2022 Year End Recap / 2023 Outlook

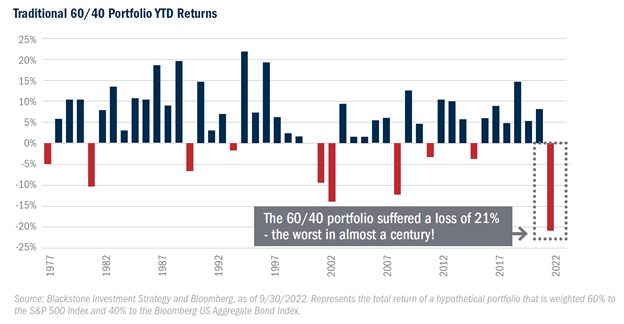

If one word could be used to describe the markets in 2022, tumultuous would be the first that comes to mind. High inflation, slowing growth and monetary tightening largely defined the global economy throughout the year. It was the worst combined performance for domestic equities and bonds since 1969, with double-digit negative returns in both asset classes. As correlations between the two asset classes spiked dramatically, the traditional 60/40 bond portfolio ended the year with a loss of 21%, the worst results in nearly a century.

Few areas were left unscathed. Oil held up, rising strongly in the first half of the year before correcting on lower global growth expectations. The US Dollar was the big winner, gaining 9% on the year. The words of wisdom “cash is trash” touted by the largest hedge fund owner, Ray Dalio, soon changed when he tweeted out “I no longer think cash is trash”1 which epitomizes the year in review.

Fixed Income Markets:

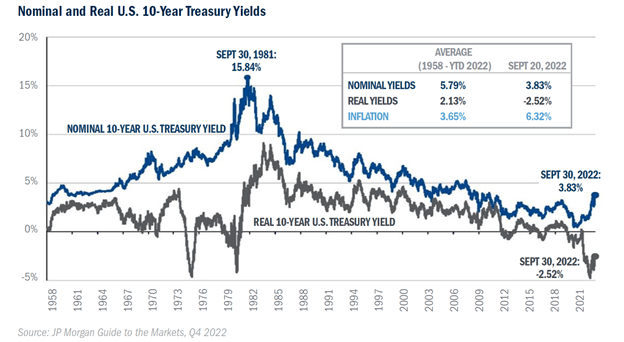

Inflation remained elevated throughout the year, with the Fed’s “transitory” inflation rhetoric falling by the wayside soon after the 7.5% inflation print in February of 2022. The Federal Reserve started acting in March, increasing the Fed Funds Rate by 25 basis points to a target of 0.25%-0.50%. The rapid pace of the tightening cycle would blindside many and would become the fastest seen in U.S. history. For added context, the 2022 rate hike cycle increased rates by 2.36%2, nearly twice as fast as the rate hike cycle of ’88-’89.

As a result, fixed income delivered negative returns. Longer maturity / lower quality bonds in particular experienced outsized losses. The Bloomberg US Aggregate Bond Index, which is a broad fixed-income index and a good proxy for the overall bond market, was down -13.02% in 2022. Short-maturity treasuries were one of the few areas to provide positive nominal returns in 2022 but posted one of the most negative real return figures seen in history due to inflation. Municipal bonds also fared better than broader fixed-income markets due to higher coupons, higher quality, and less issuance in comparison to 2021. However, the Bloomberg Municipal Bond Index still saw -8.53% performance for the year. In a nutshell, lower-quality bonds and longer maturities were a recipe for large double-digit negative performance.

