Mid-Quarter Commentary

Market Commentary: Is the Bear Waking Up?

November 1st, 2018

Suffice it to say that equity investors are glad to have October of 2018 behind them. Despite rallying for the last two days of the month, October was a brutal reminder that there is such a thing as volatility in the markets. A confluence of issues came together to spark the sell off early in the month. Continued trade tensions, worries over peak earnings, rising interest rates and the coming mid-term elections all contributed to a sharp decline that persisted for virtually the entire month. If you have read our previous commentaries this year, you will know that most, if not all of these issues, have been on the table during the course of 2018. In particular, the FOMC’s shift to tighter (i.e. more normalized) monetary policy and the continued trade tensions between the US and China have been recurring themes that we have discussed for many months, going back to 2017.

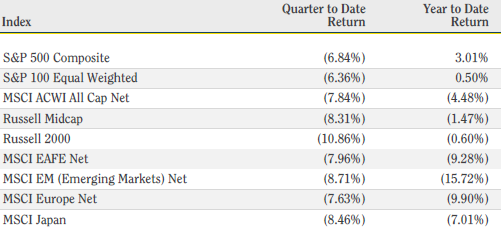

As you can see from the equity index returns below, the month of October was negative around the globe and across the capitalization scale. While the S&P 500 Composite ended the month up 3% for the year, the positive returns are largely on backs of mega-cap technology names such as Amazon, Microsoft, Apple and Netflix, which continued to deliver outsized returns through the end of September. The S&P equal weighted 100 index, which does not take market cap into account, ended the month up just .50% for the year. Globally, The MSCI All Country World Index ended the month down 4.48% for the year.

Justifiably, the overwhelming question we have been fielding is if this is the beginning of a new bear market. Calling the onset of a bear market (defined as a 20% pull back from previous highs) is extremely difficult (if not impossible), and we leave ourselves open to the possibility that an acceleration in some of the above-mentioned headwinds could certainly lead us there. Having said that, we think the odds are low that we are in or entering a bear market and continue to believe that the current backdrop remains supportive of equities as we head into the end of the year. We believe the majority of current economic and market fundamentals support this view.

Recession Unlikely:

Key economic fundamentals remain strong, including ISM manufacturing data, jobs growth, unemployment and GDP growth. While the yield curve has been flattening, this is normal as economic expansions mature and it remains positively sloped. The Fed has consistently reiterated that their policy of tightening monetary policy is aimed at normalizing interest rates and supporting growth, not slowing the economy. While interest rates have certainly oved higher, they are by no means at a level that should be a significant headwind to economic expansion. While some may rely on the quip that we “are due for a recession”, the likelihood of a recession does not depend on the length of expansion. Rather, recessions are typically set up through a misallocation of capital, over investment or extremely tight monetary conditions, and are often accompanied by an excessive amount of leverage.

Earnings Remain Strong / Valuations Have Contracted:

Despite misguide fears that earnings would experience significant deterioration in Q3, earnings have actually remained quite strong, up over 20% year over year. While we find it unlikely that this pace of earnings growth is sustainable, 6-7% growth in 2019 seems likely as well as supportive of equity prices.

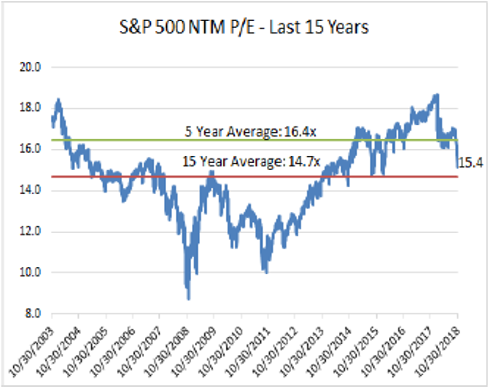

Meanwhile, the forward looking next twelve months price to earnings ratio has contracted to 15.4x consensus estimates. This level is not indicative of extreme valuations and is below the 5-year average of 16.4x and significantly lower than the peak measure of 18.6x earlier in the year.

