Q3 2017 Commentary

Q3 2017 Commentary

October 10th, 2017

The third quarter of 2017 was eventful to say the least. Political antics, Fed policy and market related news took a back seat to a series of deadly hurricanes and the tragic and senseless shooting in Las Vegas. With such heavy hearts, it is difficult to shift focus to economic and financial topics. Our thoughts and prayers go out to all of those affected by Hurricanes Harvey, Irma and Maria, as well as those affected by the mass shooting in Las Vegas.

Third Quarter Summary:

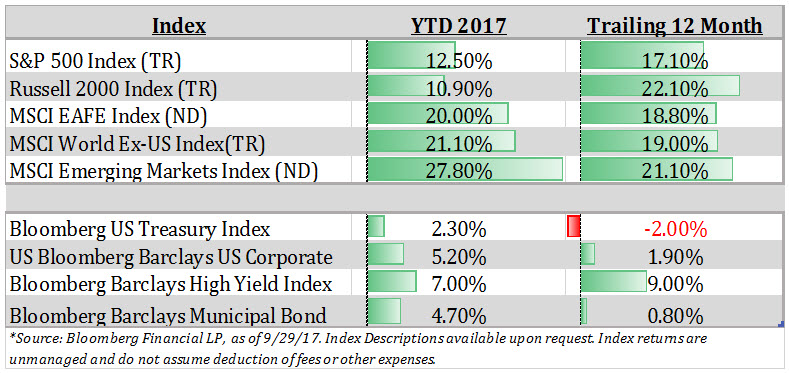

Equity market volatility rose early in the quarter, as US markets pulled back approximately 3%, primarily in reaction to increased tensions between the US and North Korea, as well as the prospect of tighter monetary policy. However, said weakness was short lived, as markets quickly rallied once again to reach all-time highs on multiple occasions during the quarter. Earnings growth continues to impress after the slow / no growth two year stretch of 2015-2016. In fact, Q3 2017 marked the eighth consecutive quarter of positive performance in US equities, a rare streak by historic standards. Conversely, US Treasuries rallied early in the quarter with the 10 Year Treasury yield touching a low of 2.06% at one point before reversing quickly and closing the quarter with a yield of over 2.3%. Developed international and emerging markets exhibited strong performance as well. Despite negative results for August, EM remains the top performing equity component for the year with a total return of approximately 28% through September 29th.

The US economy continued to deliver steady results, with the Q2 GDP print coming in at 3% in the second revision. Labor market measures remained strong for the 3rd quarter, and readings on the US consumer (which accounts for 69% of US GDP) continue to be supportive of economic growth. Although most inflation measures remain below expectations, it is widely expected that the Fed will continue to tighten monetary policy through gradual increases in interest rates, as well as the announced reduction in their balance sheet.

By contrast, the European Central Bank is likely to continue to proceed with caution despite improving economic expansion. Their lagging recovery leaves the economy in a fragile position, and should the ECB move to tighten too quickly it would likely damage the recent progress in economic expansion. While the pace of balance sheet expansion should slow, we would be surprised to see any significant increase in rates coming out of the ECB. The Bank of Japan is also likely to remain extremely accommodative for the foreseeable future.

Assuming our observations above are generally on target, we would expect to see the dollar begin to strengthen again, to the benefit of overseas economies and markets. Given this backdrop, we continue to view developed international markets, and to a lesser extent emerging markets, favorably.

Trump Tax Proposal: Will it be huuugge?

On September 27th the Trump Administration and Congressional tax committees released an outline of proposed tax reform aimed at simplifying the tax code and broadly cutting taxes. The outline is moderately more informative than the Administration’s initial one page release from April, with many key details still to be debated and determined. President Trump has set a very ambitious goal for enacting a final bill into law by the end of the year. Due to the complexity and partisanship involved in tax reform, we find it unlikely that President Trump will be able to claim success by year end.

While the new blueprint gives us a little more insight into what we may see come out of congressional tax committees, several key provisions are glaringly left unaddressed. Hotly debated topics will include the final top tax rate and what current deductions will be eliminated. The only clarity in the outline is that it would certainly reduce the number of taxpayers with complex tax returns, encouraging most Americans to file a 1040EZ, reducing the load on the overtaxed IRS service (pun intended).

