Q1 2017 Commentary: Focus on Interest Rates and Taxes

Q1 2017 Commentary: Focus on Interest Rates and Taxes

April 6th, 2017

First Quarter Recap:

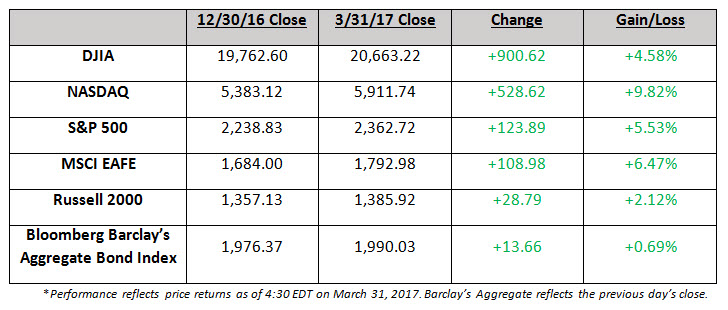

The first quarter of 2017 marked the sixth consecutive quarter of gains in US equity markets. Following the post-election rally, a quiet January led to substantial gains in February and essentially flat returns in March. International markets also experienced strong returns in Q1, while fixed income yields generally came off the recent highs seen after the presidential election.

Recent economic readings have been mixed, with available data suggesting a softer than expected 1-2% annual GDP rate. Consumer spending growth is expected to moderate following the strong pace in Q4 2016, while job gains and wage growth have remained supportive.

As we suggested in our year-end commentary, investors have been keenly focused on a handful of geo-political factors. The reflation theme (popularly referred to as the “Trump Trade”) has been at the center of attention, with every move out of Washington being viewed through the lens of economic impact. As we referenced in January, the euphoric response in the markets to President Trump’s election potentially set the stage for some near term disappointment. The reality of moving his ambitious agenda forward set in: policy change takes time and cooperation between and across party lines. Exhibit A: The failure to pass swift healthcare reform. Despite republicans holding both houses of Congress, President Trump was unable to push through the repeal and replacement of the Affordable Care Act (ACA), a hallmark of his campaign. Financial markets generally shrugged this failure off, as the administration quickly shifted its focus to tax reform. The failure to repeal and replace ACA has certainly created some doubt around the administration’s ability to execute their campaign agenda. Tax reform will be the next litmus test, and failure to move a proposal forward will likely result in consolidation in US equity prices. Other issues that will remain keenly in focus or the remainder of the year include fiscal stimulus and financial regulatory reform.

UK Prime Minister Theresa May triggered Article 50 of the European Trade Union Treaty, kicking off the complex negotiating process of Britain’s divorce from the EU. The clock is ticking on the two year time frame, with negotiations expected to intensify in early 2018. Working through multiple trade deals, immigration and judicial sovereignty will be a tricky process for both sides, with very real risks associated with failure to reach a mutually beneficial deal.

Focus on Interest Rates:

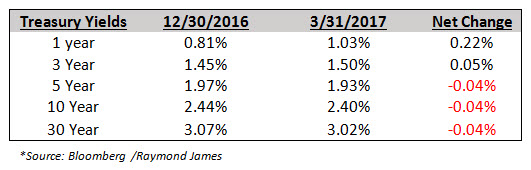

In regards to monetary policy, the Federal Open Market Committee (FOMC) raised its target range for the federal funds rate by 25 basis points (.25%) on March 15th, citing realized and expected improvement in the job market. The move was broadly priced into the markets, but the tone and verbiage of the Fed’s minutes were more dovish than expected, triggering a rally in equities and bonds (pushing yields lower). To date, the primary result of the Fed moving to a tighter monetary policy (e.g. higher rates), has been a flattening of the yield curve. In other words, shorter term rates have generally moved higher while intermediate and longer term rates have generally remained flat or moved lower. The chart below of the ten year treasury illustrates this quite clearly:

The FOMC is expected to raise rates further in 2017, as well as potentially reducing the size of its portfolio later in the year, further tightening monetary policy. The Fed will have a challenge in balancing the pace of future tightening policies with the actual strength of the economy. Should they move too quickly, they could impede growth and possibly set the economy back in its recovery. If the yield curve were to become inverted (where short term rates move higher than long term rates), investors should take notice. Inverted yield curves have been a great predictor of recession, including preceding recessions in 1981, 1991, 2000 and 2008.

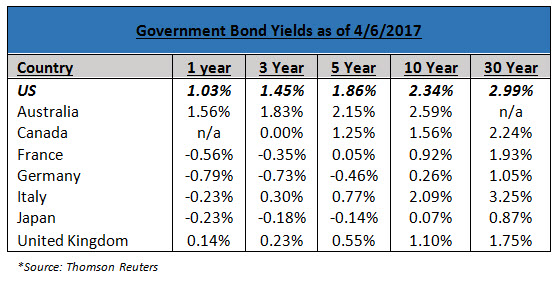

The US is currently one of the few developed markets moving towards a tighter monetary policy, and US government bond rates remain among the highest in the developed world. This disparity in rates has generally widened over the last year, increasing demand from foreign investors seeking high credit quality and higher rates. This increased demand has served as an additional headwind to higher intermediate and longer term rates in the US.

Municipal investors are taking notice to chatter surrounding tax reform and whether or not the tax free nature of municipal bond interest will be on the table. While we are always hesitant to predict the outcome of policy proposals, we would note, as the Wall Street Journal recently pointed out, that there have been at least 125 failed attempts in the modern era to reduce or eliminate the municipal bond interest preference. The preferential tax treatment has massive support at the state, local and industry level with organizations including the US Conference of Mayors, the National Association of Counties, The American Hospital Association and many others rallying to lobby house leaders to maintain the status quo. We are very skeptical that any push to reform the tax code would include a rollback of preferential tax treatment for municipal bonds. The municipal bond market appears to agree with us, as issuance of new bonds has remained steady and the ratio of municipal to Treasury bond yields (an indicator of relative value) has not been significantly influenced.

If you are interested in discussing the interest rate environment and how it may affect your portfolio in more detail, please email us to schedule a time to chat.

A Quick Note on Taxes:

Please note that you should have all of your 1099’s from our custodian, and all of the limited partners have issued their K-1s. If you are missing any 1099’s, they are available on through your Investor Access portal, or feel free to reach out to Maggie and Maggie.Trinh@MeridianAdvisors.com.

As you plan for the 2017 tax year with your CPA, please let us know of any expected changes to your tax rate, expected income or significant deductions so that we may incorporate any new tax related information into our planning for the year.

As always, please don’t hesitate to reach out with any specific questions or concerns. Thanks for taking a look!

Best,

Josh L. Galatzan, CIMA®

Meridian Wealth Advisors

Managing Director & Founder

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.