2023 Year End Recap / 2024 Outlook

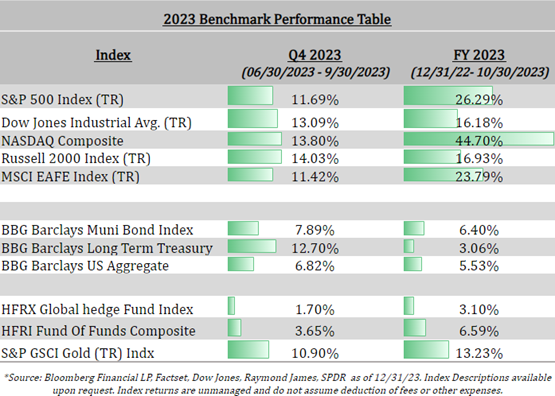

Despite a general sense of pessimism throughout most of 2023, equity markets delivered strong results for the year with the NASDAQ leading the pack with a 44.7% total return and the S&P 500 following with a total return of 26.29%. Most of this could be attributed to the Magnificent Seven (Nvidia, Tesla, Apple, Microsoft, Amazon, Meta, and Google) as it grew to a historical 29% of the S&P 500, the largest concentration ever seen. The equal weight index only earned 12% and without the Magnificent Seven, the S&P 500 would have risen just 8%. The outlook for fixed income securities turned more bullish as markets began anticipating rate cuts once the Fed hit pause on rate hikes.

Inflation moderated over the course of 2023, which provided the Federal Reserve with justification to halt rate hikes as well as initiate discussions around potential future rate cuts. This dynamic benefited most market sectors and led to positive returns in 2023. This optimistic outlook provided additional tailwinds to both fixed income and equity markets as the year concluded. Investors in large-cap domestic growth stocks were handsomely rewarded for their strategic positioning, particularly in the Magnificent Seven stocks that dominated performance.

Fixed Income Markets:

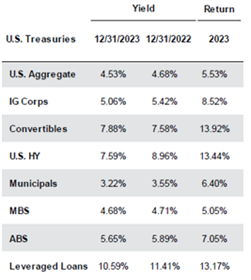

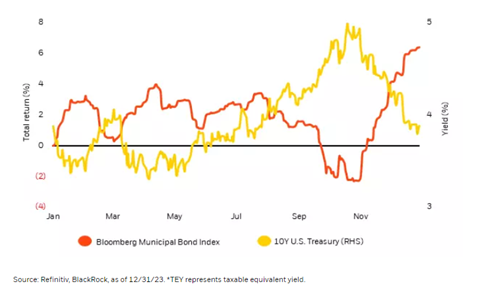

Despite inflation remaining above historical averages, it experienced a significant decline from 6.5% in December 2022 to 3.4% in December 2023. This reduction was attributed to the normalization of supply chains and the impact of Federal Reserve rate hikes and balance sheet runoff. Consequently, fixed income investments yielded positive real returns in the latter half of the year (i.e., treasury rates minus inflation), a trend expected to continue into 2024. Municipal bonds had strong absolute and relative performance against their fixed income counterparts with the Bloomberg Municipal Bond Index gaining 6.40% in 2023. However, the market was volatile with peak yields reaching 3.65% on October 30th, followed by a nearly 1.40% drop by year-end finishing at 2.27%.

Markets quickly baked in three rate cuts in the final month of the year providing a substantial tailwind to municipal bond markets as illustrated in the chart below culminating in a total return of 8.67%, derived mostly from November and December’s positive

Equity Markets:

Despite market sentiment hinting at a potential negative GDP year and expectations of some price-to-earnings compression, equities were not only resilient but performed incredibly well as economic indicators remained relatively positive. Most segments of the equity market recorded double-digit returns, with U.S. large-cap growth emerging as the standout performer thanks mostly from the Magnificent Seven.

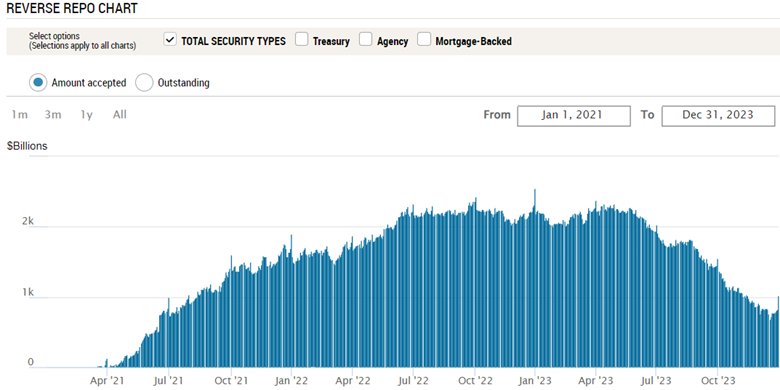

Less than expected financial tightening and excess liquidity could have played a factor in 2023’s positive performance. The Federal Reserve balance sheet roll-off plan that began in June of 2022 fell short of projections as they provided mid-year emergency lending to select banks, particularly emanating from the situation from First Republic and Silicon Valley Bank. This is important to note as excess liquidity in the financial system can help bolster equity markets. A proxy to measure this is by observing the reverse repo market figures. The reverse repo market allows money market funds to lend their U.S. treasuries in exchange for cash to help with day-to-day operations. This figure peaked at over $2.5 trillion in January 2023 and has since gradually dropped throughout the year. Presently, the reverse repo market stands at approximately ~$600 billion, showing still elevated figures (i.e., typically it’s in the low teens), but moving downward as the Federal Reserve continues to tighten conditions.