The initial outline calls for a collapsing of the brackets, from seven to three, changing the rates from 10%-39.6% to, 12%, 25% and 35%, with the potential to add a fourth higher rate for the wealthiest tax payers. Unfortunately, the initial blueprint does not address income ranges for each bracket, which is arguably more important than the rates themselves!

The standard deduction is almost doubled to $12,000 for individuals and $24,000 for married couples and includes an unspecified increase to the current $1000 per child tax credit. Additional standard deductions for the elderly and personal exemptions would be eliminated, as would the alternative minimum tax for both individuals and corporations. In an effort to simplify the tax code, the blueprint eliminates most itemized deductions, but retains key tax breaks for home mortgage interest and charitable donations. Tax advantaged retirement savings are expected to stay in place as well as tax advantaged dividend and capital gain rates. Needless to say, any eliminations of deductions will breed extensive lobbying by special interest groups and will add to the inevitable challenges in pushing reform forward.

Perhaps the most controversial aspect of the blueprint is the elimination of the deduction for state and local taxes (SALT). This is an enormous hot button issue for high tax states such as New York, New Jersey and California as well as those states with large sales and property taxes, like Texas. Expect significant push back from Congressional leaders, almost certainly to include key GOP members. According to the Tax Foundation, “Of those that claim the (SALT) deduction, almost 90 percent of the deduction flows to those with incomes in excess of $100,000. The deduction favors high-income individuals who are concentrated in high-tax states. Six states—California, New York, New Jersey, Illinois, Texas, and Pennsylvania—claim more than half of the value of the deduction.”

Another controversial aspect of the blueprint relates to pass-through income from limited partnerships, sole proprietorships and S corporations. Under the current outline, pass-through income would be taxed at a new flat 25% rate on business profits. This approach, should it be enacted, will no doubt lead to a difficult task in sorting our individual compensation vs. business profits (as well as a rush by many businesses to convert to pass-through entity status). Controls to prevent abuse were requested in the documents.

The plan calls for a corporate tax rate of 20%, down from 35%. Recall that President Trump initially called for a 15% corporate rate. Business expensing is proposed to allow for 100% expensing over five year for investments in depreciable assets (other than structures built after September 27th, 2017). Repatriation was addressed as a one-time tax to bring assets onshore, and future taxes on both liquid and illiquid assets held in foreign assets.

On the whole, we still don’t know enough to make an informed judgement on the eventual impact of the proposed tax reform. The White House, desperately in need of a legislative victory, will certainly be pushing hard to get a bill passed before the 2018 mid-year election. However, given the complexity of enacting actual tax reform (rather than just tax cuts) and the controversial nature of some of the proposed revisions, we are certain to be in store for a long and hard debate that could easily stretch beyond Q2 2018.

Surely it is time for a recession, right?

It has been well documented that the current economic recovery (and bull market) is one of the longest in history. We do not debate that if the calendar were the only measure of a recovery, this one would be classified as having some serious grey hair. However, while this cycle might be used, we are not convinced that it is all used up.

Predicting recessions (and bear markets) is extremely difficult, if not impossible. Typically, it is only in retrospect that even the most astute prognosticators can definitively define the beginning and end of a cycle. However, there are a handful of leading indicators that are noticeably lacking if this economy is heading into recession.

