2021 Year End Review & 2022 Outlook

2021 Year End Review & 2022 Outlook

January 19th, 2022

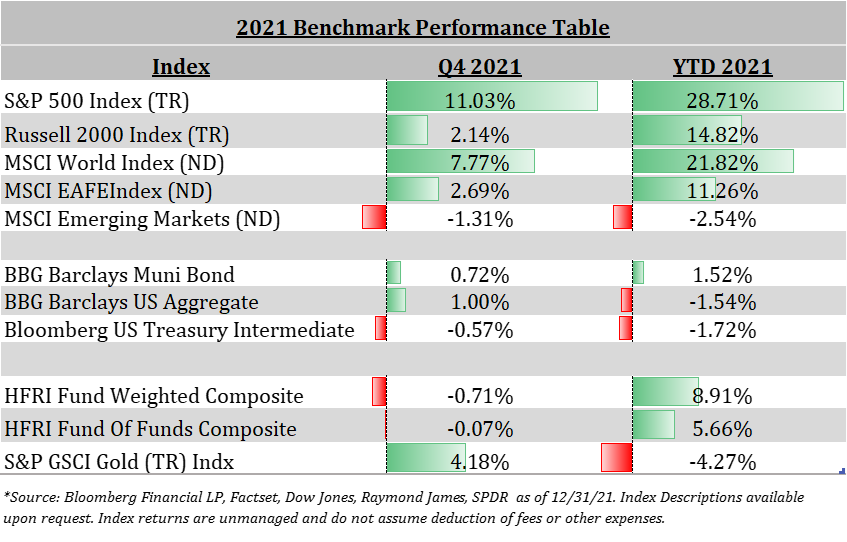

Fears of rising inflation, the Delta and Omicron variants and political strife dominated headlines last year. However, the continued re-opening of the economy coupled with loose monetary conditions and strong earnings led most risk assets higher. U.S. Equities once again led the way with stellar returns, particularly in large capitalization companies. Yields rose, pushing bond returns lower while oil ripped to the upside.

The major themes of 2021 have poured over into 2022, but we don’t expect to see a mirror image of last year. Inflation is likely to stick around longer than originally anticipated; equities are unlikely to repeat the lofty returns we experienced (and increased volatility is already in play); GDP growth is anticipated to slow, although should remain above trend. The evolution of the pandemic is really anyone’s guess. After two years we have learned that we cannot anticipate the path that COVID-19 will take, but we do believe the world is better positioned to return to normalcy sooner rather than later. We find it unlikely that we revert to the broad-based shutdowns that abruptly threw the world into a global recession in 2020.