Black Gold and LNG:

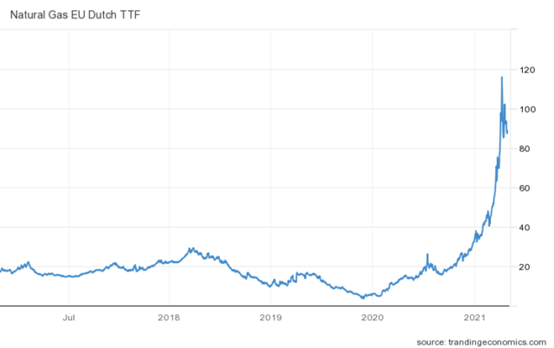

Although markets were broadly negative, energy continued to be one of the top-performing market segments for the year with the S&P energy sector rising +58%, the best annual performance in history. Spillover effects from the negative spot oil prices of 2020 led to reduced rig counts and thus less production of crude oil. Additionally, we experienced a confluence of geopolitical pressures and increased demand as economies reopened from the COVID pandemic. Furthermore, the Russia/Ukraine conflict ushered in further price pressures when Europe was cut off from Russian oil and natural gas, causing massive bouts of supply-side inflation. Prices peaked in August, climbing 15-fold from 2021 levels before normalizing in late 2022 from government intervention through price caps, subsidy packages, and through the U.S.’s efforts of increasing their supply of LNG to Europe (i.e., natural gas) by a factor of three to help combat the rising cost.

Equity Markets:

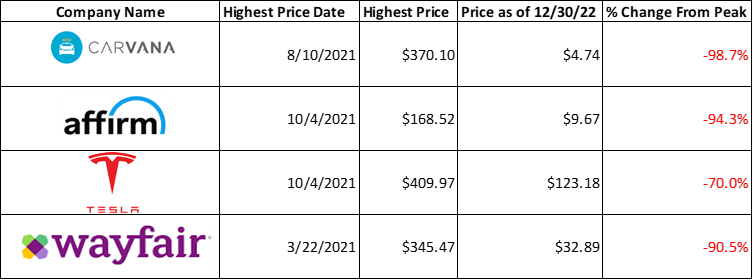

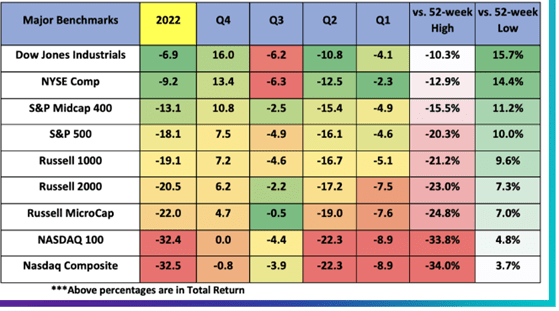

The equity markets suffered in 2022 as the Federal Reserve aggressively tightened monetary policy, causing seismic moves up in U.S. interest rates. This caused market fears of slowing consumption and thus concerns over reduced economic growth. One of the hardest hit indexes was the NASDAQ which fell -32.5% on the year. Market euphoria surrounding the massive quantitative easing in 2021 led to valuations that were multiple standard deviations above historical averages. The hardest hit were heavily indebted companies with low to no profitability, perceived to be high growth within the index. Some highlights of the hardest-hit companies within the NASDAQ are in the following table below.

None of the major equity indices had a positive return in 2022 with the 2nd quarter showing the worst performance for the year as rising rates and increasing Federal Reserve hawkishness started getting baked into market forecasts.

Alternative Investments:

While 2022 returns in traditional financial assets were deplorable, many alternative asset classes held up very well on both a nominal and relative basis. Private capital fundraising was down nearly 20% in 2022 but on par with 2020. However, performance was strong in 2022 with alternatives providing diversification benefits as many of the sub-sectors reported positive performance on a year where U.S. equities and U.S. core fixed income were down 20% and 13% respectively.

