Economic Commentary: Focus on Inflation

Economic Commentary: Focus on Inflation

September 13th, 2022

Inflation has been dominating the headlines and the markets all year, and the reaction to Tuesday’s hotter than expected CPI data release underscores just how focused investors are on the topic. We are clearly past the point of referring to this inflation spike as transitory and we continue to believe that the path of inflation and the Federal Reserve’s policy reactions will be the most important topic for the remainder of the year and beyond.

While July CPI data reflected lower numbers, the data from August came in higher than expected. The year-over-year August CPI figure came in at +8.3% (vs. consensus estimates of +8.1%), while month-over-month inflation was +0.10% (vs. consensus estimates of -0.10%). Digging a little deeper, several data points were especially concerning. Shelter costs rose +0.7% month over month (the highest reading since 1991) while food costs rose +0.8% month over month to +11.4% year over year (the highest reading since 1979!). On the positive side, energy came in lower for the second month in a row. The Market reaction was not surprising, with equities selling off sharply and treasury yields spiking, as today’s data virtually guarantees a 75 basis point rate hike at next week’s FOMC meeting.

Prior to Tuesday’s release, the market was reflecting optimism that recent economic data was pointing to a slowdown in the economy with multiple indicators flashing signs of cooling inflation. Expectations (hope?) that the Fed may be nearing the end of its tightening cycle, investors pushed capital to risk assets, driving equity markets higher. Much of that optimism was unwound on Tuesday. Going forward, markets are likely to remain focused primarily on the trajectory or trend of inflation rather than the absolute numbers. Below we explore some of the major themes that we believe will be at the forefront of the economic conversation for the foreseeable future.

Recession + Inflation?

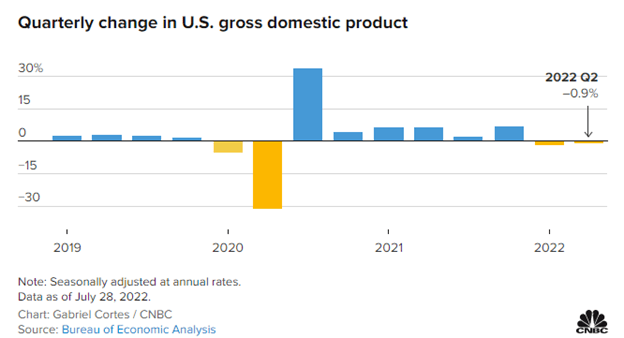

The textbook definition of a technical recession is two-quarters of negative GDP. Therefore, one might reasonably conclude that we are already in a recession with -1.5% GDP growth in Q1 and -0.9% in Q2. However, recessions are officially declared by the National Bureau of Economic Research (NBER), which takes a broader look at economic indicators such as the labor market and industrial production (which remain strong), often declaring recessions weeks or even months after the fact. The bond market has often been a better reflection of investment risk. The spread between 10-year and 2-year Treasuries has been inverted—with the shorter-term yield higher than the longer-term yield—since early July; the spread was –26 basis points as of September 13th. While this is a concerning data point and should not be dismissed, the 10-year/3-month Treasury spread has not inverted and is widely considered a more reliable indicator of recession. While it may be premature to declare a recession, Tuesday’s data release in our mind increases the likelihood that the Fed will overtighten and bring one about sooner rather than later.

Global Destabilization

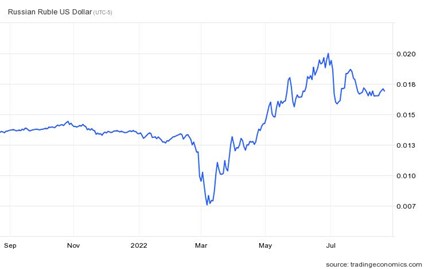

Global destabilization remains at the forefront of the global economic conversation, ushered in by the unfortunate war between Ukraine and Russia. Ukraine is the 4th largest supplier of wheat and a large exporter of other food resources; the average American will continue to see pressure in the supermarket as this conflict continues. The sanctions levied against Russia have not had the anticipated effect needed to bring them to the negotiating table as their countermeasures seem to be holding up. Their decade-long work to reduce their foreign debt obligations by nearly half, coupled with a shift to a quasi-gold standard to peg their currency have given them a stronger ability to withstand the sanction. To put it into greater perspective, at the start of the conflict, the Russian Ruble had depreciated from 80 to roughly 120 rubles for every U.S. dollar, but this has since reversed and the ruble has jumped 112% against the dollar since March lows, with one U.S. dollar now being only worth ~58 rubles, putting it above pre-conflict exchange rates. With this perceived stability from Russia, it’s hard to imagine this conflict will end anytime soon.