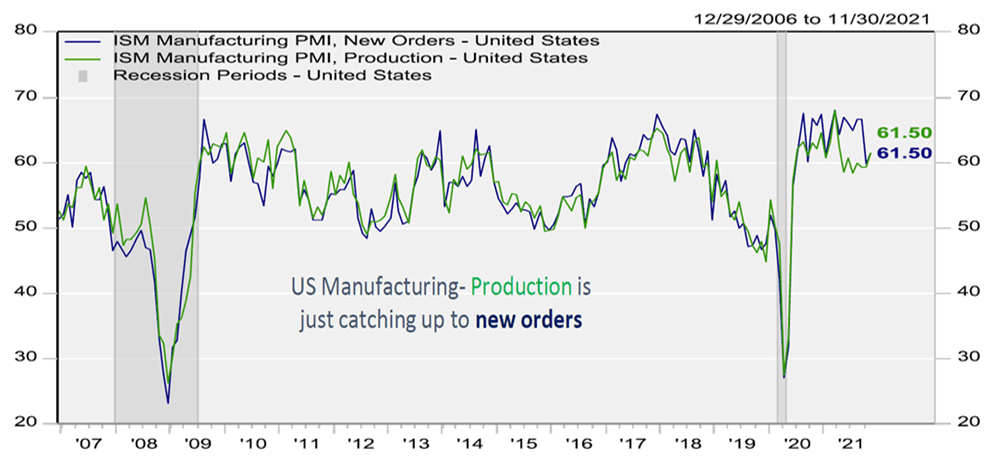

Inflation: Everyone is Talking About it

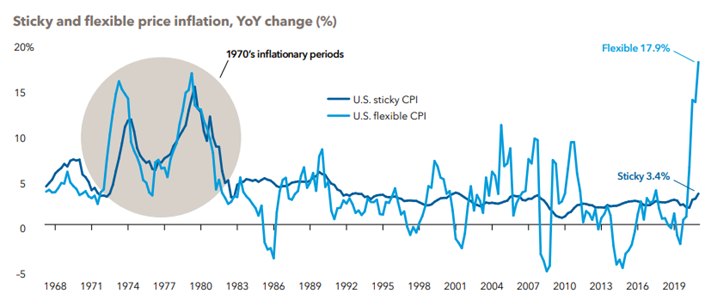

It has been a long time since we really had to worry about significant inflation, but those worries reared their head rather abruptly in mid-2021 when COVID related distortions and supply chain issues caused a significant spike in some consumer goods. The question moving forward is how high will it go and how long will it last? We expect inflation to remain stubbornly high in 2021, but by no means anticipate 1970’s style runaway inflation. Much of the spike we have experienced thus far has been in what is known as “flexible” (quick to change) inflation categories, such as food, energy, and automobiles. Conversely, “sticky” (slow to change) categories rose as a rather tame 3.4%. During the runaway inflation of the 1970’s these two categories rose almost in tandem, as shown in the chart below.

Clearly the upside risk is in the sticky components, such as rents, insurance medical expenses. Our base case is that inflation remains stubbornly high but begins to moderate before fears of a 1970’s reprise become realistic. There are a few key reasons we believe this is the case.

- Supply chain issues have already begun to improve, a trend which should continue and allow companies to rebuild inventories.

- Unless Senator Joe Manchin flips, additional fiscal stimulus is all but dead. This is unlikely given his stalwart opposition to much of the Biden Administration’s policy efforts, most importantly the Build Back Better program.

- The Fed has already begun tapering (reducing the expansion of its balance sheet) and has signaled three anticipated rate hikes in 2022.

- Productivity is expected to be above average in the coming years, in start contrast to the chronically slow productivity growth in the 1970’s.

- The open nature of the US economy today, as compared to in the 1970’s, leads to much more intense competition (a disinflationary force).

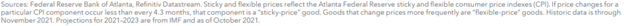

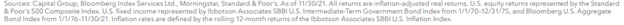

Runway inflation would be decidedly negative for the economy and financial markets. But is a reasonable level of inflation all that bad? Has persistently low inflation been good for Japan and the Eurozone or best for the US? Probably not. Studies indicate that inflation around 3% may actually be more beneficial to the economy than when at 2%. Nor does inflation guarantee negative returns in financial assets such as stocks and bonds or real assets such as real estate.

Simply put, some inflation can be healthy. It allows companies to raise prices and enhance profitability. Inflation benefits banks and commodity-related companies that have struggled in a low interest rate, low inflation world. Other assets, such as commercial real estate, also have pricing power to raise rents, consistently outpacing inflation historically.

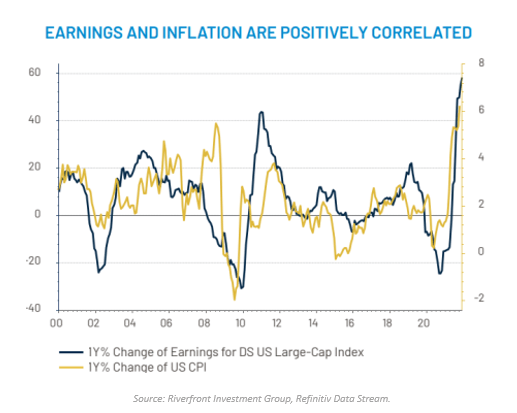

Economic Growth: Still Strong

How will GDP hold up in the face of tighter monetary conditions? The Federal Reserve is projecting GDP growth to remain above trend for the foreseeable future, although moderating from 2021 levels (which will likely come in as the highest growth rate in 40 years at an estimated +5.5%). Strong GDP growth is generally supportive for risk assets and will substantiate the Fed’s path towards tighter monetary conditions.

