2024 Recap / 2025 Outlook

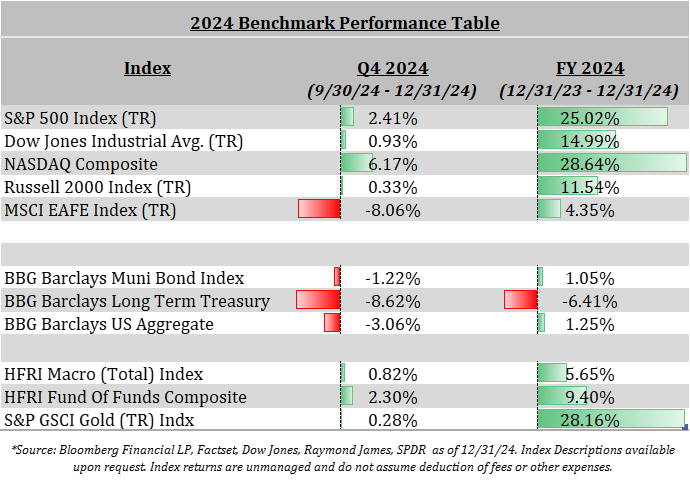

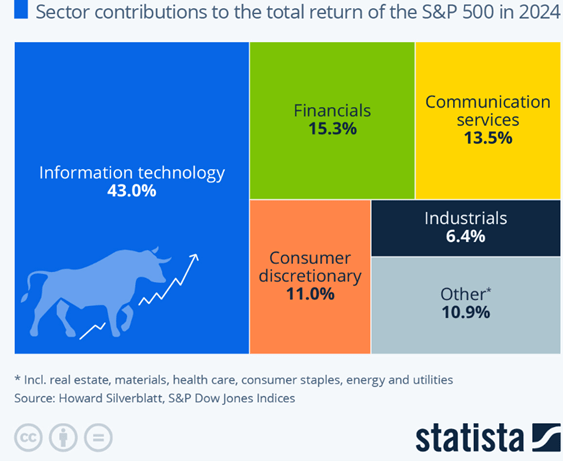

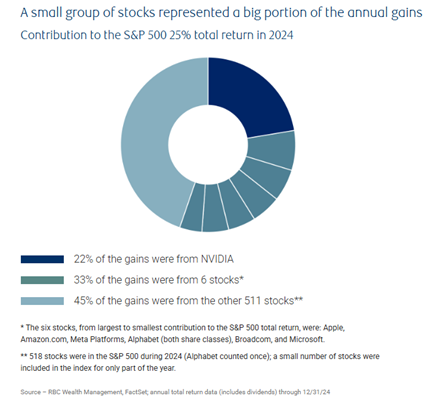

Despite some headwinds, 2024 proved to be another strong year for equity markets as performance was bolstered again by a concentrated performance within large-cap equities. The Magnificent 7’s total return for the year was 66.9%1, representing more than half of the annual total return from the S&P 500. Like equity markets in 2023, information technology was once again the best-performing sector, providing the largest performance contribution to the S&P 500 at 43%, largely from riding the AI wave. While several other sectors generated positive returns, they paled in comparison to information technology.

Equity Markets:

Nearly all sectors had positive performance for the year with the largest laggards being materials, health care, energy, and real estate respectively. Factors like higher interest rates, slowing global market economies (i.e., China and parts of Europe), and unfavorable supply and demand dynamics have persistently weighed on some of these sectors. Regardless of headwinds, domestic equities, in general, continued to provide impressive performance with information technology, specifically AI-related stocks, leading the way. A significant percentage of the S&P 500’s total return for the year was concentrated in just 7 stocks (“The Magnificent 7”).