Directly related to the Ukraine/Russia conflict, the energy crisis continues throughout Europe, hitting countries like Germany incredibly hard. Natural gas and oil prices have gone completely parabolic since 2021, as shown in the graph below. Although the U.S. has more energy independence than Europe, this most certainly brings a negative spillover effect domestically especially if there’s an increased need for the U.S. to export to European countries.

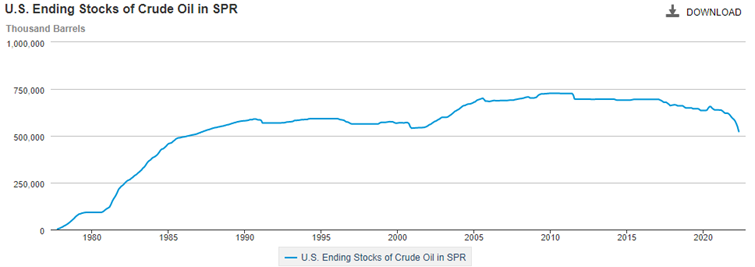

Current U.S. oil drilling efforts – proxied by looking at the online oil drilling rig count, have climbed since the pandemic but are well under pre-pandemic levels. Furthermore, U.S. strategic reserves have been depleted by over 100 million barrels, equal to five days of domestic use since 2020, with the most recent figure putting us at the lowest levels in over thirty-five years. Additionally, OPEC+ recently lowered output projections, reversing course from the increase following President Biden’s visit to Saudi Arabia.

Chinese Relations Tail-Risk

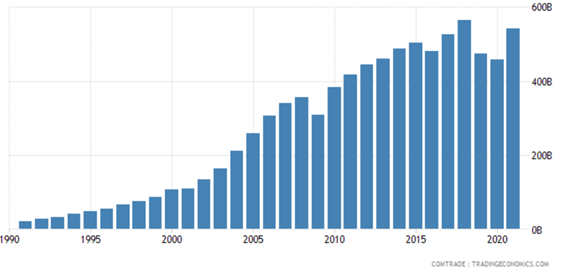

China-Taiwan relations continue to devolve as headlines report Chinese military drills near the shores of Taiwan and countermeasures taken by Taiwan with their recent takedown of a Chinese drone. This increasing tension puts the U.S. in a precarious position as Taiwan is responsible for 56% of global microchip manufacturing. If China were to take control of Taiwan, this could disrupt supply chains. The U.S. is combating this risk with the bipartisan bill passed in July called the CHIPS act which will fund $52 billion toward onshoring microchip production in the U.S. However, this pivot in U.S. foreign trade reliance could be the start of increasing hostility from China as we continue to reduce our overall trade reliance with them. The chart below shows our annual Chinese trade imports– still below 2018 highs.

Softening Housing Market

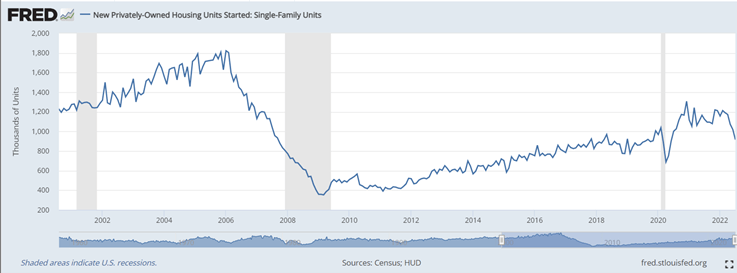

Since The Great Recession of 07’-08’ single-family home builds have been below historical averages causing both housing shortages and increased prices for both homes and rent. Since 2017, we have seen a near doubling of the cost per square foot for homes making housing affordability very difficult for middle-income Americans. In turn, this could create a feedback loop of unaffordable housing that perpetuates higher rent costs from increased rent demand. If higher interest rates cannot materially bring down home prices, then there becomes an ever-increasing renters’ class that will be at the mercy of landlord price increases thus supporting higher future inflation prints within OER.