In summary, despite witnessing a tightening of liquidity throughout 2023, it has stayed elevated. This, coupled with other bullish factors like the anticipated Federal Reserve pivot, the surge in interest around artificial intelligence (AI), and a moderation in inflation figures, decisively propelled equities upward from 2022. These combined elements underscore the resilience and positive momentum in the equity markets.

Alternative Investments:

Private credit delivered attractive relative returns, primarily due to their floating rate and short-duration structure. Private credit sponsors will likely continue to be busy in 2024 as banks continue to step back in lending. Investing with experienced, disciplined credit managers will prove to be important in the year ahead.

Private equity saw a slowdown in deal activity; according to Pitchbook, private equity fundraising is on track to close the year only slightly higher than fundraising in 2022.2 Secondary investments have had a strong year as some limited and general partners turned there for a source of liquidity.

Real assets had a challenging year as rising interest rates and higher financing costs dampened market transaction volumes. Recent “Preqin numbers suggest that 2023 will record the lowest levels of transaction volumes for the past decade in both real estate and infrastructure.”3 With infrastructure fundraising down making it more difficult to get projects off the ground, major alternative managers have been throwing their hat in the ring, seeing future opportunities to lend and acquire these assets at cheaper prices than in the past.

Looking ahead, we continue to believe that alternatives will play a key role in portfolio construction, returns, and diversification.

Looking Ahead: Things to come in 2024…

Fed Rate Expectations and Inflation:

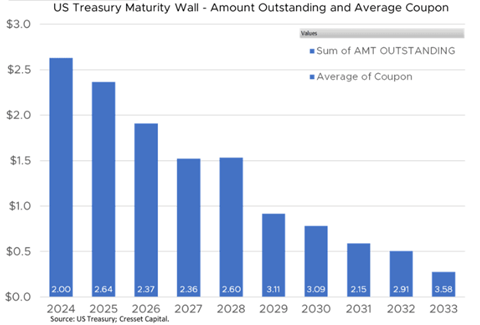

Pinpointing the precise timing of potential rate cuts remains challenging given the intricate interplay of various data points. While many inflationary indicators suggest a slowdown, it is noteworthy that inflation remains stickier than some have anticipated. Several factors could influence the Federal Reserve to start cutting rates, but the two most significant are the debt maturity wall in 2024 coupled with current and future interest expenses. The debt maturity wall shows a highly concentrated amount of debt coming due in 2024 and for the next few years thereafter. This becomes particularly relevant if there is diminished interest in purchasing U.S. debt, especially from foreign countries like Japan and China. Higher yields could potentially be needed to entice foreign investors to buy as they see more treasury issuance come to market causing an even higher interest expense burden on the U.S. Simply put, the more of something readily available, the lower the price; in the case of treasuries lower prices mean higher yields.

Addressing the challenges posed by the debt maturity wall and interest expenses could involve a strategic move such as cutting rates and basically re-financing the country by issuing longer-dated U.S. treasury maturities to capitalize on lower yields. However, this approach carries significant risks, notably the potential to awaken the "inflationary bear.” Furthermore, playing this interest rate game could frustrate foreign buyers, thus reducing their appetite to buy U.S. debt in the future.

It appears that Jerome Powell is inclined to maintain the current rate pause unless compelling data, such as signs of a weakening economy, deflationary indicators, or disruptions in the financial system, prompts him to consider rate cuts. Rather than making a move and potentially restoking inflation, he will likely wait until the economy loses steam before making any moves, even if it means dealing with interest payments that are approaching a trillion dollars annually.

2024 Portfolio Positioning:

Cautiously optimistic is the key posture going into this year. From the surface level, most economic data has been holding up as we reach the later stages of this economic cycle but looking more critically, there seems to be some economic window-dressing. We have seen downward revisions on Non-Farm Payrolls for 11 out of 12 months in 2023, and after stripping out government spending, the U.S. would have had a more subdued GDP growth figure in 2023. We have also seen some cracks in banking from the Silicon Valley Bank and First Republic debacle that took place in 2023.

Prevailing logic would say that softening economic data would bring a market downturn, but the market does not always move in lockstep with the economy. Once The Federal Reserve has enough ammunition to justify the end of quantitative tightening, this could boost both fixed income and equities markets alike in 2024. One tail risk that we will be monitoring is the potential uptick of inflation that could come from supply chain disruptions caused by increased global conflict and tension.

Taking advantage of higher-yielding short-duration assets for enhanced cash returns, diversifying for different performance outcomes, and holding to a structured investment process will be key to this year’s investment landscape as volatility potentially kicks up.

As always, please feel free to reach out with any questions or for further discussion. Thanks for taking a look!

|

Josh L. Galatzan, CIMA® |

Kirk Price |

|

Chris J. Popso |

Brian J. Noonan, CEPA |

|

Meagan Moll, CIMA®, CFP®, CPWA® |

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

1https://www.blackrock.com/us/individual/insights/municipal-monthly

2https://alterdomus.com/insight/alternative-asset-annual-review-how-markets-performed-in-2023/

3https://alterdomus.com/insight/alternative-asset-annual-review-how-markets-performed-in-2023/