Source: FactSet, Raymond James Technical Strategy Group

Secular Bull Market vs. Cyclical Bull Market:

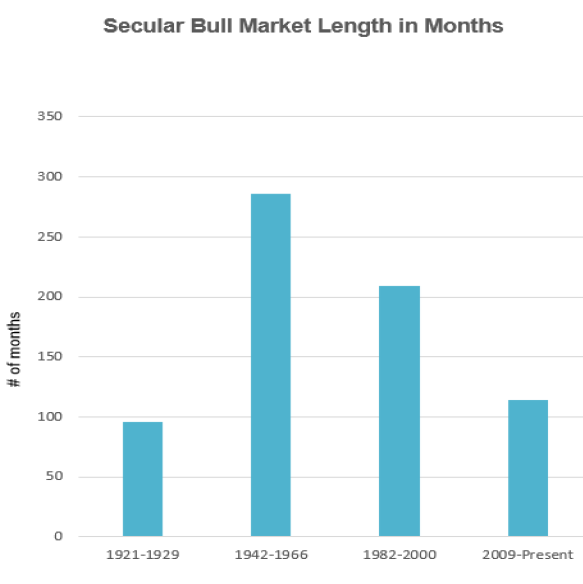

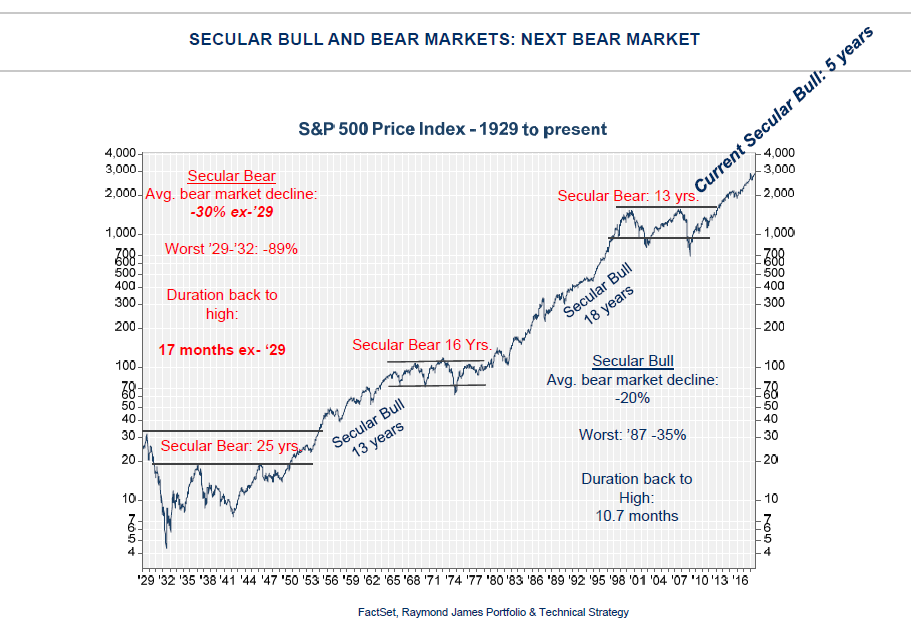

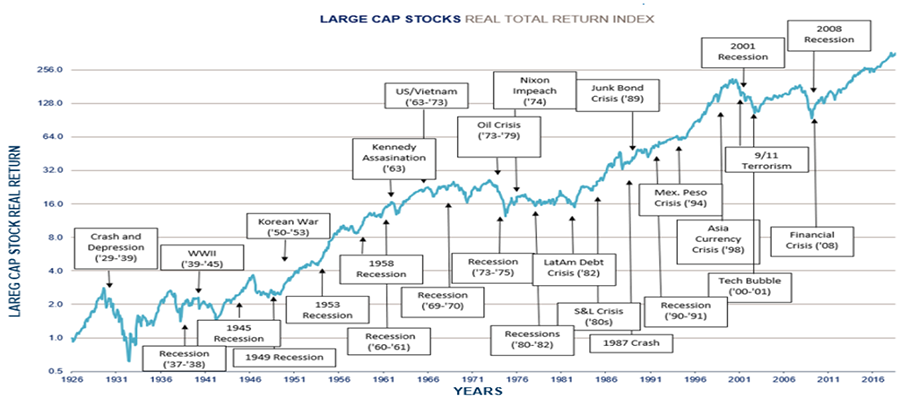

For nearly a decade we have been in what is defined as a long-term secular bull market, as opposed to a short-term cyclical bull market. The former typically spans decades and has significant long term financial impacts. While we are certainly closer to the end of the bull than we are to the beginning, statistically this cycle could have many years left to run.

