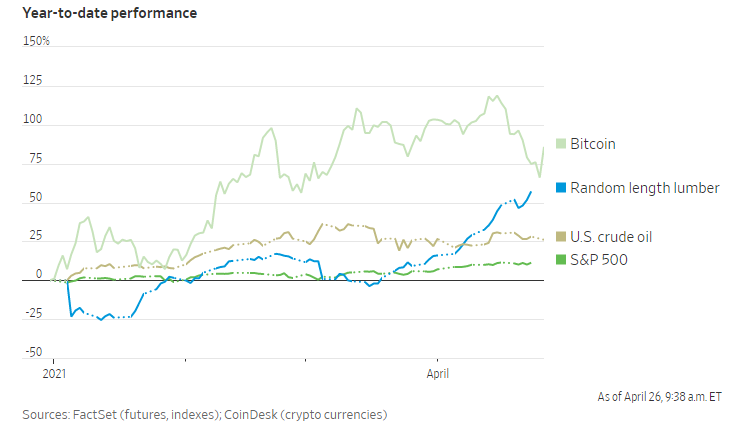

Soaring prices have been prevalent outside of traditional asset classes as well. For example, returns in US crude oil, lumber and bitcoin have significantly outpaced those in equities.

There are plenty of known factors that will influence the remainder of this year, and as history has taught us, probably more than a few unknowns. Right now, it seems investors are betting that expanding vaccinations and a healthy dose of stimulus will lead to a banner year in economic growth.

Monetary Policy & The Fed:

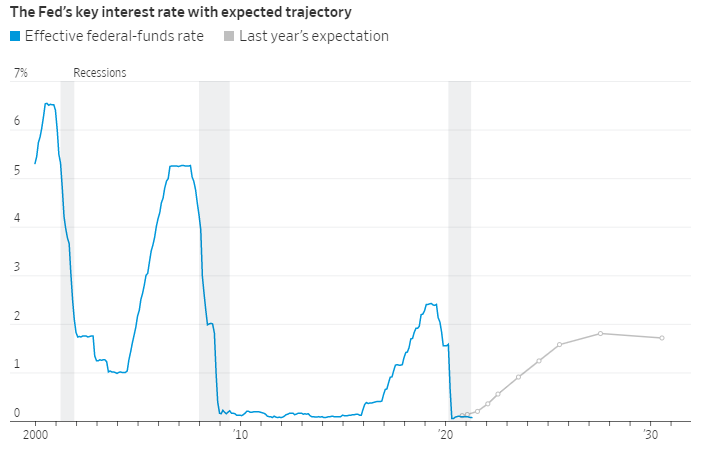

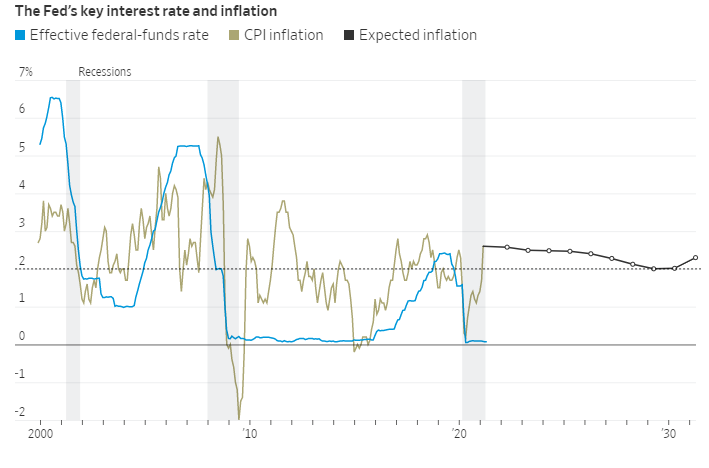

Fed Chair Powell has repeatedly indicated a commitment to easy monetary policy for the foreseeable future, despite an uptick in inflation expectations and generally positive economic indicators. Current indicators suggest the Fed intends to look past any short term increases in inflation and do not expect to raise rates until 2023.

The Fed’s decisive and aggressive actions in 2020 have been extremely supportive to the economy and financial assets. This looks unlikely to change anytime soon. The risk, of course, is for inflation to spike faster and higher than expected. In this scenario the Fed’s hand could be forced and rate increases may come sooner than widely expected, resulting in a premature end to the current expansion.

