2017 Mid-Year Update

2017 Mid-Year Update

July 12th, 2017

The first half of 2017 was a good one for financial assets and the global economy, despite broad based concerns around tightening US monetary policy (rising rates), high valuations in US equities, abundant geo-political concerns and a lack of follow through from the GOP and the Trump administration on tax and health care reform.

The Economy, Rates and the Fed:

Real GDP growth rose at a 1.4% annual pace in the 3rd estimate for Q1 2017, with Fed officials continuing to project annual GDP growth of about 2.2% for the full year. The unemployment rate fell to 4.3% in May, a 16 year low, leaving the US closer to full employment. The June employment report of +222k nonfarm payrolls brought the three month average to +194k. However, wage and productivity growth both continue to fall short of what we would expect to see in this environment, and inflation measures continue to disappoint. Consumer spending weakened in Q1, with higher gasoline, rents and healthcare costs taking a larger piece of consumer budgets this year. Putting it all together, the data suggests a continuation of the slow growth long term recovery we have experienced for the last several years (one of the longest on record).

The Fed’s stated monetary policy goals are “to foster economic conditions that achieve both stable prices and maximum sustainable employment”. These goals, also known as the Fed’s dual mandate”, currently present a dilemma for Fed governors. While the unemployment rate continues to hover near the Fed’s goal of 4.6%, inflation remains below their target of 2%. This contrast, among other factors, leads us to believe that the Fed will continue to tighten monetary policy at a very measured pace. Since the first rate hike in December of 2015, the Fed has only increased the target rate by 100 basis points, a very slow pace by historical standards. They have also telegraphed intentions to reduce their balance sheet, likely beginning in late 2017. We believe this additional form of tightening is further evidence that the Fed will continue to move relatively slowly in increasing the target Federal Funds Rate.

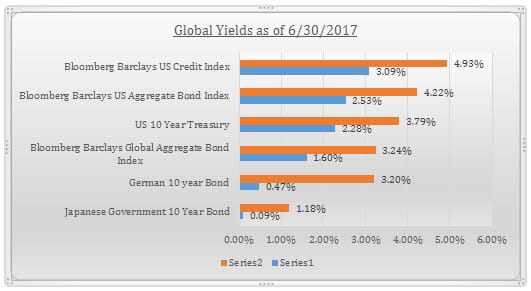

Overall we expect a relatively gentle climb in yields over the long term, although possibly rising more than markets currently expect. So far the Fed has been pushing on short term rates, while fiscal policy delays have been pulling on the long end. The yield curve has generally flattened throughout the first half of the year (short term rates moving up faster than long-term), but steepened again in June following renewed hawkish rhetoric from Fed Chair Janet Yellen. Rates around the world have generally followed the same trend, with yield curves flattening and yields below long term averages.

Equity Markets, Trumponomics and D.C.:

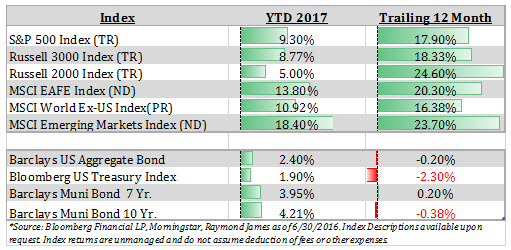

The strong returns in global equities that began after the November US Presidential election have persisted through the first half of the year, despite the lack of significant progress on the “Trump Agenda”.

Tax reform has taken a back seat to GOP efforts to repeal and replace The Affordable Care Act, efforts which have been at a stalemate all summer. Proposed fiscal stimulus in the form of deficit based infrastructure spending has, so far, been a non-starter in Congress. While financial regulation reform is also on the table, the house and senate have yet to see eye to eye on moving forward. Suffice it to say that despite controlling the White House and both chambers of Congress, it is slow going on Capitol Hill. With 2018 mid-term elections on the horizon, we believe Congress will eventually have to move off high center on both the healthcare and tax issues. Otherwise, they risk losing their majority in both houses.

Our confidence in the prospect of substantial tax reform becoming a reality is not high. While some degree of tax cuts remain a distinct possibility in late 2017 or early 2018, we doubt that the White House and GOP majority will push true reform through. Tax reform is inherently difficult given the complexity of the tax code, and the fact that very few constituents want to give up their deductions (despite the call for a simplified code). Furthermore, the republican majority is not likely to propose a reformed tax code that potentially increases the deficit further, although the Trump Administration claims their proposal will “pay for itself” through economic growth.

