Equity Market Update Everybodys Selling

Equity Market Update: Everybody’s Selling

February 4th, 2018

As we pen this letter (end of the day, February 5th), the S&P 500 Index has fallen nearly 224 points (-7.7%) from its peak in late January. The Dow Jones Industrial average has fallen yet further from its recent high, off 2,270 points (-8.5%). With strong volume and decent breadth to the downside, Friday marked the first pull back in the S&P 500 of more than 3% in over a year (448 days to be exact). As you might recall from our Year End Summary & 2018 Outlook, in 2017 we experienced extremely low volatility relative to all historical standards. We postulated that the trend of such low volatility was extremely unlikely to persist in the new year. It appears that just shy of a month into the new year, volatility has indeed returned to the markets.

What is causing the current negative action? We believe a combination of rising interest rates (the ten-year treasury has risen from 2.4% to 2.8% since the end of the year) and indications of rising wages stoked inflation worries and have contributed to the change in investor sentiment. As a reminder, higher interest rates and wages eat into corporate profits. With equities entering the year at historically high valuations, it wasn’t going to take much to trip the first wave of cautious profit taking.

The pressing question is, what do we make of this corrective action? Is this the beginning of a more substantial correction? Or worse? Or, is this the long overdue periodic pull back that is very common during secular bull markets?

The current corrective trading action has not changed our views published in January. We continue to see the majority of data available as favorable to equities in general, with the previously mentioned lofty valuations serving as the biggest headwind to the asset class. The pullback cannot be blamed on deteriorating economic indicators, as global growth remains strong and most economic indicators remain positive. Likewise, we can’t turn to earnings as the culprit, with close to 70% of S&P 500 companies having already reported, earnings growth remains very strong. Lastly, while interest rates have moved up, yields remain low relative to historic standards.

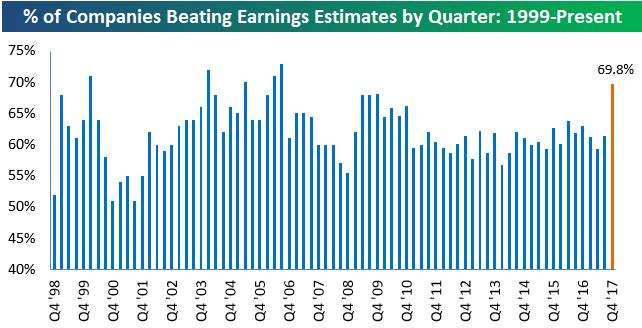

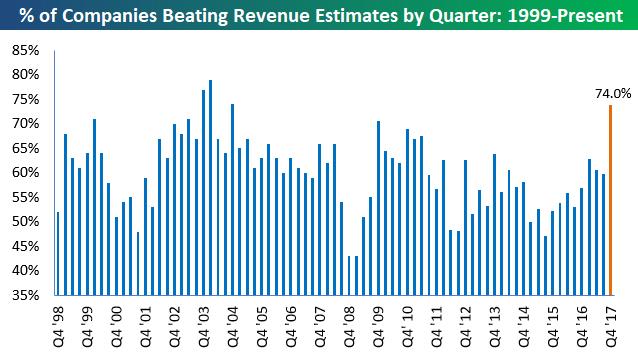

The chart below from our friends at Bespoke Investment Group give a good visual of the earnings strength we have experienced so far this season. As shown below, both the earnings and revenue beat rates this season are at their highest levels in at least a decade.

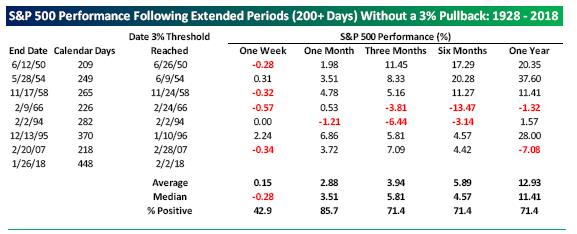

It is also important to note that, while this pullback certainly stings, this type of movement is very normal from a long-term perspective. Friday’s close marked the first 3% or greater decline since President Trump was elected. February’s pullback takes us back to mid-December levels, before we had an unusually positive January. Stocks don’t go straight up, and the longer they do over short or even intermediate periods, the worse it feels when more normal trading activity returns. In point of fact, since the S&P 500 began in the late 1920’s, there have been 628 3%+ pull backs, or an average of 7 per year! The most recent streak of 448 days was not only the longest on record, but only the 8th time in history that the S&P has gone over 200 days without a 3% move to the downside. So, while it was a great streak that we all enjoyed, it is unlikely that any of us will ever see such a streak again in our lifetimes.

Another interesting chart (below) from Bespoke Investment Group shows the S&P 500’s performance following the date when each of the prior extend periods without a 3% pull back have been broken. It appears that on average, investors have experienced good “bounce back” returns over the following one, three, six and twelve months.

In summary, the decline in equities over the last several days has been swift and unpleasant. However, until we see a meaningful deterioration in economic readings and / or earnings, we view the current pull back as normal and overdue. It is likely that due to lofty valuations and overzealous investor sentiment, we could be in store for further declines over the next several weeks. That said, our full year thesis remains optimistic, for now. We will continue to monitor key indicators very closely for any changes that may impact our outlook.

As always, please don’t hesitate to reach out directly with any questions. Thanks for taking a look!

Josh Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Meagan Moll, CIMA®, CFP®, CPWA

Partner

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.