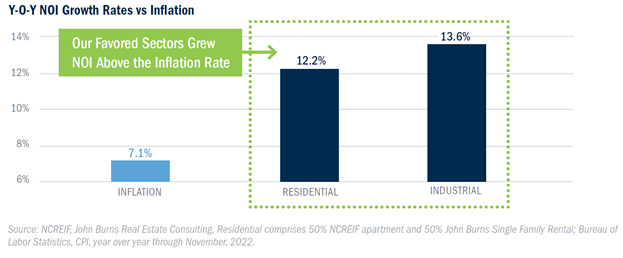

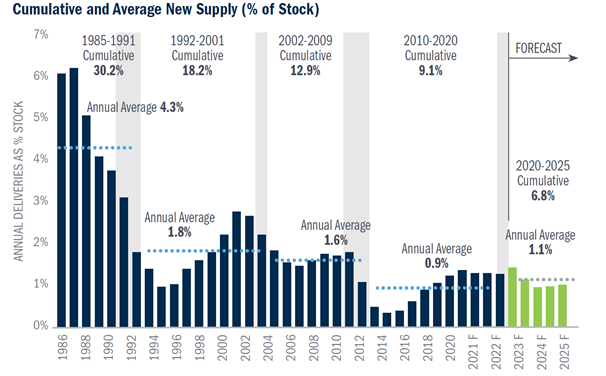

Private real estate was a top performer for 2022, particularly our favored sub-sectors of multi-family and industrial. Much of this outperformance was driven by a strong consumer, rent growth, and a fundamental undersupply of products. Sector selection and geographic locations have proven to be crucial when investing within this area. Furthermore, this was a strong opportunity set in 2022 with the dislocation seen between private and public real estate.

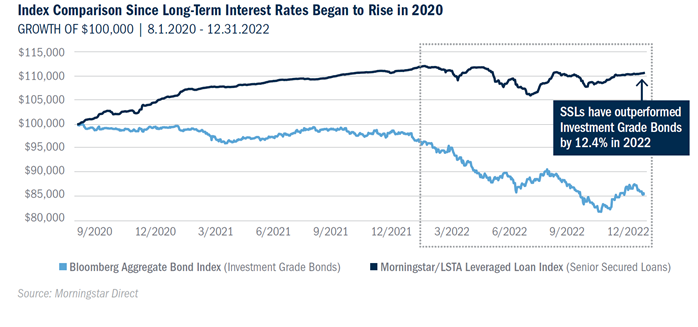

Private Credit also delivered attractive relative returns, primarily due to their floating rate and short-duration structure. Private credit sponsors will likely be busy in 2023 as banks continue to step back in their willingness to lend. Investing with experienced, disciplined credit managers will prove to be important in the year ahead.

It's important to recognize the lagging nature of private investment valuations. As assets are repriced, many will likely prove to be down in the first half of this year. Many private funds will ultimately mark down portfolios based on 2022 results from higher discount rates and more volatile future guidance. The rising rate environment has led to a dramatic pause in the capital markets as buyers, sellers, and banks are trying to figure out valuations. Buyers are waiting for sellers to become more realistic about their sale prices while sellers are attempting to recover some of the value lost from the asset peak.

Public market volatility has negatively impacted private market comparables and thus private equity valuations have moved down – particularly in the software sector. The number of private equity exits was at the lowest level since 2010 as a direct result of said market volatility, which has negatively impacted valuations. Private businesses with real EBITDA and a moat around themselves fared well in 2022 and should continue to in 2023 while private businesses that eat up cash and project future growth underperformed in 2022 and will be challenged until rates reverse course.

Looking ahead, we continue to believe that alternatives will play a very important role in portfolio construction and returns.

Looking Ahead: Things to come in 2023…

Fed Rate Expectations and Inflation

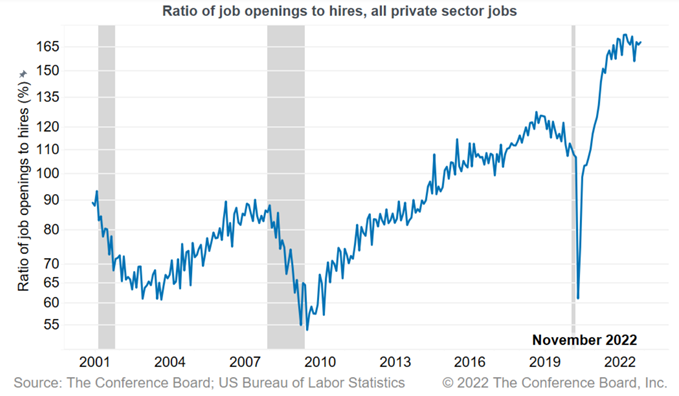

Markets have been largely dictated by Federal Reserve policy and expectations. In Jerome Powell’s December speech, there were a few things he mentioned that should be highlighted. He reiterated his concerns surrounding wage inflation, providing more rhetoric from his previous speech focusing on shrinking the gap for the job openings to hires ratio. Chair Powell has also repeatedly emphasized the need to reduce inflation through a prolonged period of higher rates and expressed concern that moving to a dovish stance prematurely would lead to a revival in inflation. This may be a headwind for both equity and fixed-income markets as Powell continues to dig in his heels.

