2018 Year End Commentary / 2019 Outlook

2018 Year End Commentary / 2019 Outlook

January 15th, 2019

Driven by economic momentum and stellar 2017 equity market returns, 2018 began with abundant optimism surrounding the economy and financial markets. Despite periodic pullbacks early in the year, the S&P 500 closed at a new all-time high on September 20th at 2,930, reflecting a nearly 9% gain for the year to that point. Entering the fourth quarter, historically a strong period for equity returns, the market seemed on track to deliver another year of double-digit returns. Alas, it was not to be…

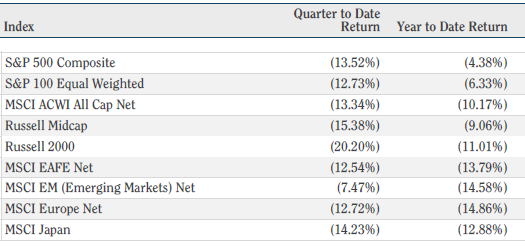

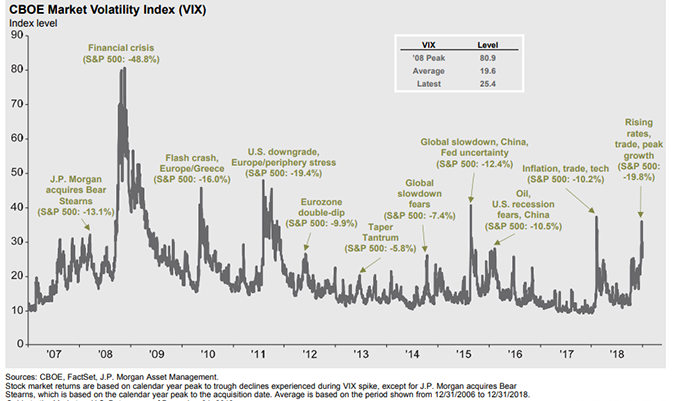

Increased focus on trade tensions between the US and China, a flattening yield curve leading to increased fears of a global economic slowdown and possible recession in the US, tightening financial conditions and geo-political concerns surrounding Brexit, government shutdowns and the Mueller investigation came together to drive the most negative December on record and the worst year for equity returns since 2008. International markets delivered even more disappointing returns than domestic markets, exacerbated by a strong rally in the dollar relative to nearly every major currency in the world. The fourth quarter was a stark reminder to investors that volatility may dissipate over short periods of time but is an ever-present factor in the markets.

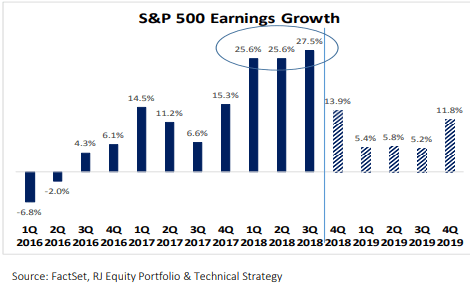

Despite the resoundingly negative returns in the fourth quarter, the news is not all bad. Very few of the factors driving Q4’s returns were fundamental in nature (trade, geo-political concerns etc.). The US economy continued to chug along with predominately positive readings heading into year end, while earnings grew at an astounding 20%+ pace over the course of the year.

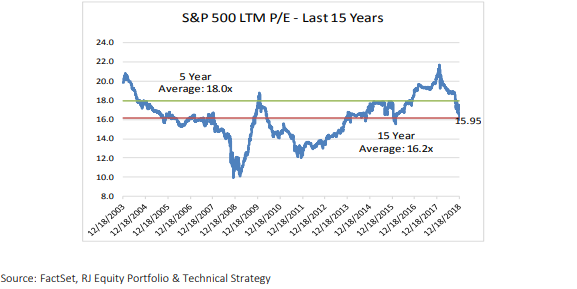

The combination of strong earnings growth and weak Q4 returns left the S&P trading at just 16x trailing twelve-month earnings after having peaked at 23x early in the year. On a forward earnings basis, assuming consensus estimates, the price to earnings ratio as of 12/31 was just above 14x. While certainly not excessively cheap by historical standards, neither are these ratios excessively expensive, especially when comparing them to more recent five- and fifteen-year averages.