The outlook on Repeal and Replace is even murkier, in our opinion. The Senate could choose to push their latest proposal through via the budget reconciliation route (which would only require 50 votes, with VP Pence breaking the tie). The House and Senate versions look very similar, but some Republicans fear a backlash from swing voters in the mid-term elections due to reduced benefits for many lower income voters alongside tax cuts for higher income earners. On the other hand, so Republicans oppose the bill because it doesn’t go far enough to repeal the ACA.

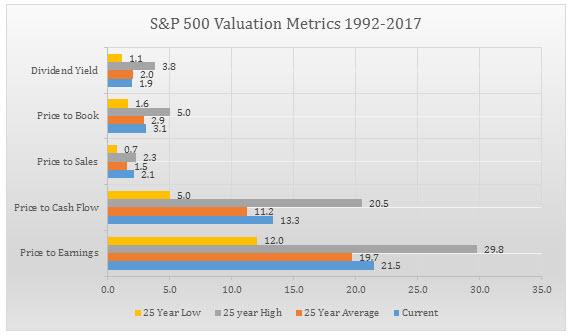

U.S. Equity valuations have been a hot topic of late; and justifiably so. At an inflation adjusted PE ratio of 21.5, it has been some time since we have seen the S&P trade at current valuations levels. The previous 11 bull markets have peaked at an average PE of 23.3. Most other valuation metrics look generous as well, but perhaps not at the extreme levels many might think. Looking at the chart below, you can see a comparison of current valuation metrics compared to 25 year average valuations.

Current valuations suggest multiple expansion in the short term is unlikely, and earnings must continue to improve to drive equity markets higher. At the same time we view downside as relatively limited. The underlying macro fundamentals, driven by solid earnings growth, sustained (albeit slow) economic growth and relatively favorable monetary policy backdrop continue to be supportive of risk assets.

S&P 500 earnings have been growing steadily since Q3 2016, reaching 14% year-on-year growth in the first quarter. Earnings forecasts outside the US have been revised upwards throughout the year as well. While we do not expect earnings growth to sustain this pace, we do believe that the full year outlook remains positive and, along with favorable economic trends and monetary policy, remains supportive of healthy valuations. That is not to say that we do not expect to see some volatility return to the markets. Through June 30th, the market had experienced 8 consecutive months of gains (and 15 out of the last 16 months). Volatility, as measured by the VIX index, has remained persistently benign, near 20 year lows. It is statistically unlikely that we would not see an increase in volatility, and would expect to see some level of consolidation in the markets; as we expect to see in any secular bull cycle. Assuming we avoid any unexpected geopolitical / financial events or policy blunders by the Fed, ECB or D.C., we would expect any near term corrections in US Equity markets to be relatively short and shallow.

Our once contrarian positive view on developed international markets seems to be morphing into consensus, and most overseas markets have generally outperformed US markets year to date. European markets have been trading at a valuation discount to the U.S. for several years, reflecting broad based geo-political concerns (Greece, Brexit etc.) and concerns around the health of financial firms. But, Europe’s economy is enjoying a cyclical upswing, supported by a still accommodative European Central Bank (ECB). Eurozone stalwarts Germany and France are poised to have pro-European government leadership, with Emanuel Marcon’s party achieving a substantial majority in the French parliament and Angela Merkel poised to win her fourth term in Germany. Despite concerns over Brexit negotiations and a relatively weak banking sector, we see further upside in Europe as investors become more comfortable with the real economic and structural progress being made. In Japan, more share-holder friendly corporate behavior, a stable Yen and improving earnings are supportive of continued positive momentum. Overall, the backdrop for developed international markets remains compelling.

Summary:

We began the year surrounded by investor euphoria around the “Trump Agenda”, which we described at the time as long on promises while short on substance. The lack of progress towards said agenda has yet to be a setback due to solid economic fundamentals in the U.S., an improving economic picture abroad, exceptional earnings growth and favorable global monetary policy conditions. Assuming earnings growth persists and we avoid any major unexpected economic or financial setbacks, we view the current environment as favorable for both U.S. equities and developed international equities. Should we see progress in the areas of tax reform and / or healthcare reform, we would anticipate an additional boost to the momentum we have experienced year to date. A gradual increase in global yields should be expected (and appears to be priced in to markets), as the Fed continues to move towards a more normalized rate environment.

As always, please reach out directly if you would like to discuss any of the above information further. Thanks for taking a look!

Josh L. Galatzan, CIMA®

Founder & Managing Director

Meridian Wealth Advisors

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.