Mid-Quarter Update: Tariffs, Protectionism and Volatility

Mid-Quarter Update: Tariffs, Protectionism and Volatility

March 5th, 2018

Our last update came to you on February 5th, following a pullback in equity markets sparked by inflation worries. Ultimately, in just a matter of days the major US Equity Indices experienced a pullback of more than 10%, wiping out all of January’s gains. At the same time, US Treasury yields were grinding higher, with the Ten Year reaching nearly 3% and the Two Year 2.2%. When the books closed on February, the nearly yearlong streak of positive monthly returns on the S&P 500 came to an end (fifteen months if you include dividends) with a -3.6% return. While it appears that investor sentiment around inflation worries is settling down, March began with a new wave of selling sparked by last Thursday’s announcement that the Trump Administration plans to implement a 25% tariff on imported steel and a 10% tariff on imported aluminum. While we were surprised at the announcement, we were not surprised to see the negative reaction in the markets. We have commented as far back as November 2016 that a move towards protectionist trade policies would most likely have negative impact on the economy and equity markets. It is important to note that the tariffs have not yet been implemented, and it remains to be seen if / when they will be. Rumors of disagreement over the announcement within the cabinet are rampant, as are rumblings that most Republicans in Congress strongly disapprove. It is also worth mentioning that a popular theory being thrown about is that President Trump is using the announcement to jump start the stalled NAFTA negotiations with no intention of actually implementing the Tariffs. Whatever the case, with the information at hand it is too early to judge the full ramifications of last week’s announcement. It is, however, possible to draw some general observations as we prepare for the end of the first quarter.

Overwhelmingly, economists agree that protectionism has a negative impact on economic growth. While we do not hold ourselves out to be economists, we certainly agree with this sentiment. Simply put, if the Tariffs are indeed implemented, the cost of imported steel and aluminum will be higher to US firms, leading to lower margins. This includes auto manufacturers, aerospace companies and industrial manufacturers. Additionally, supply chain disruptions, possible higher interest rates and reduced capital investments due to higher uncertainty could all drag on the economy. However, it is impossible to predict actual outcomes until we have a clear understanding of the details behind the Tariffs and any retaliatory polices implemented by other countries. The European Union has already indicated plans to impose Tariffs on Harley Davidson motorcycles, bourbon whiskey and Levi’s jeans, while Canadian Foreign Minister Chrystia Freeland has said that “should restrictions be imposed on Canadian steel and aluminum products, Canada will take responsive measures to defend its trade interest and workers.” Such rhetoric naturally leads one to ask if an all-out trade war is in the making. While there is certainly that risk, we do not think the risk of a trade war is high, and find it more likely that we are seeing a significant amount of posturing.

Not surprisingly, the US is the world’s largest importer of steel (and is not a significant producer at only 5% of global production). China, Mexico and Canada are by far the largest sources of US imports of steel and aluminum. According to Ben May at Oxford Economics, 88% of Canadian Steel exports went to the US in 2016, while the same is true for nearly three quarters of Mexican steel exports*. This is supportive of the theory that President Trump’s controversial announcement was an attempt to push the NAFTA negotiations into gear. The importance of NAFTA is far reaching, as Jeff Saut of Raymond James outlined in his weekly commentary:

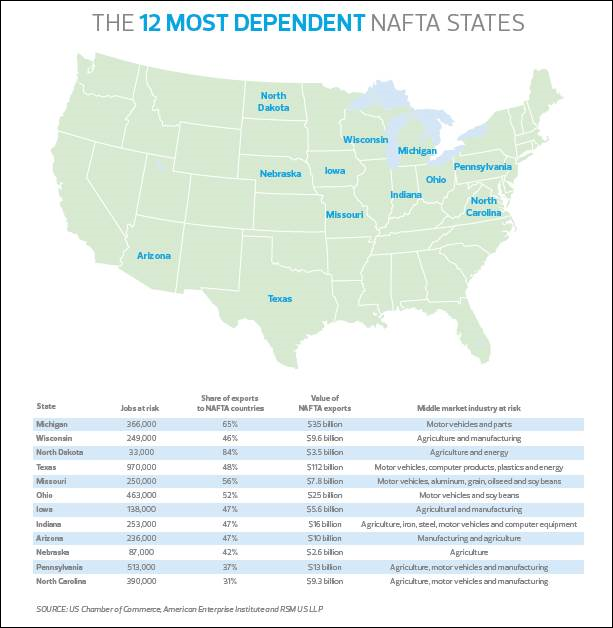

“So what’s the big deal with NAFTA? Well, according to our pal Joseph Brusuelas, who is the eagle eyed Chief Economist for RSM, NAFTA is a big deal for the US. In a recent presentation Joe notes that there are $312.4 billion worth of US goods exported to Canada from the US and $61.4 billion of US services. Meanwhile, $240 billion worth for US goods are exported to Mexico and $30 billion worth of services. Speaking to the potential impact of pulling out of NAFTA, Joes shows the 12 most affected states (chart below). Take my home state of Michigan. Exiting NAFTA would put 336,000 jobs at risk, mainly in the auto and auto parts sectors. For Texas there are 970,000 potential jobs at risk; so yes, NAFTA is a big deal.”

-Jeff Saut, Chief Investment Officer, Raymond James Financial

As previously noted, we won’t know the true implications of the proposed Tariffs for many days if not weeks. And, while we speculate that the likelihood of a trade war is low, the risk does exist. If we were to see such a result, it would undoubtedly have swift and negative implications on equity markets and if not resolved quickly, negative long term implications on the economy. At the very least, the added uncertainty is likely to increase financial market volatility. That said, with the information currently at hand, we believe the positive underlying fundamentals (Strong global growth, earnings growth and accommodative monetary policy) outlined in our January and February commentaries remain intact.

As always, please do not hesitate to reach out to us directly with any questions or discuss further. Thanks for taking a look!

Josh Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Meagan Moll, CIMA®, CFP®, CPWA

Partner

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.