2020 Mid-Year Commentary: Extremes Continue as Uncertainty Abounds

2020 Mid-Year Commentary: Extremes Continue as Uncertainty Abounds

July 6th, 2020

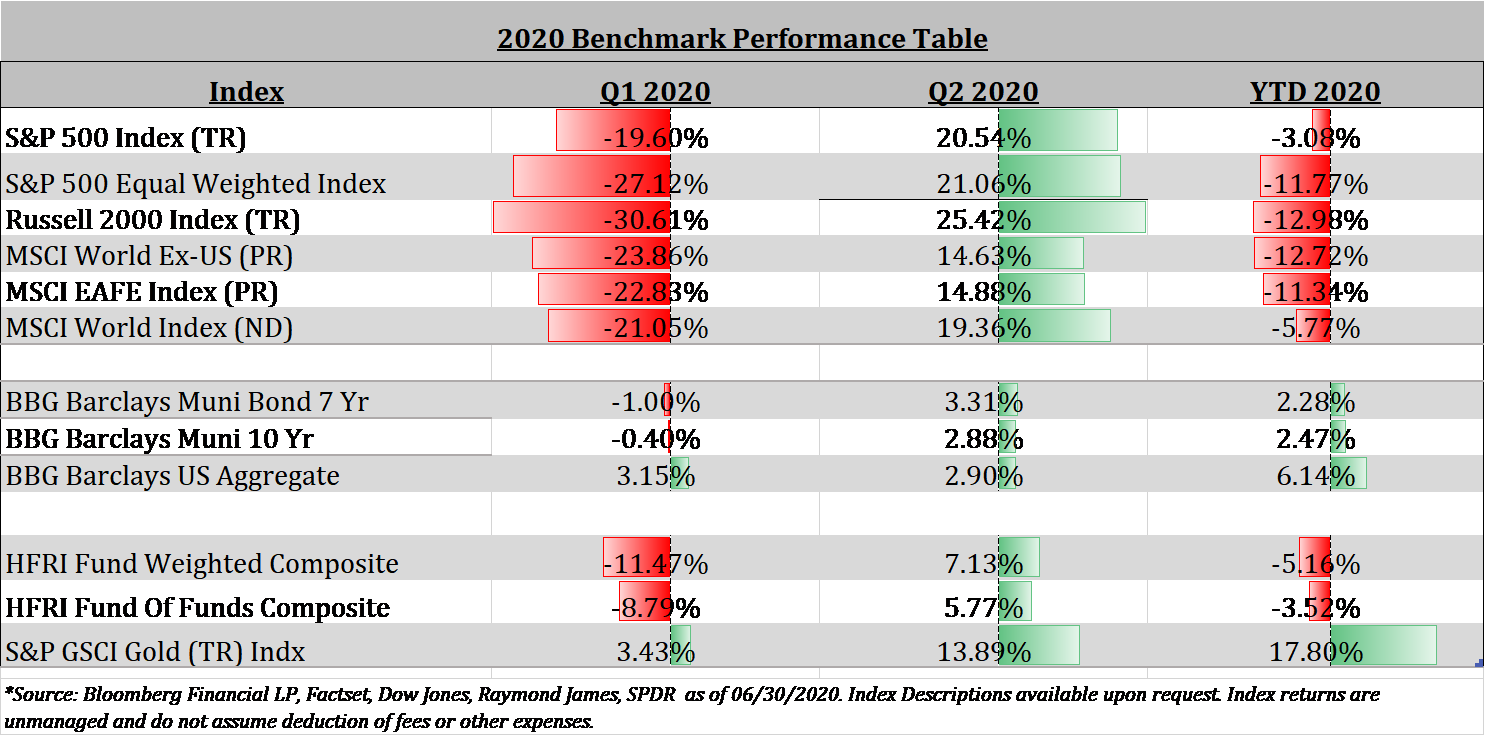

It is hard to believe we have only reached the halfway mark of 2020; it seems like a lifetime ago that we closed out 2019 with a strong economy, strong financial markets and little idea that we were staring down the barrel of a global pandemic that would leave millions of people sheltered at home and bring the global economy to a standstill. The negative economic impact and massive uncertainty in the first quarter led financial markets to record declines in virtually all risk assets. Fixed income markets froze up and liquidity became a major concern for even many blue-chip companies. Safe havens such as US Treasuries saw massive inflows of capital as investors tried in vain to gauge the ultimate impact of the developed world mandating that economies be virtually shut down.