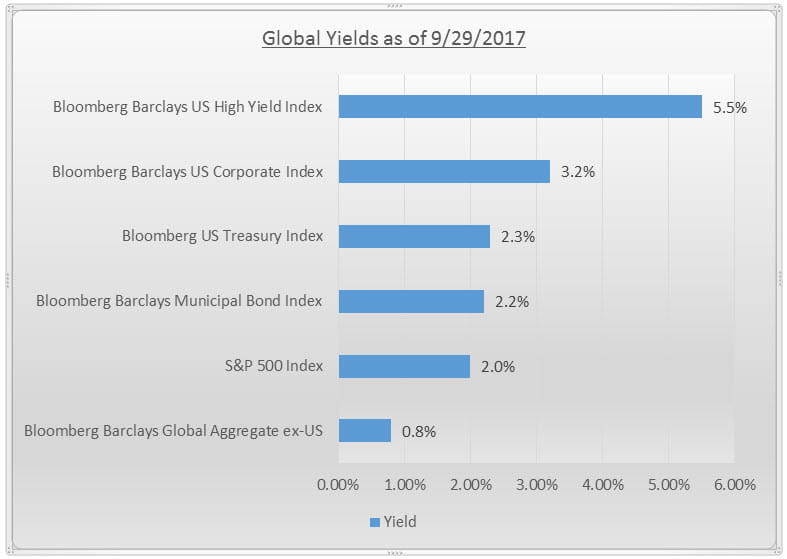

1. The Yield Curve: an inverted yield curve has historically been a nearly perfect predictor of recession. However, currently we have a nearly eighty basis point spread between the two and ten-year treasury (i.e. a normal yield curve).

2. Sentiment: while investors have become more positive since November, they are far from the euphoric optimism that is typical of the end of a cycle. This remains “the recovery that everyone loves to hate”.

3. Liquidity: current liquidity measures remain strong relative to historic pre-recession levels.

4. Credit Spreads: the spread between Baa corporate bond and 10-year treasury yields remain relatively wide, implying that investors have a muted fear of credit risk. Typically, as recession nears, these spreads would tighten as they have in most pre-recessionary periods.

5. Leverage: Debt loads, debt service ratios and debt usage relative to GDP do not appear to be extreme by historic standards.

Given the pure longevity of the current recovery, it would not be surprising if we were in the closing stretch. However, the general health the economy remains strong and lacking many of the typical signs looming recession. Monetary policy remains favorable, despite the Fed embarking upon a well telegraphed tightening phase. We find it plausible that, due to the extreme nature of the financial crisis, an extended period of recovery is to be expected.

Looking Ahead: Has anyone seen my crystal ball?

2017 has been great for investors, with nearly every risk asset class delivering strong results and bonds performing better than expected. The length of the current recovery and bull market has been abnormally long, cycles simply do not normally last this long. We all know it can’t go on forever, but we believe making investment decisions based on a calendar is short sighted. Despite the longevity of this cycle, we believe that on the whole, the good outweighs the bad. The US economy remains on firm footing, developed overseas economies continue to improve and global monetary policy remains favorable for risk assets. The current bull market in equities has matured from one driven by extreme low valuations and interest rates to one driven by earnings growth and strong balance sheets. While it is difficult to view equities as underpriced, we view the combination of strong earnings growth, healthy balance sheets and low interest rates as deserving of elevated valuations. Should the GOP be successful in pushing some version of tax reform (or even tax cuts) through, we would expect an additional tailwind in equities. We would be extremely surprised if we did not see volatility pick up in the coming months. Equity markets have trade in an extremely narrow band all year, with an unusually low occurrence of any meaningful pullback.

Overseas we see above trend economic expansion, improving earnings and fundamentals driving further upside in international asset class returns. Should the dollar begin to strengthen again as many expect, we should see an additional boost to our international asset class exposure.

Within fixed income, it will be increasingly difficult to generate the total returns investors have enjoyed for the last several years. US Treasuries will be pressured by economic expansion, tighter monetary policy and increased inflation expectations. The conditions should favor US Credit (corporate bonds) over Treasuries. Tax Free Municipal Bonds continue to demonstrate strong relative valuations and the perpetual demand for tax favored income combined with strong credit quality should continue to be favorable for the sector.

If you have been underinvested or recently experience a liquidity event, it would be wise to exercise caution and a deliberate approach to new investments. For our existing portfolios, we are increasingly scrutinizing our risk exposure and making tactical adjustments accordingly.

If you have any questions or would like to discuss any of the enclosed information in more detail, please do not hesitate to reach out directly.

Best,

Josh L. Galatzan, CIMA®

Meridian Wealth Advisors

Managing Director & Founder

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.