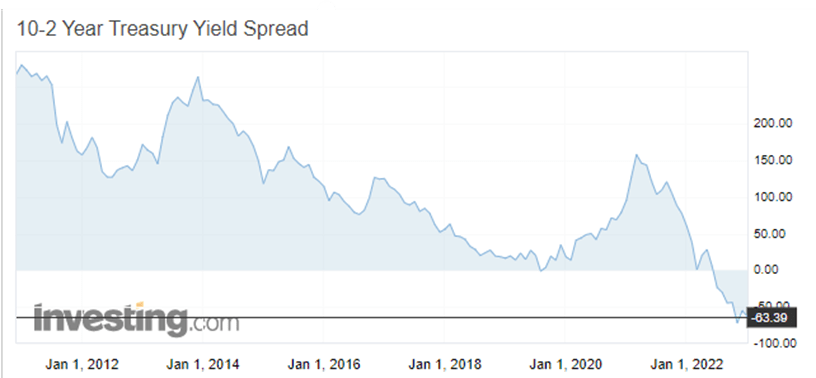

The Federal Reserve’s dot plots show that not a single Fed member expects a rate cut in 2023. In the November speech, Powell mentioned that the terminal rate may also be higher than initially anticipated, meaning The Fed could continue to hike rates as they see fit to combat persistent inflation. However, the Federal Reserve’s rhetoric is contrary to what many strategists and asset managers are predicting in 2023. Fixed-income veteran Jeffrey Gundlach of Double Line Capital has made the argument to look at the bond markets and not the Fed to see where interest rates are headed. Continued treasury yield curve inversions would tell us that rates should come down in 2023 if CPI figures continue to soften.

2023 portfolio positioning:

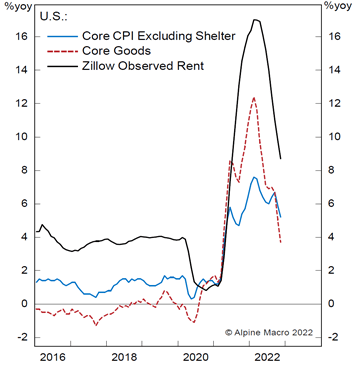

The 60/40 portfolio had one of the worst performances on record in 2022, slowing growth, lower inflation and the potential for a Fed pause in the second half of the year create a rather compelling case for this type of positioning in 2023. If they pause / pivot, we should broadly see both equities and fixed income have strong results, a reversal of what took place in 2022. We are indeed seeing evidence that inflation is rolling over. Should this trend continue, it is likely only a matter of time before the Federal Reserve presses pause on the tightening cycle. Historically, markets tend to reverse course prior to the end of a tightening cycle, often even in the face of recession.

We expect the first half of the year to deliver muted yet volatile returns in most asset classes as the Fed is hesitant to declare victory over inflation, investor fears of recession rise, and the earnings outlook remains uncertain.

We view the second half of the year as being more promising as it becomes clear that the economy is slowing, which likely leads the Fed to pause and investors to begin discounting lower rates and a further weakening dollar. This should prove a tailwind for global equities, fixed income, and many alternative investments such as real estate and private equity.

As always, please feel free to reach out with any questions or for further discussion. Thanks for taking a look!

Sincerely,

Founder & Managing Partner

Wealth Management Associate

Managing Partner

Managing Partner

Partner & Wealth Advisor

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

1Trio of indexes that measure the change in the selling prices or wholesale prices received by domestic producers for their output

2Depicts future retail spending habits as the survey asks consumers how they feel about the economy, personal finances, business conditions, and buying conditions

3Vanguard https://advisors.vanguard.com/insights/article/thefedsplantoshrinkitsbalancesheetquickly