The Pandemic & Vaccines:

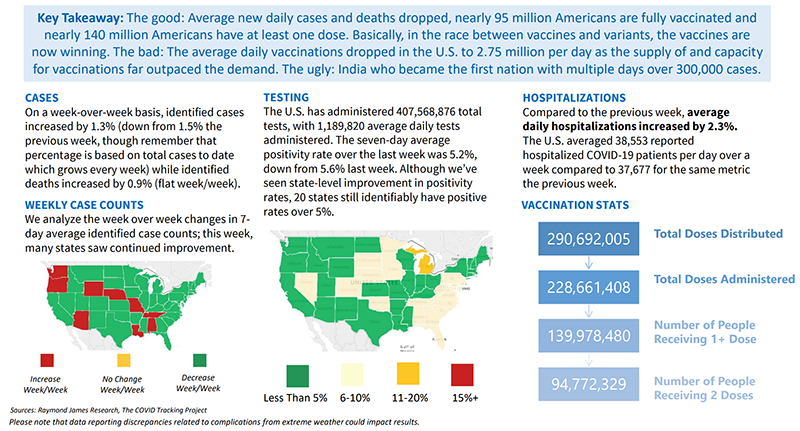

Overall trends in the US have been positive. Nearly 95 million Americans are fully vaccinated, and 140 million Americans have at least one dose. Average new daily cases and deaths have dropped, and many states are working to roll back many of the pandemic induced restrictions that have hampered their economies. Unfortunately, average daily vaccinations have dropped as supply and capacity have outpaced demand. A recent CBS poll suggests that nearly 40% of Americans are hesitant to receive the vaccine. If this poll is accurate, it is not a positive indicator for achieving herd immunity.

Globally the picture is mixed. Worldwide case count increase averaged 809,000, a new high. India is facing a crisis in fighting the B1617 “double mutation” variant, leading to widespread shortages of oxygen and other key medical supplies. Cases have topped new highs for 4 straight days (300k+). The US, UK, France, Germany and Pakistan are jumping in to send much needed supplies.

Clearly the path to “re-opening” lies through continued progress in vaccinations and reaching heard immunity. Currently we view the trends as positive overall, acknowledging the threat of spikes due to mutations and the relaxing of restrictions and protocols.

Fiscal Stimulus & Taxes:

In March, President Biden announced a $2 Trillion “Phase One” infrastructure proposal, which is expected to be followed by a $1-$2 Trillion “Phase 2” Social-Infrastructure proposal. There is a lot in the plan, some of which may not fit the traditional definition of infrastructure. Republicans have countered with a plan focused on traditional infrastructure (at a much lower price tag). Democrats have mostly ignored their counterparts and it is widely expected that the bill could pass under reconciliation. Generally speaking, the proposed stimulus should have a positive short-term impact on the economy (more jobs, government spending etc.), but with a hefty long-term price tag.

The bill calls for an increase in the corporate tax rate from 20%-28%, increasing the tax rate on overseas profits and a myriad of other tax changes aimed at corporations. Last week, headlines erupted with news that President Biden would propose an increase in capital gains rates for those earning over $1 million from 23.8% to 43.8% (nearly double!). We have also seen proposed increases to estate taxes, including significant reductions in exemption amounts.

It should not come as a surprise to anyone that the administration is proposing higher taxes, it was a cornerstone of President Biden’s candidacy. Republicans and moderate Democrats are pushing back on many of the tax proposals as being anti-growth and making the US a less attractive home base for large corporations. Adding to the fray, Democrats from high tax states are pushing for the elimination of SALT tax deduction limitations (i.e. property tax and state income tax deductions).

We view the likelihood of a significant infrastructure bill as high. The end result may not reach $2-$4 trillion as currently proposed, however. Even under a reconciliation process, some Democrats may be hesitant to endorse significant tax increases ahead of mid-term elections. With a razor thin majority in congress, Biden may be forced to seek some middle ground with Republicans.

Is it Over Already?

The recovery in risk assets from the Pandemic Lows has been staggering. Optimism surrounding re-opening, easy monetary conditions and a hefty dose of stimulus have acted as a springboard to the economy and risk assets. Can the recovery continue? All things being equal, we are constructive on the prospects for the remainder of the year.

- The Economy is Strong: recent indicators from manufacturing and housing to employment have been improving steadily. We can’t underestimate the impact of the Fed’s dovish stance.

- Re-Opening: We expect to see progress in the “re-opening process”, bolstered by expanded vaccinations (particularly in the US) and the roll-back of pandemic restrictions. Savings rates are hovering at 45-year highs (15%), creating the potential for consumers to unleash significant pent-up demand.

- Fiscal Stimulus: We expect an infrastructure bill to pass, which will be supportive of the economy, at least in the short term.

Given the strong returns we have seen so far this year in most asset classes, it is reasonable to assume that much of the above has already been priced into asset prices. We do not expect this year to be smooth sailing and would anticipate an increase in volatility in the coming weeks and months, particularly as we navigate COVID / re-opening and the proposed infrastructure bills / tax increases.

As always, if you have any questions or would like to discuss any of the above in more detail, please do not hesitate to reach out to us directly.

Best regards,

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.