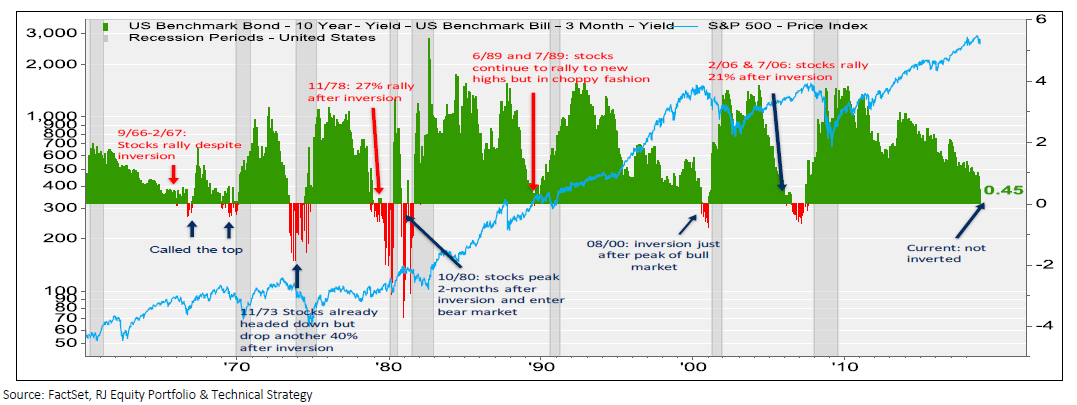

The Federal Reserve continued to gradually tighten monetary policy in 2018, aiming to “normalize” short term interest rates while also shrinking its balance sheet. These moves were expected. But, as the economy appeared to slow in the second half of the year, a widespread fear of a policy error took hold. Throughout the second half of the year the yield curve flattened (short term rates rose more than long term rates) and some parts of the curve inverted. For example, the 2 to 10 year treasury yield curve inverted in the fourth quarter, causing some to cry impending recession. You have heard us talk about the yield curve extensively over the last year, and we would contend that the appropriate curve to monitor in relation to possible recession is the 3 month T-Bill to 10 Treasury Curve. We did not see an inversion in this curve. However, inverted yield curves have been an extremely consistent precursor to recessions and are a metric that we will continue to closely monitor. Interestingly, recessions seldom immediately follow an inversion. In fact, in several cases equity markets have seen some of their strongest gains after inversion, with recession not setting in for many months after the curve inverts.

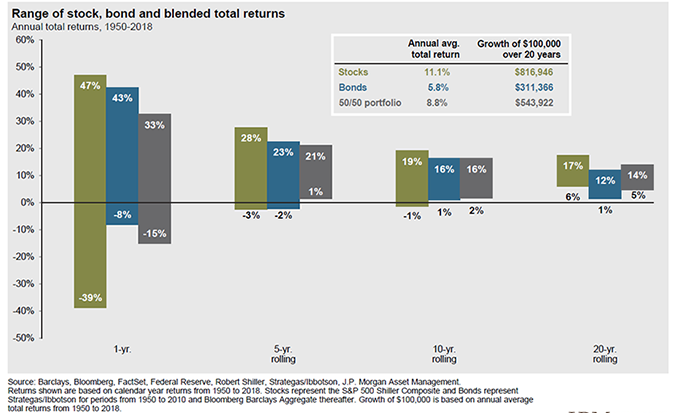

What road lies ahead? As always, predicting economic and financial market outcomes is a daunting, if not impossible task. 2018 was a great example of unexpected late year outcomes relative to early year expectations. Ultimately, long term portfolio results are not driven by short term swings in the markets, but by positioning appropriately for both short and long term expectations is absolutely important in managing both risk and potential reward.

We believe there are a handful of dominant factors influencing the markets at this time, most of which we believe will persist for all of 2019. Trade policy (specifically US – China trade), Fed Policy, economic growth (or possible recession) and equity market valuations are at the forefront. We are also keeping a close eye on Brexit negotiations and the ongoing Mueller investigation.

Trade: Something’s Got to Give

Regarding trade policy, we fundamentally believe that trade wars and protectionism are seldom, if ever, beneficial to any country or economy. More than any other factor last year, negative news surrounding the US – China tariff standoff drove volatility in the markets and negative returns. The US is by far the largest economy in the world, while China is not only the second largest, but also growing at a much faster rate than the global economy. Ultimately China has more to lose than the US. While the full implementation of the 25% tariffs would likely shave a few basis points off GDP and a few dollars off full year earnings, we do not believe it would push us into recession. In fact, to this point, the trade standoff has yet to manifest itself to a significant degree in hard economic data. China’s economy is currently slowing to sub 6% growth rates, spurring policy makers to apply stimulus (both interest rates and the Yuan have dropped). Fundamentally the Chinese economy is more fragile than the US economy, and most importantly much more reliant on exports. While we are not hopeful that a sweeping agreement will be reached in the short term, we are hopeful that more conciliatory negotiations resulting in a face-saving agreement can be reached. It is likely that any good news on China-US trade negotiations would lead to a positive response in financial markets.

The Economy & The Fed Policy: Policy Mistake Already?

The telegraphed tightening of monetary policy throughout 2018 should not have come as a surprise. Long term we view a normalization in rates as a positive for the economy and financial markets. Short term, rising rates coupled with slower economic data and a flattening yield curve have led many to believe that we are on the precipice of recession and questioning whether or not the Fed has already made a policy error.