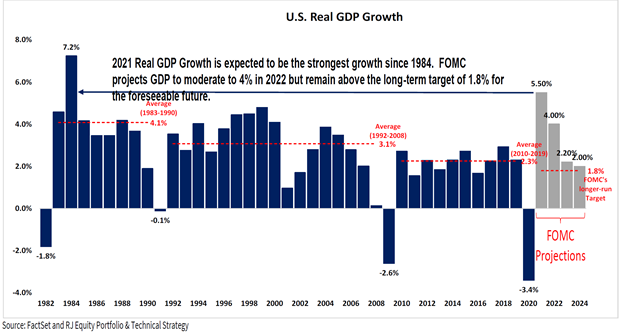

As previously mentioned, supply chain issues appear to be improving as US manufacturing is finally catching up to new orders. This suggests that supply and demand levels will remain elevated. It will take some time for companies to work through the backlog of orders that has built up, but the continued need for elevated production levels will add to economic strength as companies rebuild inventories to meet demand.

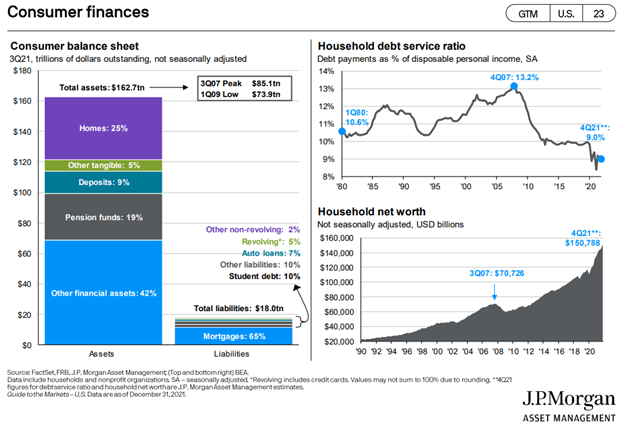

The Consumer remains strong, with excess personal savings exceeding $2.2 trillion at the last reading. Personal debt to income ratios are at lows not seen since the early 2000s and we have experienced positive wage gains. The strong financial position of U.S. consumers coupled with the pent-up demand created by the pandemic and supply chain issues are also supportive of economic growth.

The housing market remains strong, and while mortgage rates are likely to rise, we expect the strength to continue amid high demand and a maturing millennial population.

The Fed’s first rate hike could come as early as March and they are currently projecting 3 rate increases in 2022 alongside tapering of the Fed balance sheet. While we will clearly experience less accommodative fiscal and monetary conditions in 2022, history suggests there will be a long lag period before the full impact will be felt on economic growth. It is likely that the primary effect of tightening conditions will be felt in 2023 rather than 2022.

There are multiple risk factors that could stall economic growth, such as inflation running too hot and / or the potential for a policy misstep by the Fed. Most notably COVID related pressures on labor and potential shutdowns could hamper growth. However, we find it unlikely that we return to broad based shutdowns due to COVID, as evidenced by the response to the highly contagious Omicron variant and we believe the labor market will continue to improve this year.

Conclusion: We are Still in a Recovery

The recovery is maturing. Concerns over inflation are appropriate and we are certainly entering a period of tighter (although not tight) monetary conditions, we remain generally constructive on the macro back drop for 2022.

We expect increased levels of volatility in equities coupled with positive but more moderate returns. As we pen this note, the S&P 500 is in the midst of its first 10%+ correction in roughly two years. We do not believe this correction signals the end of the current cycle, but future return expectations are coming down. Negative surprises relating to COVID, hyper inflation or a policy misstep could certainly further dampen returns and increase volatility.

Fixed income will remain a challenge as rates are likely to move higher throughout the year, coupled with elevated but moderating levels of inflation. Yields on the U.S. 10-Year Treasury have risen to over 1.7% in recent weeks, but remain well below current inflation readings.

We believe our allocations to alternative investment will become increasingly important in this environment as both a source of positive returns and diversification. In an environment with higher inflation, moderating economic growth and lower return expectations in public markets, investors will be challenged to generate stable income streams and alpha through public markets alone. We have also seen correlations of public equities and fixed income narrow, reducing the benefits of the traditional 60-40 allocation in terms of overall volatility reduction and risk adjusted returns. Importantly, alternatives can provide public market diversification and generate stable returns / alpha. Certain alternative investments can also position a portfolio well in an inflationary environment, when generating positive real yields with growing cash flows becomes extremely important. Balancing liquidity needs with risk-adjusted return expectations is critical when developing an appropriate asset allocation. We have linked a very well written piece from JP Morgan Asset Management that does an excellent job of outlining the potential benefits of alternative investments in the current environment.

Please do not hesitate to reach out to us directly to discuss any of the enclosed information further. Thanks for taking a look!

Sincerely,

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

Meagan Moll, CIMA®, CFP®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.