2018 Mid-Year Commentary

2018 Mid-Year Commentary

July 3rd, 2018

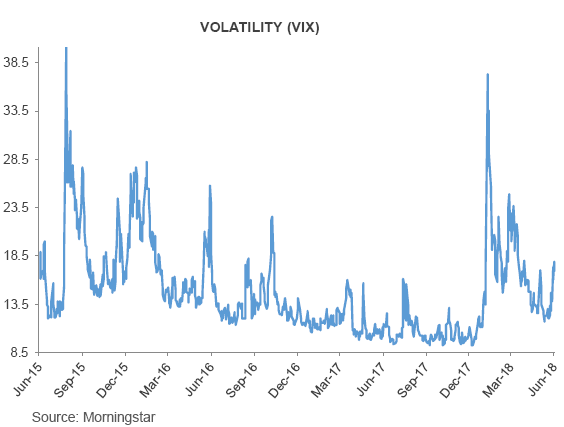

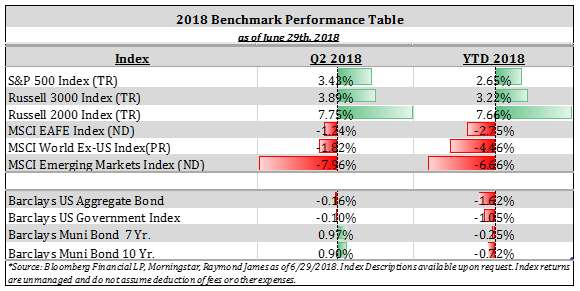

The first half of 2018 could not have looked more different than 2017. Last year was characterized by extremely low volatility and generally strong equity market returns both domestically and internationally. With trade tensions and tariffs dominating the headlines this year, equity markets around the world have experienced a sharp upswing in volatility while delivering generally meager returns. Domestic equities have noticeably outperformed international equities, with small and mid-capitalization companies outperforming their larger counterparts. Fixed income investments have generally delivered negative returns year to date, with tax free municipal bonds outperforming both government and corporate bonds.

On July 6th we will see a 10% tariff on $50 billion in Chinese goods (primarily industrial) go into effect, and the Trump administration has already announced further tariffs on another $200 billion in primarily consumer goods. While the announced tariffs and trade policy uncertainty have had a modest impact on the overall economy, the prospect of escalating trade tensions and a potential trade war would be more disruptive to the US and global economies. We have noted as far back as November 2016 that the administrations move towards more protectionist trade policies would serve as a headwind to the economy and global markets. Increased tariffs against US imports raise input costs, serve as an indirect tax on US consumers and businesses and disrupt supply chains. Additionally, the threat of retaliatory tariffs against US exports and the threat of a broader trade war all culminate into greater uncertainty for global investment.

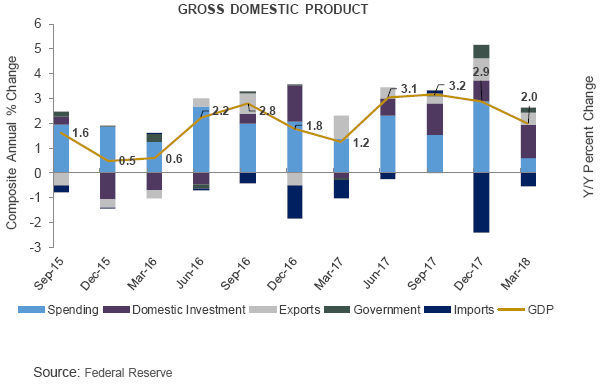

The uncertainty surrounding the future of the current trade tensions falls against the backdrop of improved earnings, lower unemployment, a flattening yield curve, moderate GDP growth and gradually rising inflation. Recent data suggests that the US economy continues to expand, albeit at a moderate pace. This current economic cycle continues to be one of the longest and slowest expansions on record. Q1 GDP was revised down in the latest estimate from 2.2% to 2.0% (Q2 estimates are expected to pick up modestly). Non-farm payrolls rose by 223,000 in May, while the unemployment rate dropped to 3.8%.

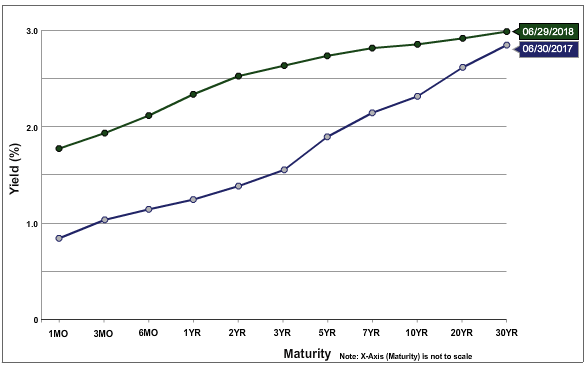

The Federal Reserve raised short term rates again in June by .25% (to 1.75%-2.0%) as expected. Reflecting a more hawkish tone as inflation expectations have moved up, the Fed removed its forward guidance by eliminating the conditional commitment to keep rates low “for some time”. We expect at least one more rate hike in 2018, and would not be surprised to see two hikes.

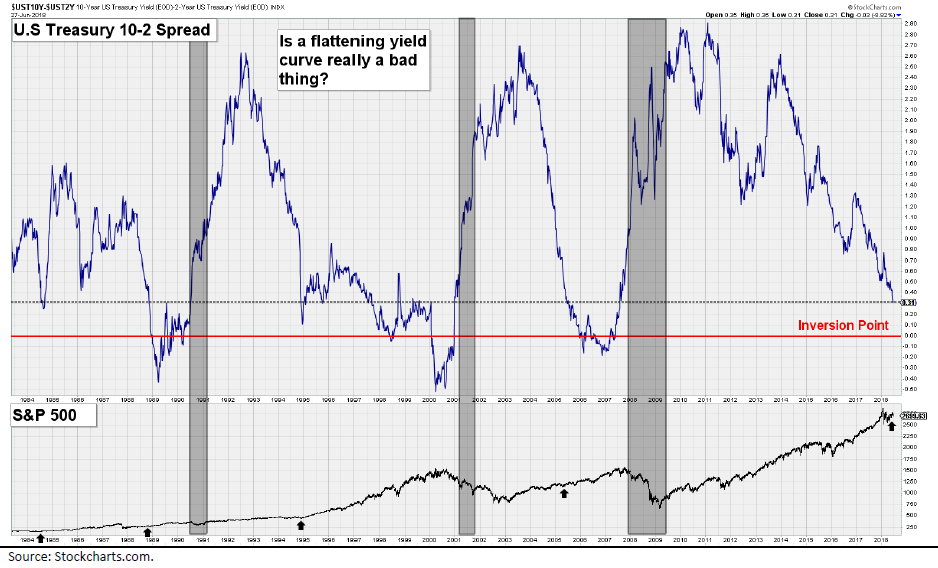

While short term interest rates have steadily moved higher throughout the year, longer term rates have been much slower to move. The 10-year treasury closed the first half of the year at a yield of 2.85% (after nearly crossing 3% earlier in the year). The result has been a flattening yield curve, and increased speculation around a potential inversion of the yield curve (short rates higher than log rates). Recall that historically an inverted yield curve has been a nearly perfect predictor of recession. That said, a flattening yield curve is not a recession signal and can indeed steadily flatten for years prior to inversion. On average the economy has slipped into recession about two years following a yield curve inversion (and we are still a far cry from inversion).

Additionally, history shows that equity markets have actually performed quite well as the yield curve flattens, as markets have often delivered some of their best performance late in the cycle.

Looking forward to the second half of the year it is evident that investors will continue to focus on trade tensions and the possibility of a trade war. Investors will also be keeping a close eye on the US mid-term elections. In reviewing historical research from our friends at Bespoke Investment Group, the party that holds the Presidency typically loses seats in both the house and the senate in the first mid-term election of a new President. If democrats were to regain a majority in Congress, we can be certain that they would do whatever possible to derail future action on Trump’s economic agenda. Fed action will also be in focus, as the likelihood of two additional rate increases has grown.

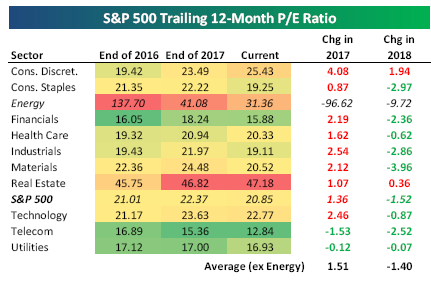

While political agendas, trade tensions and the Fed have been the dominant influences on the markets thus far in 2018 (and will likely remain so in the coming months), underlying US equity market fundamentals have been relatively strong. Strong earnings growth and the sideways trading of the market has led to a contraction in equity valuations. All but two S&P 500 sectors have seen their price to earnings (PE) ratios drop this year. On a trailing 12-month basis the S&P 500’s PE Ratio has dropped from 22.37 at the end of 2017 to 20.85 at the end of June (a nearly 7% drop).

Actual year over year earnings growth for Q1 2018 came in at 24%, and while EPS growth is projected to slip some in the second half, expectations are still for growth near 20% for the remainder of the year.

Full year consensus earnings estimates are currently at $157.58 for 2018, which implies a forward PE of 17.2x. 2019 estimates are at $174.96, implying a forward PE of 15.2x. While these levels are on the high end of historical valuations, they are by no means as stretched as where we were at the end of 2016.

So where does that leave is for the remainder of the year? Our full year thesis has not changed dramatically from the beginning of the year.

- Trade tensions and rising inflation will be headwinds for both the global economy and the equity markets.

- Rates will likely continue to rise steadily in the second half of the year, with short term rates moving more than long term rates.

- The US economy continues to improve at a moderate pace that will be supportive of equities, with little risk of a recession in the next twelve months.

- Strong earnings growth will be supportive of equities, while rising rates will provide some counter pressure. Valuation has become less of a headwind.

- Volatility is back and likely to remain elevated relative to 2017.

- Developed international markets appear attractive from a valuation standpoint, both relative to their historic valuations and domestic equities.

As we stated in our January 2018 Outlook, we continue to believe the good outweighs the bad despite the increasing negative forces that have intensified in recent months. While 2017 may have breed some complacency that has led some investors to be surprised with the lackluster performance thus far in 2018, we feel our strategy and our portfolios are well positioned in the current environment. As always, please do not hesitate to reach out directly with any questions or to further discuss your portfolio.

Josh Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Meagan Moll, CIMA®, CFP®, CPWA

Partner