2019 Review & 2020 Outlook

2019 Review & 2020 Outlook

January 27th, 2020

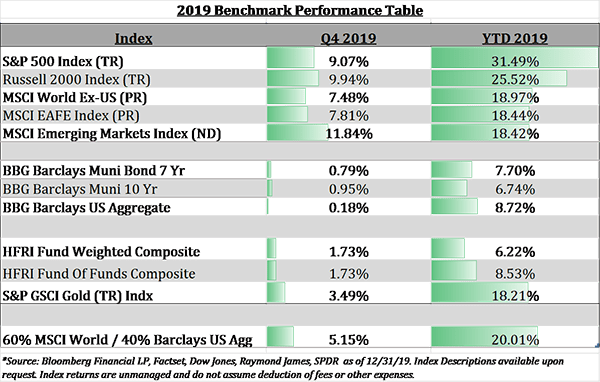

Closing 2018 and entering 2019 investors were facing increased fears of recession driven by slowing global economic data, a Fed tightening cycle, increased trade tensions between China and the United States and an inverted yield curve. Q4 2018 equity market returns reflected the widespread concern, with returns among the worst in recent memory and erasing three quarters of steady upward progress. Many investors were left digesting their first year of negative returns in several years and the general investor sentiment heading into the last year of the decade was resoundingly negative.

Enter the Fed…spurred by a reversal in Fed rhetoric and policy to a more dovish stance, equity markets around the world rebounded dramatically in 2019, the yield curve normalized, and overall economic data improved. By year-end financial market returns were among the best of the current (and prolonged) recovery cycle, generating the highest benchmark returns for a 60/40 balanced portfolio since the mid 1990’s.

Despite geo-political concerns (Iran, Brexit), trade tensions, impeachment drama, an upcoming presential election, slowing global manufacturing and flat corporate earnings growth, equity markets experienced significant multiple expansion fueled by accommodative monetary policy and expectations of trade tensions easing. A Phase One US-China trade agreement was indeed reached late in the year, halting the escalation in trade tensions and preventing the implementation of additional tariffs on Chinese goods while partly unwinding the Tariffs implemented in September.

Looking to the year ahead, 2020 is likely to have some similar themes influencing the economy and financial markets as well as some significant differences. Below we will discuss some of themes we believe will be most influential.

US Presidential Election: BIG Policy Differences

In the coming months we expect to have more clarity on who the democratic nominee will be. Senator Sanders has been gaining momentum in recent weeks, gaining ground on front-runner Joe Biden, while Elizabeth Warren, Pete Buttigieg and Michael Bloomberg all remain very much viable candidates for the nomination. The policy differences between the more liberal and moderate democratic candidates is stark and we believe the outcome of the democratic primaries will prove to be very impactful on the outlook for the economy and financial markets. Clearly the presidential race between the eventual nominee, whoever that may be, and President Trump will be heated with stark policy differences. While Mr. Biden, Bloomberg and Buttigieg represent what we feel are more “market friendly” platforms, Senators Sanders’ and Warren’s policies are decidedly less so. Layer in the uncertainty surrounding upcoming congressional elections and which party will control the senate and the house. The market hates nothing more than uncertainty, as you have heard us say many times, and we believe the wide array of potential outcomes surrounding the 2020 election is a risk worthy of caution.

Historically, equity market returns in a presidential election have a very strong positive bias. Excluding 1940 (due to the impact of WWII), there are only two instances of the S&P 500 delivering negative returns in the twelve months leading up to an election.

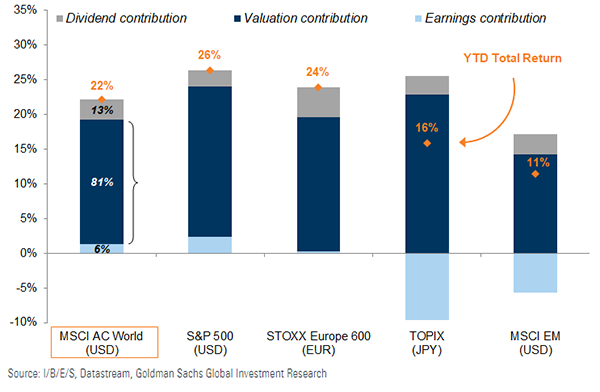

Equity Market Valuations: Moving from a tailwind to a headwind

In 2019 equity markets rose dramatically due to significant multiple expansion while corporate earnings were basically flat. Coming off the drastic sell off during the fourth quarter of 2018, multiples had ample room to expand as we noted in our 2019 year-end commentary. Fast forward a year and valuations look much loftier at roughly 20x EPS vs. 14.4x. We find it unlikely that the market will experience significant, if any, multiple expansion in the coming year. Therefore, earnings growth will be of paramount importance if the equity market is to deliver positive results in 2020. Consensus estimates currently call for reasonable earnings growth, and we have seen expectations rising in recent week. Short of a recession, it is unlikely to see significant multiple contraction. Nevertheless, valuations will be a headwind and volatility will be likely to increase.