The recovery in financial assets in the second quarter was nearly as extreme as investors flocked back into risk assets amid unprecedented fiscal and monetary policy stimulus, optimism that the worst of the recession was over and that countries around the world could contain the spread of COVID-19.

We do not find it surprising that risk assets have recovered swiftly as the news cycle surrounding the pandemic has remained negative. As we speculated in our March commentary “More than likely the markets will begin to turn before the negative news subsides, and if history is any guide, we are likely to see the initial moves back up in the markets happen quite quickly, setting the stage for a longer term recovery”.

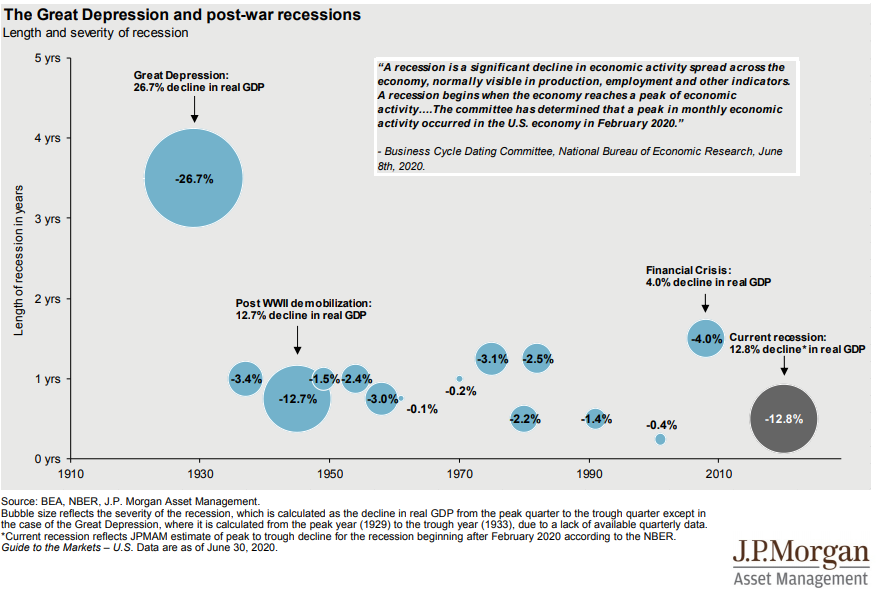

While progress has been made in re-opening parts of the economy, the ultimate economic impact of the virus and ensuing shut down is unclear. New hotspots around the country have sprouted up, particularly concerning in economic powerhouses such as Texas, Florida and California. JP Morgan Estimates that the ultimate economic contraction will be the worst in the post WWII era.

