Q3 2024 Commentary and Presidential Election Update

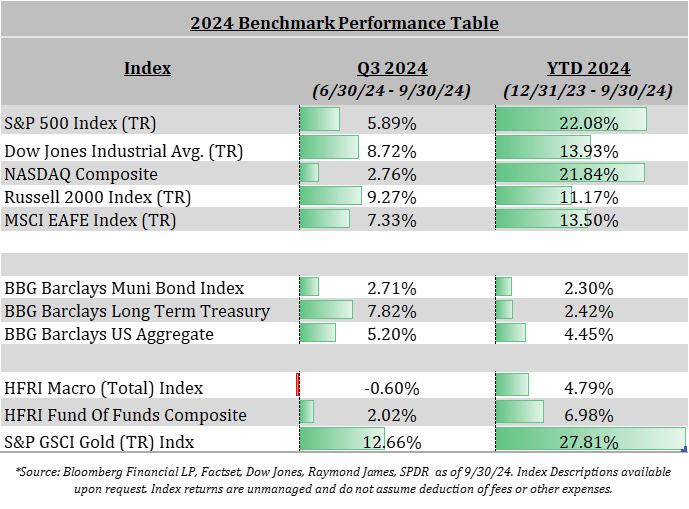

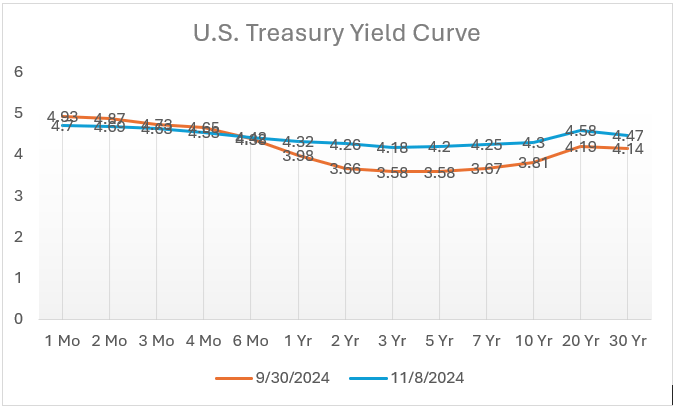

With most companies having reported third-quarter earnings, the U.S. economy continues to show strong growth, reflected in the S&P 500's year-over-year earnings growth rate of 5.3% for the quarter. Seventy-five percent of companies exceeded earnings expectations, slightly below the five-year average of seventy-seven percent. U.S. equities broadly performed well, with the S&P 500 posting a 5.9% return for the quarter. The top-performing sectors were consumer discretionary, utilities, and communication services. Meanwhile, the U.S. 10-year Treasury yield hit its annual bottom near the end of September, but this trend has reversed, with 10-year yields climbing by over half a percent as the overall yield curve begins to un-invert.

Post-presidential election, we have seen the biggest upside movements in financials (specifically credit cards and diversified banks), consumer discretionary, energy, and industrials. The more muted areas have been healthcare, utilities, materials, and consumer staples.

U.S. presidential elections have long been viewed as pivotal moments for equity markets, with investors closely monitoring these events for potential shifts in economic policy, tax structures, and regulatory changes that could impact corporate profits. Historically, however, the actual impact of presidential elections on the stock market is often less significant than many anticipate. In the months leading up to an election, markets can experience increased volatility, largely driven by uncertainty as investors try to anticipate the potential economic policies of each candidate. Despite this, election-related volatility tends to be temporary, with markets typically stabilizing as the results become clear.

Over the long term, data suggests that U.S. equities have generally trended upward regardless of which party holds the presidency. From a historical perspective, the stock market has performed positively under both Democratic and Republican administrations. While certain industries may experience more immediate gains or losses depending on the prevailing political agenda, the overall market typically reflects broader economic forces, such as interest rates, corporate earnings, and global events, rather than the political party in office. This resilience indicates that market performance is more closely tied to fundamental economic conditions than to the political affiliation of the president.

While investors may initially react strongly to presidential election results, these reactions are typically short-lived, with markets resuming trends driven by fundamentals. Over time, investors tend to focus more on corporate earnings and economic developments, relegating the effects of political events, including elections, to the background. Historical data suggests that while elections create short-term noise, they are not a significant determinant of long-term equity market returns.

Although historical data has shown a typically muted impact on market performance from U.S. elections, a Republican majority in both the Senate and House of Representatives could make passing legislation significantly easier. Several major policies are being followed for their potential impact on markets. The first being the potential implementation of tariffs on China allowed by presidential executive order, which could drive supply-side inflationary pressures in the short to intermediate term.

Another key factor is the possibility of a faster rate-cutting cycle. Although technically not a legislative policy move since the Federal Reserve operates independently of both the President and Congress, it remains an influential factor. Recent statements from some advisors to the president-elect have sparked speculation about this directive, especially as some have suggested replacing Federal Reserve Chair Jerome Powell. In his latest conference, Powell responded to questions from reporters regarding this speculation, underscoring the Fed’s commitment to its economic mandate, independence from political pressure, and highlighting the constitutional protections the Federal Chair has from being removed by a president.

Lastly, we could prognosticate all day with charts and see the swing in momentum that has taken place post-election, however, these reactions typically fade within a few months, so staying anchored with data and holding to a consistent investment process makes the most sense as we get a new president in the coming months. As time goes on it should become clearer what policy directives will have the most impact on a longer time horizon while keeping an eye on macro-economic trends with a continued investment focus on high-quality companies.

|

Josh L. Galatzan, CIMA® |

Kirk Price |

|

Chris J. Popso |

Brian J. Noonan, CEPA |

|

Meagan Moll, CIMA®, CFP®, CPWA® |

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.