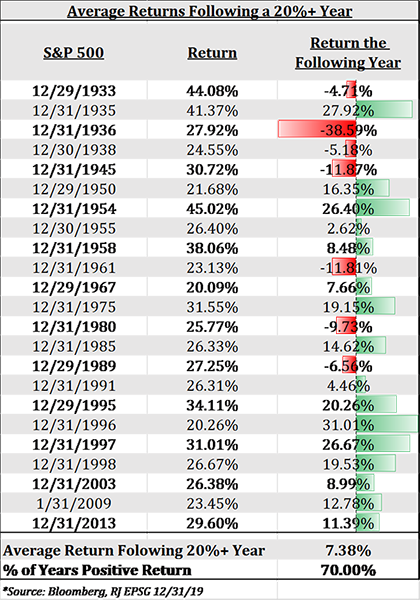

2019 equity markets were so strong, isn’t it most likely we have a down year or correction from these levels? Not necessarily. In fact, historically the S&P 500 has a bias towards positive returns in years following 20%+ returns.

Trade: Moving in the Right Direction?

While the Phase One trade deal between the US and China represents a step forward and a cooling of tensions, there is still much work to be done. The expectation for Phase Two negotiations to include greater domestic market access, intellectual property rights and transfer property rights will be key. Should discussions revert to on-again / off-again or become confrontational, we see downside risk. It is also unclear if future trade tensions with our European trade partners will emerge. We are, however, in a better place trade wise today than we were just a few short months ago.

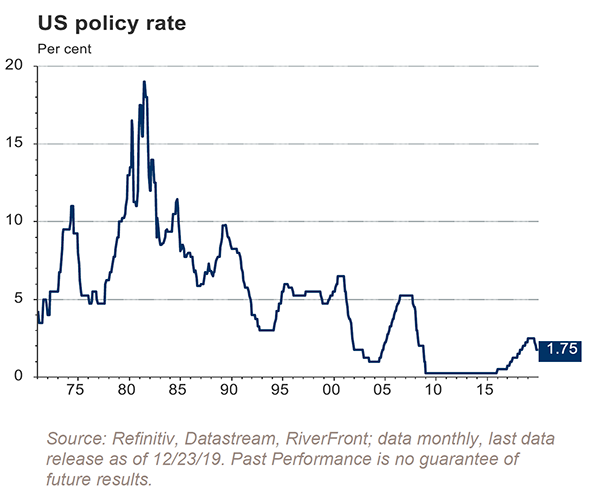

Monetary Policy: It’s Still Easy

The fuel that sparked the 2019 equity market rally was the Federal Reserve’s shift to a more dovish stance early in the year, ultimately cutting rates three times in 2019. Expectations are high that monetary policy will remain accommodative in 2020, and we see little reason to doubt it will be so. While we have seen a rebound in manufacturing, strong housing and very strong jobs and unemployment numbers, GDP growth remains moderate and inflation almost absent. While the risk remains, that inflation could jump sharply if the Fed becomes complacent, we feel that this Fed Board is living up to their “data dependent” rhetoric. The economy appears strong enough to withstand higher rates, but we do not believe we will see any Fed action in the first half of the year. Generally, we view monetary policy as a tailwind in 2020.

Other Influencing Factors: Headline Risk

There are certainly other factors that are present or will arise worth noting. The Trump Impeachment Trial and the Coronavirus are grabbing much of the headline space right now. We see both as being unlikely to have lasting impact on the economy and the markets, as past data from similar events well represents.

Conclusion: How are We Positioning

More than anything else, entering 2020 feels as if we are entering unchartered territory on several fronts. We are currently experiencing the longest uninterrupted economic expansion on record (127 months!), and the longest bull market in US history. We have record low unemployment, non-existent inflation, record equity levels and extremely low interest rates all while seeing the US deficit rising in excess of $1 trillion dollars over the last year. If you read the previous two sentences a few times you may be asking yourself aren’t we due for a recession / bear market? Good question, a hard one to answer, but a good question. Everything certainly feels expensive; stocks, bonds, real estate, private equity. There also seem to be a lot of risks, whether it be trade, the presidential election or a potential pandemic virus spreading from China. And yet, while all of the aforementioned factors leave us little reason to be overly optimistic about 2020, we also find a lack of reasons to be overly pessimistic.

Valuations are lofty, but with extremely accommodative monetary policy and low interest rates, we would argue justifiably so. Earnings growth is likely to re-enter the picture early in 2020. Trade conflicts currently appear to be heading in the right (or at least a better) direction. Manufacturing around the globe has rebounded and the Eurozone economies are showing signs of bottoming and resuming growth. The consumer remains strong and inflation extremely low. We have seen economic expansion under both republican and democratic presidents, although never a socialist…

The current environment has multiple positive and negative factors pushing against each other, some of which are rare in history. While we find it unlikely the current decade plus old expansion dies in 2020, elevated risks certainly call for caution. We have been and remain moderately more defensive than earlier in this expansionary cycle, focusing on risk management and volatility reduction in our strategic and tactical allocations. However, we feel it would be a mistake to become overly bearish as the current environment provides multiple positive influences that are supportive of risk assets.

As always, please feel free to reach out to our team directly to discuss any of above comments in more detail.

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

Meagan K. Moll, CFP®, CIMA®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.