Market Update

Equity Markets Overview:

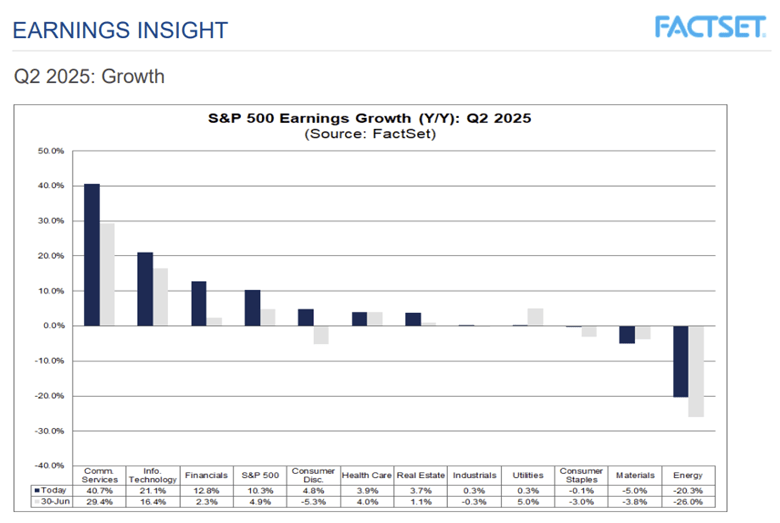

U.S. equity markets continue to print positive single-digit performance, despite the double-digit decline in April, after a V-shaped recovery that has led to both the S&P 500 and Nasdaq Composite hitting new all-time highs. The gains have been driven largely by persistent momentum in mega-cap tech names, continued excitement around AI infrastructure, and a resilient consumer sector. The earnings season, which is now winding down, has been largely surprising to the upside. The largest year-over-year second-quarter earnings growth so far has come from communication services, information technology, and financials, respectively.

International markets have outperformed U.S. equities in 2025, supported by strong fiscal momentum, a surge in industrial investment, a notable increase in defense spending across Europe, and a weakening dollar. Following heightened geopolitical risks and NATO pressure, countries such as Germany, France, and Poland are looking to accelerate their military budgets, funneling billions into aerospace, cybersecurity, and local manufacturing. This uptick in government outlays has acted as a stabilizing force for European equities, particularly in industrials and defense-linked sectors, while also lifting broader sentiment. Simultaneously, Japan continues to benefit from corporate governance reforms and its increasing focus on shareholder value, providing international investors with more reasons to diversify outside the U.S.

Meanwhile, U.S. equities—particularly outside the mega-cap space—have lagged as valuation dispersion widens and concerns about the American consumer increase, leading to lags in consumer discretionary and real estate. International valuations remain attractive, with the MSCI EAFE Index trading at a discount to U.S. benchmarks. The combination of renewed European fiscal activism, rising global defense spending, and attractive relative pricing is drawing capital flows abroad for the year.

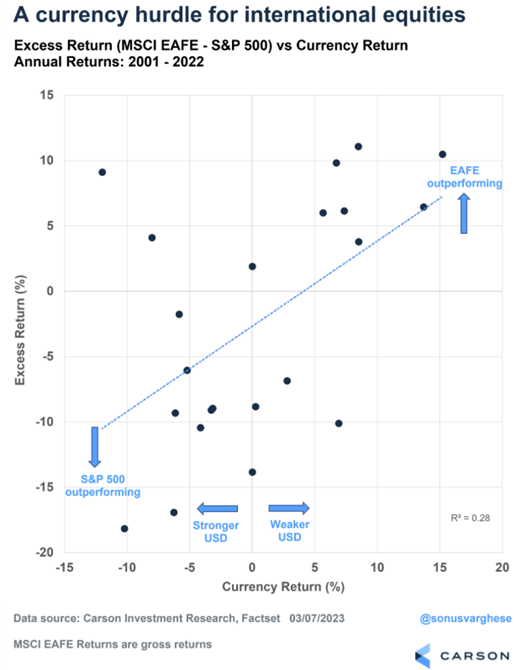

U.S. dollar weakness has played a part in international market outperformance, partially backed by some statistical analysis provided in the chart below, which shows the excess return of the MSCI EAFE based on the U.S. Dollar annual performance return. Based on this data set, it seems that the larger the currency moves in either direction, the higher the likelihood of international markets outpacing the S&P500. This intuitively makes sense as some countries can take advantage of their weaker currency to increase exports to the U.S., while a significantly stronger currency can move investors into international markets, capturing additional performance from foreign currency exposure.

There has been a notable rotation within equity markets. While tech remains dominant, sectors like industrials and utilities have gained interest from expectations of looser regulatory frameworks under the Trump administration. Meanwhile, ESG-focused sectors have seen capital outflows. AI, robotics, and cybersecurity remain high-conviction trades, but stretched valuations could provide a healthy correction- but earnings have turned out to be largely positive, leading investors to believe in a longer runway ahead.

A few other interesting themes this year include the moves toward reshoring critical industries, with the U.S. Department of Defense investing directly in critical minerals companies and U.S. officials’ renewed interest in nuclear and other energy development. The DoD recently bought direct equity in MP Materials Corp, the only operating rare earth mine and processing facility in the United States. This theme should continue as the U.S. looks to reduce its reliance on China and other foreign entities.

Fixed Income Landscape:

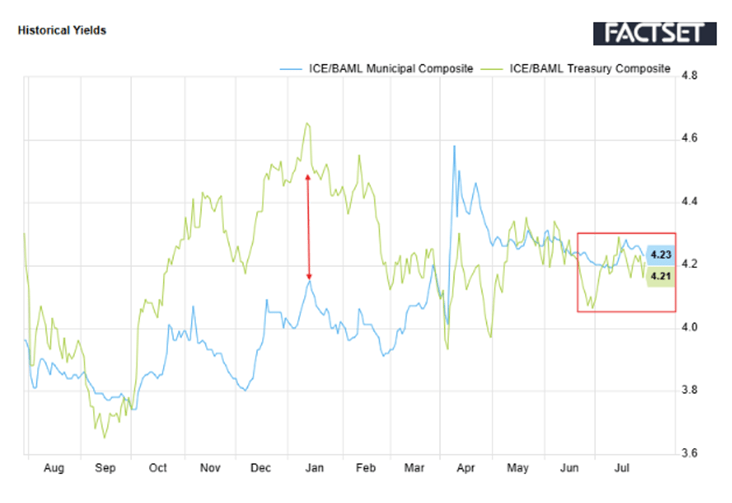

The bond market has faced ongoing volatility in 2025. After a surprisingly hawkish start to the year by the Federal Reserve, rates briefly surged before stabilizing mid-year as inflation data softened. The 10-year Treasury yield has trended down to ~4.40%, coming off at the beginning-of-year highs of 4.81%. Credit spreads have narrowed slightly, suggesting investor confidence in corporate fundamentals, but longer-dated treasuries have continued to struggle due to duration sensitivity. The municipal bond market has seen some recent opportunities, especially on longer-term maturities, as historically high issuance and softening inflation data have decreased the Municipal Market Data to treasury yield spreads, along with an increasing slope in the 15 to 20-year maturity spaces, providing more incremental yield as one goes further out in maturity.

Trump’s Return and the “Taco Trade”:

In recent weeks, investors have leaned into the familiar pattern known as the “TACO Trade” (Trump Always Chickens Out)- anticipating bold tariff threats that ultimately get softened or delayed. For example, a proposed 30% increase in Mexican tariffs was financially postponed on July 31, 2025, with existing rates—25% on general goods, plus specific duties on autos, steel, and aluminum—remaining in place while negotiations continue with President Sheinbaum. This rollback comes just before the initial August 1 deadline, reinforcing market confidence that threats often end in compromise.

Markets have responded positively: after earlier tariff announcements triggered pullbacks, optimism returned when investors assumed Trump would retreat and potentially negotiate better terms. That dynamic has helped temper fears over stagflation and corporate margin squeeze, as equity indices rebounded and risk premiums narrowed. Nevertheless, analysts caution that effective tariffs could settle around 14–15%, exert upward pressure on prices and boost inflation, especially as firms face depleted inventory buffers from previous months' stockpiles.

Precious Metals:

Gold continues to perform strongly in 2025, buoyed by persistent dollar weakness stemming from the United States’ elevated GDP-to-debt ratio—currently at 120.87%—and ballooning deficit spending. Treasury interest payments alone are approaching $1 trillion annually. At the start of the year, there was a brief narrative of fiscal restraint led by the Department of Government Efficiency (DOGE), but that momentum quickly faded. The passage of the Big Beautiful Bill reignited deficit spending, boosting expectations for future market liquidity.

More than just a “shiny pet rock,” gold remains a critical asset, backed by a multi-millennia-long track record of preserving investors' purchasing power over time. Treasury Secretary Scott Bessent has repeatedly hinted at potential gold monetization, which could imply a future upward revaluation of gold in dollar terms. Looking back at history, specifically to the Nixon era, there are notable parallels worth considering. On April 4th, 1969, then-President Nixon addressed the U.S. balance of payments issue, stating: “That trade surplus must be rebuilt, and it can only be rebuilt by restoring stable and noninflationary economic growth to the U.S. economy. Inflation has drawn in a flood of imports while it has diminished our competitiveness in world markets and thus dampened our export expansion.”1 He continued on by stating, “In export expansion, we have tentatively set an export goal of $50 billion to be achieved by 1973... This is primarily the task of American private enterprise, but government must help to coordinate the effort and offer assistance and encouragement. We must also call on the productivity and ingenuity of American industry to meet the competitive challenge of imported goods.”1

Less than two years later, Nixon dismantled the Bretton Woods system, pushing the global economy onto a fiat currency regime. As a result, the price of gold surged from $35 per ounce to over $187 within four years.

Fast forward to April of this year, and Scott Bessent delivered remarks before the Institute of International Finance that echoed similar concerns:

“Nowhere is the imbalance I mentioned earlier more obvious than in the world of trade. That’s why the United States is taking action now to rebalance global commerce. For decades, successive administrations relied on faulty assumptions that our trading partners would implement policies that would drive a balanced global economy. Instead, we face the stark reality of large and persistent U.S. deficits as a result of an unfair trading system.”2

While Nixon focused on a shrinking export surplus, he inadvertently created a system that enhanced the dollar’s global dominance through the rise of the petrodollar and its reserve currency status, making the dollar too strong to support U.S. manufacturing competitiveness. Similarly, Bessent’s concerns over trade imbalances and deficits may lead to policy actions such as further dollar weakening, coupled with the current tariff work being done to increase U.S. exports. One potential tool could be revaluing gold upward from its current official U.S. Treasury book value of $42.22 per ounce, thereby strengthening the federal balance sheet and investor confidence as these major economic overhauls are implemented. If revalued at current gold spot prices, this would increase the U.S. Treasury’s balance sheet value by over $860 billion.

Private Markets:

Private equity and venture capital activity have rebounded modestly from the subdued levels of 2023–2024. Dry powder remains elevated, and deal flow has picked up particularly in healthcare, AI, and industrial automation. Secondary markets for private shares have become more liquid, and valuations are beginning to reset higher — albeit cautiously. Private credit continues to thrive as banks continue to stay away from middle-market lending, offering attractive yields with low duration exposure. Funds with floating-rate loans continue to be highly coveted, given the lower sensitivity to rate increases compared to public credit markets. Private real estate remains under pressure in office and within some areas of multifamily, but logistics, data centers, and cold storage assets are in demand. Infrastructure funds have raised record capital this year, driven by the need to support growing AI server demand, digital connectivity, and grid modernization. Hedge fund performance has been mixed; macro and trend-following strategies have outperformed, while long/short equity has struggled given the continued narrow performance breadth in equity markets.

Looking Ahead:

Market volatility may increase as tariff trade negotiations continue and as certain economic datapoints continue to soften. Investors are closely watching the Federal Reserve for potential rate cuts in late 2025, which could provide a tailwind to risk assets. However, Federal Reserve Chair Jerome Powell and most other members have continuously voted to keep rates at current levels due to ongoing concerns about inflation and their belief in a still strong economy. Wise portfolio construction and positioning involve continually looking at long-term trends, prudentially investing in diversified high-quality growth and strong balance sheet companies, while also diversifying across both asset classes and sectors. In a year defined by macro crosswinds and political pivots, staying rooted in first principles, long-term investing will help reduce the whipsawing effects of volatility and sleight of hand from political policy changes.

As always, please do not hesitate to reach out directly to our team for further discussion.

Regards,

|

Josh L. Galatzan, CIMA® |

Kirk Price |

|

Chris J. Popso |

Brian J. Noonan, CEPA |

|

Meagan Moll, CIMA®, CFP®, CPWA® |

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

1. https://www.presidency.ucsb.edu/documents/statement-the-balance-payments

2. https://home.treasury.gov/news/press-releases/sb0094