Secular bull markets typically include multiple substantial corrections, often double digits and sometimes more severe.

China Trade Dispute and the Mid-Term Elections:

The trade dispute between the US and China has been a recurring theme for many months and, in our opinion, remains the most significant wild card for equity markets and the global economy. While the dispute has been intensifying of late and will likely continue to do so heading into the new year, we believe that it is unlikely to escalate to a point that could push the US into recession.

While not yet a done deal, projections indicate that the Democrats will take back the house in the mid-terms, which would lead us into a period of deadlock in Congress. This does not necessarily mean we are likely to see a short-term reversal in tax policy or corporate regulation. Additionally, we have historically seen that equity markets can do quite well with a deadlocked Congress (i.e. as recently as the Obama administration).

Both the China and Mid-Term issues are weighing significantly on short term investor sentiment, but it is worth bearing in mind that we have rarely experienced periods in which the issues of the day were not significant and concerning, including periods in which equities performed well.

Source: FactSet, Riverfront IG

Recessionary Bear Markets vs. Non-Recessionary Bear Markets:

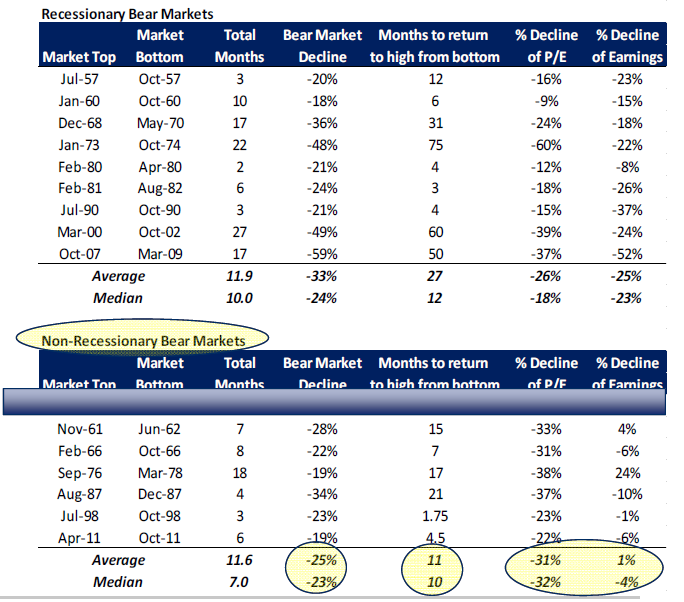

While our base case scenario does not include a bear market in the offing, it would be unwise to simply assume that we are correct and not consider the possibility that we are indeed heading into bear territory. If that is indeed the case, based on our economic analysis it seems most plausible that said bear market would be categorized as a non-recessionary bear market. Non-recessionary bear markets and recessionary bear markets have historically displayed very different statistical measures. Non-recessionary bear markets tend to be much shallower in depth and shorter in duration, although more volatile. They are also typically accompanied by some sort of geo-political or financial event. For example, in 1961-’62 we experienced a -28% bear market decline that coincided with the Bay of Pigs Incident / Cuban Missile Crisis. As recently as 2011 we saw -19% bear market decline that coincided with the European Union sovereign debt crisis.

In conclusion, the recent decline in equities has been significant and uncomfortable, sparked by concerns over headwinds such as global trade, tighter monetary conditions, slowing global growth and peak earnings. While these factors have brought equity prices down, we do not believe they have impacted our long-term thesis. The economy and earnings remain strong and should see continued growth next year and monetary policy remains accommodative. We are positioned to invest accordingly and will leave the short-term speculation trade to others.

If you would like to discuss any of the above information further, please do not hesitate to reach directly to our team. Thanks for taking a look!