Federal Reserve Orwellian Talk

For anyone who has read Orwell’s dystopian classic 1984, there is a term coined in it called Newspeak which was the act of changing language to alter the meaning of words or ideas to distort reality. This Newspeak from Orwell’s book is becoming more akin to the Federal Reserve’s “Fed speak” rhetoric around tightening financial conditions, contradicting what they tell the public versus what their actions show.

“The Fed plans to reduce its $8.5 trillion balance sheet beginning June 1, when it will no longer reinvest proceeds of up to $30 billion in maturing Treasury securities and up to $17.5 billion in maturing agency mortgage-backed securities per month. Beginning September 1, those caps will rise to $60 billion and $35 billion, respectively, for a maximum potential monthly balance sheet roll-off of $95 billion.”3 Based on Powell’s eight-minute speech at Jackson Hole on the importance of price stability and the need to continue to tighten conditions to combat inflation, it would be expected that the June 1st plan would have been followed accordingly, however, the chart below says otherwise. In the last three months, the Federal Reserve has reduced its balance sheet by a total of approximately $63 billion – well below the expected $47.5 billion monthly reduction that should have taken place in each of the last three months.

This has caused investors to question the legitimacy of the Fed’s plan to combat inflation through tougher monetary policy and has hurt its credibility.

Labor and Wage Inflation

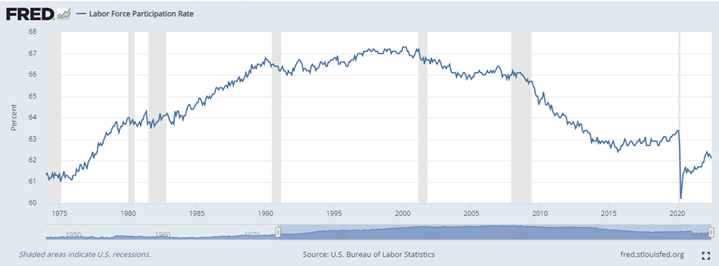

Going hand-in-hand with Fed Policy is the continued labor shortages and wage inflation problems seen in the last year. The excess stimulus has ushered in the great resignation and given employees the upper hand in negotiating higher salaries with approximately 1.9 jobs per unemployed person in America. These shifts are unlikely to reverse in the near term. Workers over 55 continue to retire prematurely and the average worker remains challenged by a rising cost of living. With a higher cost of goods and insurmountable home prices, we may see ongoing weakness in employee participation rates, as shown in the labor participation rate chart below.

While current readings indicate that the economy is slowing and inflation may be rolling over, the abundance of inflationary risks remains center stage in investors’ minds. Economists and strategists can spin their wheels debating whether or not the US will enter recession this year or next, but the fact remains that we are experiencing an economic slowdown in the face of elevated inflation and a Federal Reserve that continues to contradict itself, creating a heightened level of uncertainty.

As we have stated many times before, markets hate uncertainty. With a less than clear picture on the trajectory of inflation and Fed policy, we expect to see heightened volatility in financial markets, which should create opportunities for patient capital in both the public and private markets. While we have concerns about the current backdrop for the US economy, we continue to believe it to be far better positioned than other major economies (i.e., Europe and China) as well as emerging markets.

As always, please feel free to reach out directly with any questions on the information above.

Sincerely,

Josh L. Galatzan, CIMA®

Founder & Managing Partner

Chris J. Popso

Wealth Management Associate

Kirk Price

Managing Partner

Brian J. Noonan, CEPA

Managing Partner

Meagan Moll, CIMA®, CFP®, CPWA®

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

1Trio of indexes that measure the change in the selling prices or wholesale prices received by domestic producers for their output

2Depicts future retail spending habits as the survey asks consumers how they feel about the economy, personal finances, business conditions, and buying conditions

3Vanguard https://advisors.vanguard.com/insights/article/thefedsplantoshrinkitsbalancesheetquickly