Fixed Income Markets:

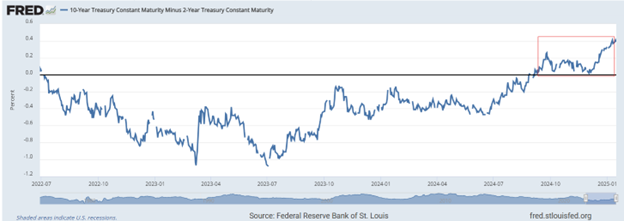

Fixed income markets had a tough year as interest rate volatility and rates increased. Even as the Federal Reserve cut rates by a total of 1.00% starting in September and continuing through year-end, 10-year treasury yields defied gravity moving up by the same amount, with the entire yield curve normalizing for the first time since July of 2022. A short-duration posture proved to be the best positioning in 2024 as longer-date maturities had negative performances.

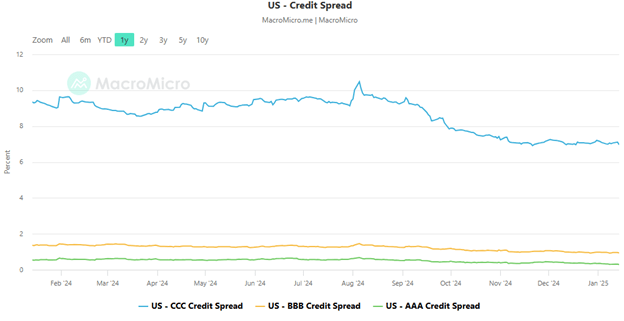

Credit spreads remain tight despite Federal Reserve policy uncertainty. Many companies are still seeing the positive effects of their increased debt issuances during the COVID-19 days of historically low rates. This has continued to provide balance sheet liquidity that is still positively impacting credit markets today. However, liquidity is now tightening, a dynamic that we will be tracking in 2025.

Precious Metals:

Gold soared to record highs in 2024, delivering an impressive 28.16% return, driven by increased central bank purchases, inflation uncertainty, and geopolitical instability. Silver also performed strongly, gaining 21.46% over the year. The challenge of limited access to capital faced by the mining industry has helped limited supply outputs, thus providing a further tailwind for precious metals. Geopolitical uncertainty and concerns about continued inflation could prove to be a ballast for these investments in 2025.

Stagflation Risk:

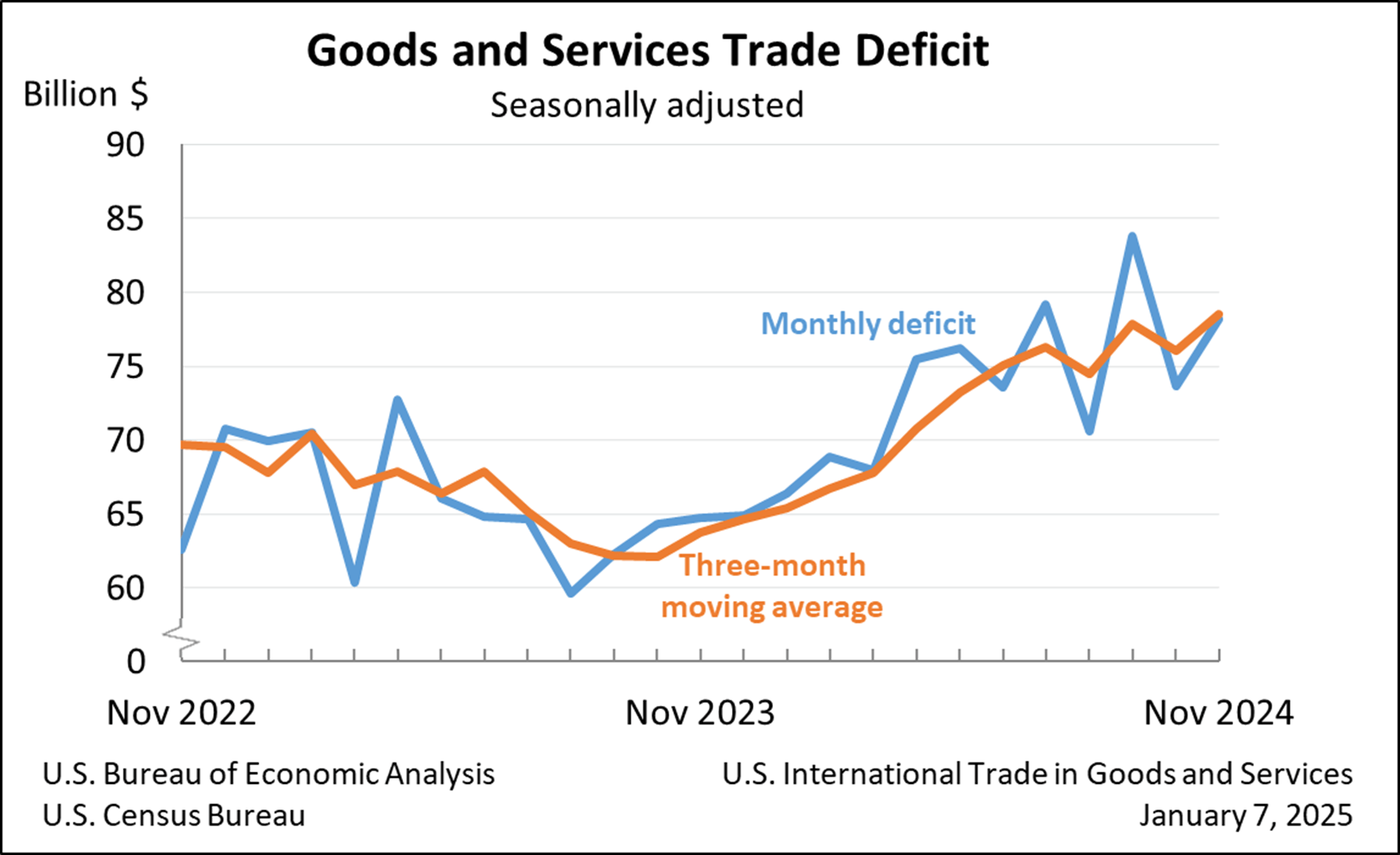

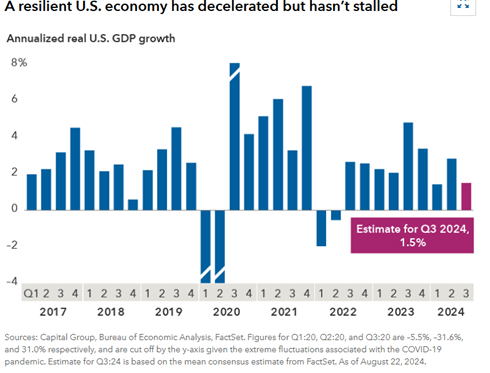

Stagflation has been a trending topic throughout the year, initially driven by concerns over a slowing economy and now compounded by the potential implementation of blanket tariffs on Chinese imports. While headlines may paint an alarming picture, GDP growth—though moderating—continues to demonstrate relative resilience, suggesting we remain in what appears to be a mid-market cycle.

Additionally, President Trump’s aggressive rhetoric on tariffs seems more likely an attempt to bring countries to the negotiation table rather than an indication of imminent implementation. This perspective was reinforced during his speech at the World Economic Forum, which he joined via video call from Davos. In his remarks, Trump struck a firm yet measured tone, emphasizing his administration’s efforts to address America’s trade imbalances, which have resulted in significant and growing deficits with several countries. This message also included leveraging U.S. natural resources to help combat inflation via LNG and oil drilling which should help offset any future inflationary tariff policies.

Alternative Investments:

Once again, Private credit delivered attractive relative returns, primarily due to their floating rate and short-duration structure. Private credit sponsors will likely continue to provide strong income and low volatility. Even if rates trend lower, the embedded spreads from the underwriting of these deals should be large enough to provide large single-digit yields. Even if yields stay elevated, the floating rate structure continues to benefit them as well. Investing with experienced and disciplined credit managers will continue to be important as more firms crowd into the space.

Higher interest rates have created some dislocations within real estate providing potential opportunities in upcoming fund vintages. One area of interest is within multi-family apartment complexes, capitalizing on forced/motivated sellers at a compelling basis below replacement cost. The macroeconomic backdrop also looks compelling in the foreseeable future as home ownership continues to be expensive compared to rent.

Looking ahead, we continue to believe that alternatives will play a key role in portfolio construction, returns, and diversification.

Macro-Economic Themes:

The U.S. economy in 2024 continued to defy recession fears and led the global economy forward, with robust job reports showing unemployment hovering not far from historic lows of 4.1% at year-end. Wage growth, while moderating, has supported consumer spending without reigniting inflation. Headline inflation has declined to an annualized rate of 3.1%, a marked improvement from the highs of 2022, thanks to easing supply chain constraints and softening energy prices. However, core inflation remains sticky, driven largely from persistent cost increases in housing and services. The Federal Reserve’s cautious stance reflects its balancing act: fostering economic growth while ensuring inflation trends downward hovering somewhere around 2%. While many believed a 'soft landing' was impossible when the Fed began tightening in 2022, recent data suggests we may indeed be experiencing this rare occurrence. It will be a balancing act, but should this end up being the case, history would tell us that economic activity should subsequently accelerate.

Federal Reserve monetary policy will remain a key focus in 2025 as markets anticipate a few more rate cuts throughout the year. However, uncertainty lingers regarding where rates will settle over the next twelve months, especially given the recent rise in treasury yields even as rates were being reduced, creating a divergence that has added more complexity to the outlook. Markets are expected to remain heavily data-dependent, closely monitoring indicators such as softer labor market data and slower GDP growth to identify a potential inflection point for further rate reductions.

Tariffs- Not a New Topic:

We first wrote about the potential impact of new tariffs during President Trump’s first term in office. If you were to believe the media, tariffs have the sound of an evil anti-economic growth principle about them. However, the truth is that tariffs have been a central part of US economic policy for over a hundred years. In fact, from 1861 to 1933 the US had one of the highest tariff rates in the world. Following World War II, this rate began to drop in an effort to increase free trade and now sits amongst the lowest rates in the world.

For decades, presidential administrations have spoken consistently about “fair trade,” although some have enacted more policy than others around the concept. The Biden administration actually extended most of the tariffs enacted by the first Trump administration, although it would have been well within President Biden’s power to roll them back. President Trump loudly proclaimed an aggressive new stance on Tariffs in his second term, particularly on China, Canada, Mexican EVs and European Autos. There has even been some discussion of high universal tariffs.

The question, of course, is whether we should take Trump’s most aggressive comments at face value or as saber rattling to pave the way for future negotiations. We believe that some of the tariffs that have been discussed will indeed be enacted (Mexico, Canada and China) at what are likely to be reasonable rates aimed at leveling the playing field. We do not believe these policies are likely to be universally inflationary or detrimental to the soundness of the US Economy.

For a great little history lesson on Tariffs, we recommend taking ten minutes to watch this video from Maxinomics.

Investing by Presidential Terms:

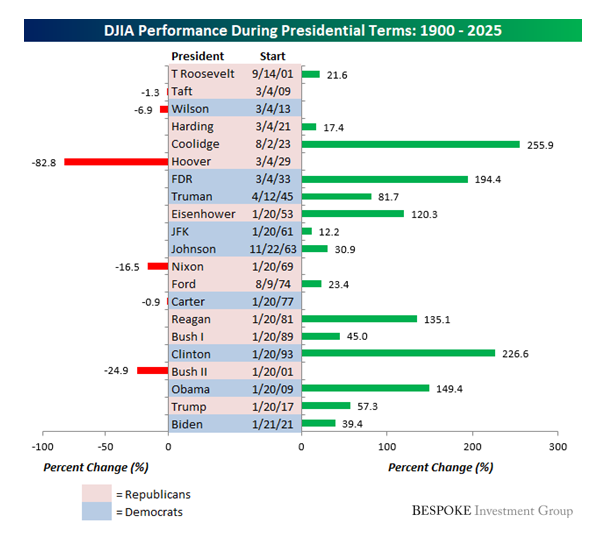

Every four years, prior to and following the Presidential election, we get an influx of questions around portfolio positioning for the upcoming administration, whether it be republican or democrat, conservative or liberal. Our stance on this topic is rooted in over 100 years of data. It just simply does not matter. As an investor, one should rarely let political views and investment decisions overlap. There are several illustrations we could walk you through, but below are a few of the most recent:

- 2008/2009- Many investors turned hyper-bearish on equity markets based on their perception that President Obama’s policies were negative for the economy and equity markets. During his tenure, the Dow Jones Industrial Average rallied nearly 150%.

- 2016/2017- Another group of investors turned bearish based on the perceived chaos, inexperience and self-dealing that would come with Trump’s first administration. During his tenure the DJIA rallied over 57%.

- 2020/2021- The cycle reversed, and some investors wanted out of the markets based on Biden’s policies of more regulation and higher taxes. During his tenure, the DJIA rallied over 39%.

This is not to say that policy does not influence the economy and the markets. The President can influence the fundamentals through policy on the margins; but financial market and economic performance are largely driven by fundamental influences outside of the President’s or Congress’ control.

2025 Portfolio Positioning:

Like last year’s perspective, we are cautiously optimistic as markets continue to show strength, strong earnings growth, and mostly positive economic data. Having avoided the long-awaited recession for at least now, we are currently experiencing many of the characteristics of a mid-cycle economy. Mid-cycle economies are typically characterized by a shift towards neutral monetary policy, softening cost pressures, accelerating credit demand and rising corporate profits. All four of these characteristics were at play in 2024. This is important to note as mid-cycle economies tend to lead to multi-year expansionary periods and a generally favorable backdrop for risk assets. Furthermore, the new presidential administration could provide tailwinds for certain industries from lower regulatory barriers which could have an outsized impact on small and mid-cap equities. Continued expansion of breadth in equity markets away from mega cap technology would be a positive tailwind for the economy and the markets. We find it most plausible that average equity market returns will be lower than average in the short term, while volatility arising primarily from uncertainty is likely to spike.

Within Fixed Income, bonds appear to be offering a compelling value from both an income and total return perspective. After years of lagging, as of November 30th the yield on the Bloomberg US Aggregate Bond Index is higher than the S&P 500 earnings yield. Additionally, there will be pressure on the Fed and Chairman Jerome Powell to maintain the gradual disinflationary environment while simultaneously keeping rates low. This will not be an easy feat, but one that could prove possible. This dynamic could mean lower rates in 2025 and thus an opportunity to start buying longer-dated fixed income maturities as both a ballast to risk assets in the portfolio and a solid source of income.

As previously noted, we believe it is plausible, if not likely, that equity market returns will be subdued relative to recent years. Back-to-back 20%+ returns from the S&P 500 have stretched market valuations, largely in the best performing sectors such as technology. While we remain cautiously optimistic, we continue to believe that alternative investments (as well as fixed income) will play an important role in portfolio diversification and returns in the coming years. We believe the backdrop to be improving in some pockets of commercial real estate and to be favorable for both private equity and private credit. While these asset classes tend to have longer durations and require patient capital, their importance in sound portfolio construction should not be overlooked.

As always, thank you for your continued confidence and support. Thanks for taking a look!

|

Josh L. Galatzan, CIMA® |

Kirk Price |

|

Chris J. Popso |

Brian J. Noonan, CEPA |

|

Meagan Moll, CIMA®, CFP®, CPWA® |

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.