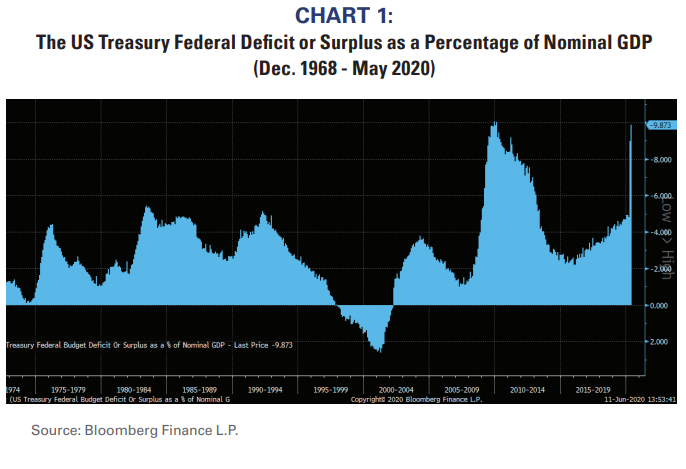

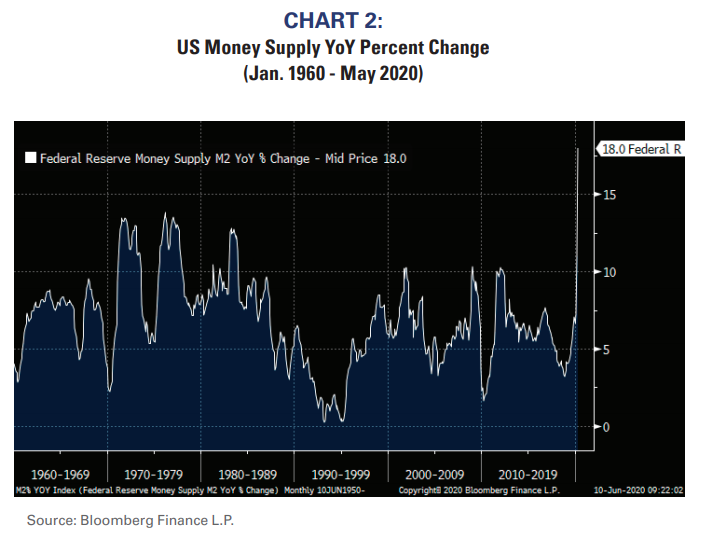

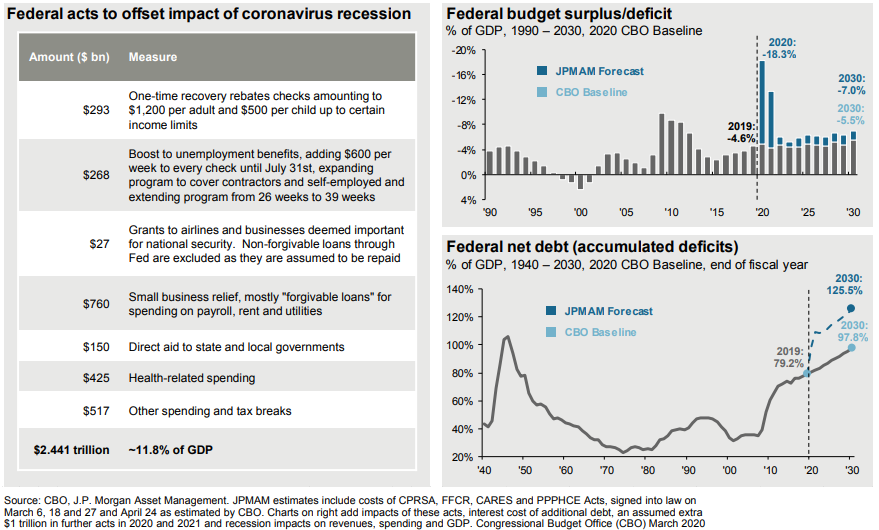

The uncertainty has left many pundits scratching their heads at the violent rally markets have experienced since the March 23rd lows. Indeed, current valuations in equities look rich, well above historic norms by many measures. However, as previously noted, financial markets nearly always lead the actual fundamental recovery and often exhibit elevated valuation metrics at the onset of the recovery. Rather than scrutinizing current valuations, we feel the more appropriate consideration should be the potential for a long-term sustainable recovery in the global economy in general, and the US in particular. In the short term, the unprecedented levels of fiscal and monetary stimulus that have been enacted has provided a launch pad for sustainable recovery. Many are discounting the stimulus efforts, however once one puts the magnitude of the stimulus into perspective, it is perhaps easier to understand the extreme bounce in risk assets.

Longer term prospects will clearly be driven by continued efforts to reopen businesses and the economy and progress in containing the spread of the virus and / or efforts to develop, manufacture and distribute a viable vaccination. Raymond James estimates that 83% of the global population has experienced “re-opening”. While there have been reversals in some re-opening efforts, those reversals are estimated to cover only about 10% of the global population.

