Q3 2018 Commentary

Q3 2018 Commentary: Lots of Noise

October 4th, 2018

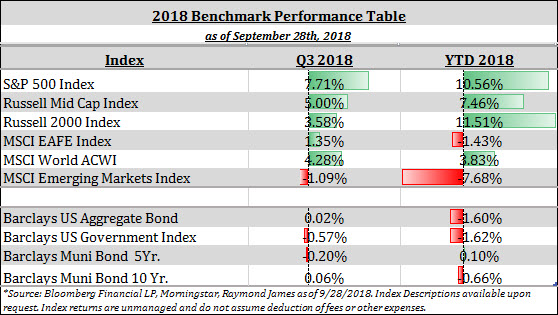

Political headlines dominated the news cycle once again in the third quarter, giving investors a lot to consider heading into mid-term elections. The Kavanaugh hearings, trade tensions between the US and China and the on again / off again re-negotiation of NAFTA have all been at the forefront. However, investors seem to have brushed aside much of the headline noise and focused more on the strong underlying fundamentals of the economy and corporate earnings, pushing US markets higher. The S&P posted its best quarter in almost five years, appreciating 7.2% (after rising just 1.7% in the entire first half of the year). Developed international markets were positive for the quarter as well, although still significantly lagging the domestic markets. Emerging Markets continued to struggle in the face of several country specific factors, worsening trade tensions and higher US rates / a stronger US dollar.

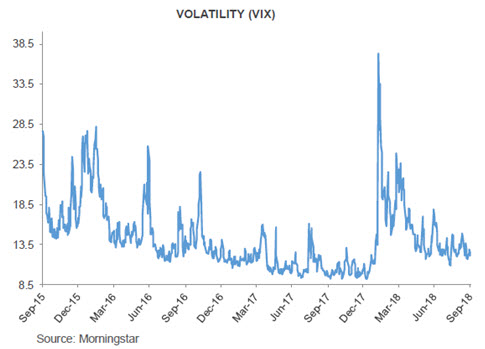

Volatility was low throughout the quarter and continued to drop as equities rose, although still slightly elevated from the last quarter of 2017. Interestingly, there were zero 1% or greater daily moves in the S&P 500 in the quarter, a significant change from the first half of the year, where 30% of all trading days experienced at least a 1% move in either direction. Fundamentally, momentum remains strong with earnings growth estimates are holding firm.

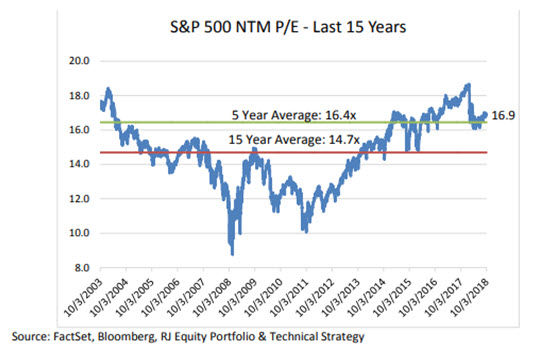

As discussed in previous commentaries, valuations have become less of a headwind to US equity markets, even with the 7%+ gain in the 3rd quarter. For example, the next twelve-month Price to Earnings Ratio on the S&P 500 currently sits at 16.9x, just slightly above the five-year average of 16.4x and moderately above the ten-year average of 14.7x. Given the current strong economic readings and earnings growth, we believe US equities are well positioned despite tighter monetary policy and the current trade tensions.

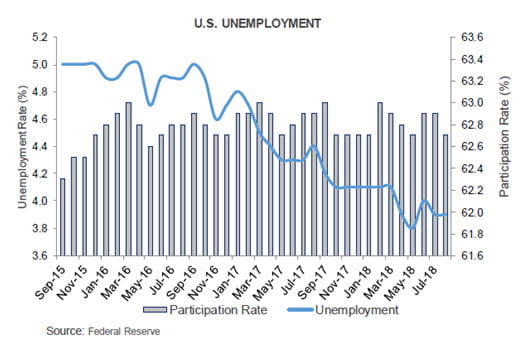

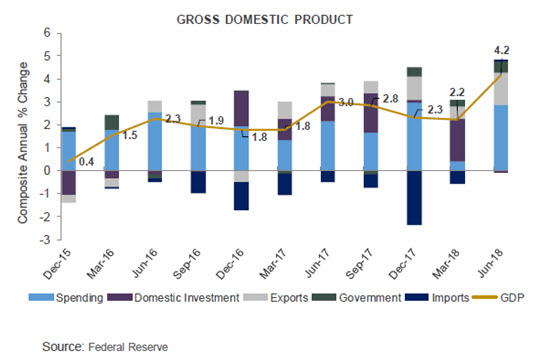

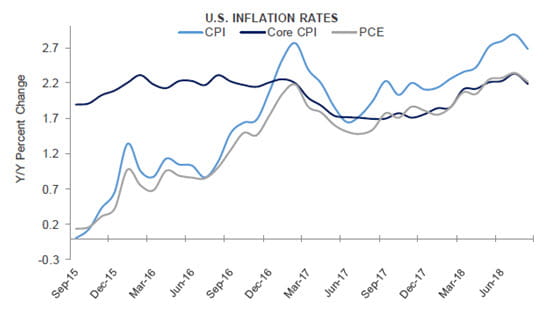

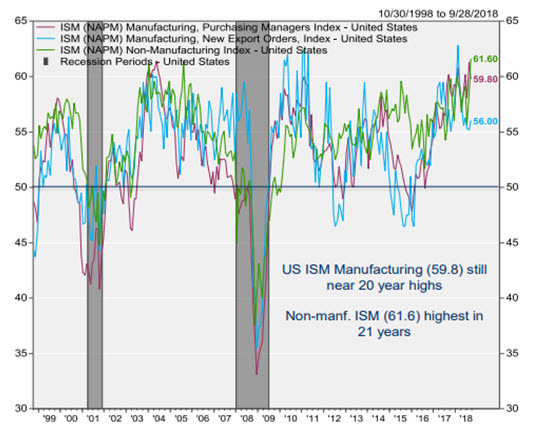

The US economy continues to chug along with a moderately strong growth pace, a tightening job market and moderate inflation. US ISM Manufacturing dipped slightly to 59.8, still near 20 year highs, while US non-manufacturing ISM hit its highest reading in 21 years (61.6) The current economic expansion (the second longest on record) seems poised to continue into 2019, although the pace of growth is likely to moderate in the face of job market constraints, less accommodative Fed Policy and a smaller impact from fiscal stimulus.

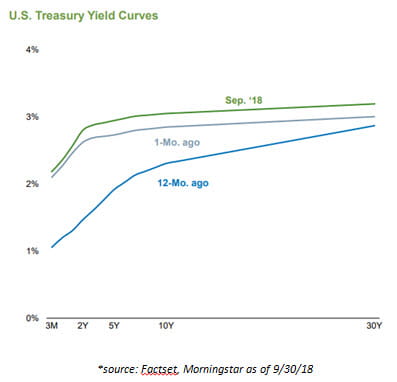

The Federal Reserve Open Market Committee (FOMC) once again raised short term interest rates by .25% at the end of September, setting the target range for federal funds at 2%-2.25%. It is widely anticipated that we will see another rate hike at the end of December, while the outlook for 2019 rate hikes remains a little murkier. Interestingly, the Fed’s statement removed a key reference to interest rate policy remaining “accommodative”, while unanimously describing the labor market and economy as “strong”, despite risks remaining “balanced”. In his press conference, Chairman Powell emphasized uncertainty around the path of rate policy going forward. On the balance, we continue to believe that short term rates will grind higher, while long term rates are likely to remain slightly more constrained (although the ten-year Treasury yield did break above its yearly high just after the end of the quarter and is quickly approaching levels not see in nearly a decade). As you can see from the chart below, the Fed has been very successful in raising rates at the front end of the curve, while longer term rates have remained significantly more stable. This has resulted in a flattening yield curve, although one that is still some ways from inverting.

Whether you call it a trade war or a trade tiff, there is no doubt that tensions between the US and China are escalating. This summer President Trump imposed 25% tariffs on $50 billion in Chinese goods. China responded by imposing 25% tariffs on $50 billion in US exports. In response, President Trump imposed 10% tariffs on an additional $200 billion in Chinese goods (effective September 24th) with the potential to increase to 25% in January. In response China has threatened additional tariffs, to which Trump has President Trump has essentially said “then I am just going to put tariffs on all Chinese imports” (threatening tariffs on an additional $267 billion). After typing that out it kind of reminds me of a playground argument between my elementary aged children, but I digress.

There are several technical issues we could go into on this topic that could fill pages, but there are just a few key points we would like to make here.

- Trade policy developments have had a significant impact on a few sectors of the economy, namely farmers and users of steel and aluminum, but the overall impact on the economy has been negligible (perhaps a tenth of a percentage point for the full year).

- Tariffs are not paid by the foreign country. They are essentially a tax on US consumers and businesses, leading to higher input costs and eventually higher cost to the consumer or lower profits to the producer (or both).

- Tariffs increase uncertainty and have the potential to disrupt supply chains.

- By themselves Tariffs will not push the US into recession, but they could make a downturn worse than it could otherwise be.

Moving to other trade issues, the US, Canada and Mexico were able to come to a trilateral agreement just ahead of the September 30th “soft deadline”. Just days before the agreement was announced, the odds looked long that an agreement would be reached. We now move into a 60-day window for congressional approval before Mexico’s Presidential term expires on December 1st. Many experts believe the deal will get approval, and we view this as a win in the trade column.

Conclusion:

The US economy remains in good shape, with very few signs that it may slip into recession in the near term. We expect the current expansion to continue well into the new year. Trade tensions, a tightening job market and less accommodative monetary policy (higher interest rates) will likely serve as the primary headwinds. Corporate Earnings in the US remain strong, and investors have so far focused on the fundamentals rather than the noise. Domestic equity markets have rallied and flirted with new all-time highs on a regular basis, while international markets have lagged significantly. In the near term, we view these as trends that are likely to continue.

As always, if you have any questions or would like to discuss any of the enclosed information in more detail, please feel free to reach out directly. Thanks for taking a look!

Josh Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Meagan Moll, CIMA®, CFP®, CPWA

Partner

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.