Historically, policy errors tend to take place when the economy is showing signs of excess (excessive consumer and corporate debt, financial market euphoria etc.). While we acknowledge that recession risk is elevated, we view the odds of recession in 2019 as low. While data has certainly softened, particularly in housing and autos, most of the hard data remains positive, and we see very few typical recession signals at this time. US household balance sheets are healthy, US household net worth has risen, and consumers are saving more and borrowing less. Given that the consumer makes up 60% of the US economy, we view these facts as supportive of further, albeit slower, growth. Other measures such as business optimism, ISM manufacturing data and the leading US Economic Indicator all remain positive. Inflation and interest rates have risen but remain subdued relative to past recoveries. As previously mentioned, the yield curve is one of the most widely followed indicators of recession and one that we monitor very closely. While the yield curve has certainly flattened, it has not inverted. A flattening yield curve is not an indication of recession.

While this recovery may be one of the longest on record, it has also been one of the slowest in terms of growth. Only recently did growth really start to pick up. Therefore, an argument can be made that this cycle should last longer than most.

Consensus estimates are for 2.6% growth next year, with weaker expectations in the second half of the year as the tailwind from tax policy dissipates and tighter monetary policy continues. While this is by no means a staggering growth rate, with unemployment at all-time lows and recent growth rates surpassing 3%, is it really surprising to see data soften?

Currently the statisticians are predicting just one Fed rate hike in 2019. We believe the Fed will be data dependent and could increase rates as many as 2-3 times this year if economic data comes in better than expected. Assuming we see short-term rates move above 3% late in the year, we continue to see monetary policy as accommodative and unlikely to push us into recession.

Valuations: Moving from a Heading to a Tailwind

At this time last year, we were outlining the lofty valuation metrics present in equity markets heading into 2018 and stated that companies would need to deliver very strong earnings growth for markets to move higher. As investors, we truly couldn’t have asked for much more in terms of earnings growth. With EPS growth consistently coming in north of 20%, equities performed well through three quarters of the year before dropping violently in Q4. As previously discussed, higher earnings and lower prices have pushed S&P 500 valuations to what we view as very reasonable levels (14.4x expected earnings). Again, this is by no means excessively inexpensive, but is in fact slightly below the fifteen-year average and well below the five-year average. Consensus estimates are calling for approximately 6% growth in 2019, and while estimates can and will be revised, we view these estimates as plausible. Fundamentally, there is no reason that the markets can not move higher in 2019, although we believe that multiple expansion will be muted relative to the last few years. Expectations of equities trading back to 23x earnings are most likely unrealistic.

The previously mentioned influencing factors will play a significant role in where multiples end up. If we see positive news regarding trade, moderate economic growth and any level of civility in Washington, a 17-18x multiple is entirely plausible. If earnings come in below estimates ($169) at $165 per share, a 17x multiple would imply that the S&P reaches 2,800, just 4.75% shy of last year’s all time high. Conversely, should earnings significantly disappoint, and multiples remain more muted, it is not out of the question that we could see back to back negative years in US equities. Whatever the outcome, we expect volatility to remain elevated, as is characteristic of late cycle returns.

Conclusion: How are We Positioning

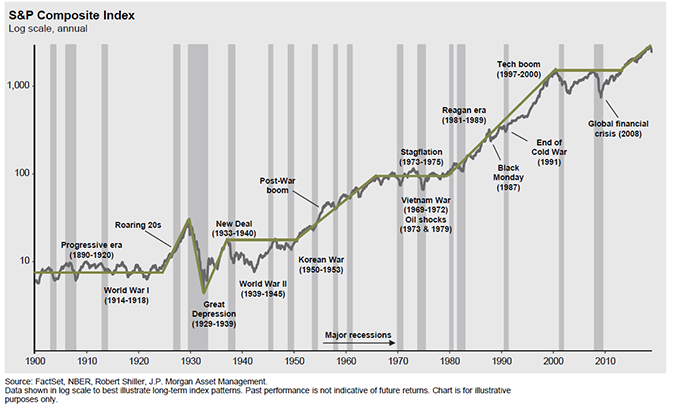

Where equities trade over the next twelve months is anyone’s guess. Similarly, we have no way to know the result and impact of the US-China trade standoff, future economic performance or whether our government leaders will be able to work together productively at any level. For the long-term investor these should not be the primary focus. Positioning to manage through volatile and even negative markets such as 2018 is of utmost importance for preserving and growing wealth. Rarely have we experienced “goldilocks” environments without similar concerns to those we now face (or worse!).

Studies have consistently shown that prudent asset allocations and risk management have resulted in positive long-term results in client portfolios through multiple market cycles.

As we enter 2019, we will be focused on managing risk in our client portfolios through our strategic and tactical allocations as well as implementing strategies specifically aimed at reducing volatility in our equity allocations. While we view the current environment as relatively supportive of equities and other risk assets, we believe we are most likely in the later stages of the bull market that began ten years ago. Late stage bull markets have historically experienced higher level of volatility, while often delivering outsized returns as well.

As we speak with you over the coming weeks, we will discuss how any changes to our allocations and strategies will impact your portfolio. In the meantime, if you have any questions please do not hesitate to reach out to us directly.

Thanks for taking a look!

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.