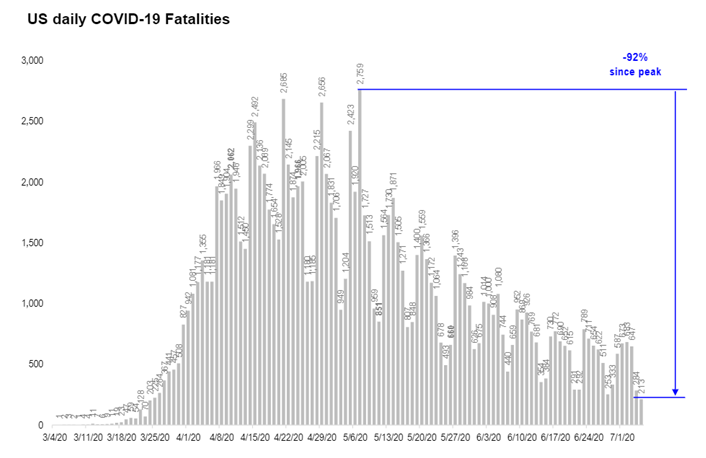

Re-opening efforts have certainly contributed to the V-Shaped recovery in recent months, and it seems logical that we would see some flattening of the recovery curve as pent up demand is absorbed and the impact of stimulus begins to wane. There is also fear that a second wave of the virus may be percolating, citing increased numbers of cases and positive test rates. Whether it is a second wave, or just the continuation of the first wave is beyond out analytical capabilities. We do find it interesting, however, that there is a widening divergence between new cases and deaths attributed to the virus. According to the COVID-19 Tracking Project, new cases peaked at over 57,000 on July 3rd, while fatalities hit a new low of 213. We have heard a number of arguments as to why this divergence could be occurring: new cases have seen a higher concentration of younger (i.e. less at risk) patients, virus could be weakening, healthcare readiness and treatment capabilities may be improving, data is stale and lagging actual deaths etc.. While we cannot explain the divergence from a scientific or medical perspective, it seems that the market may be taking it as a positive trend. While the surge in cases is alarming to say the least, if fatalities are diverging it may support policy allowing the economy to continue re-opening.

Ultimately, we will not know the impact of the pandemic until we reach the other side. Additionally, we are nearing a presidential election cycle that will likely prove to be the most polarizing in US history, augmented by significant social and political divides. There are many factors at play that are significantly influential in the direction and sustainability of the economic and financial recovery. While we find it advisable to be cautious in this environment, we feel it would be a mistake to be overly pessimistic about the path that lays ahead. Prudent asset allocations focused on high quality assets have performed admirably in both the Q1 downturn and the Q2 recovery. We have confidence in the long-term sustainability of a US led recovery and are positioned accordingly.

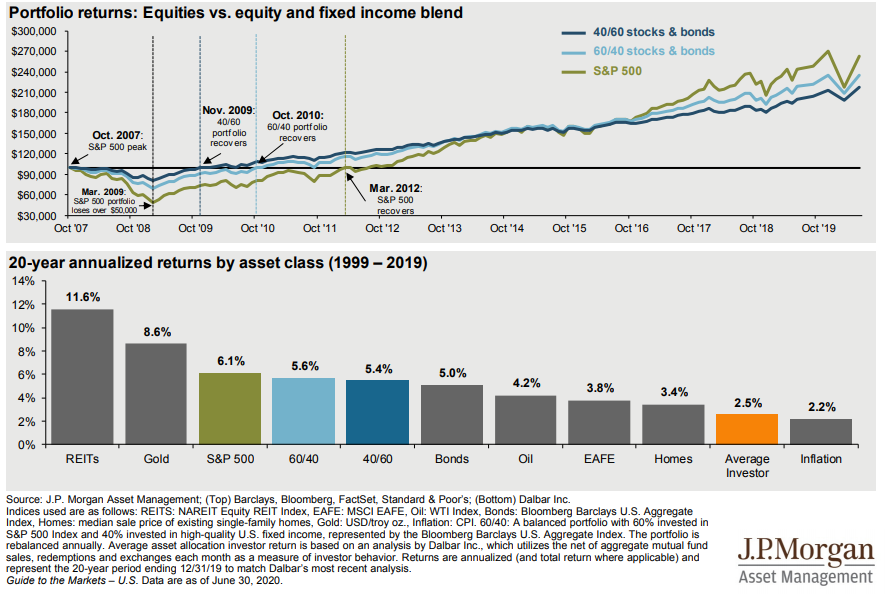

We will leave you with one final thought. Successful investors are never “in or out”. Successful investors develop long-term investment strategies that are capable of weathering difficult market environment and delivering acceptable investment returns over economic cycles. Dalbar Inc. conducts a study annually comparing the average returns for various asset classes vs. returns for the average investor. The results of that study are graphically displayed below.

As always, please feel free to reach out to our team directly with any questions or to discuss the enclosed information further. We hope you and your families are staying safe and healthy during these trying times.

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner