Market Commentary and 2026 Outlook

Equity Markets:

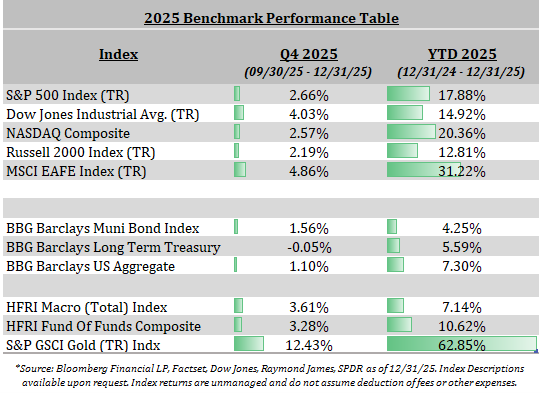

Equity markets delivered resilient performance in 2025 despite persistent macroeconomic uncertainty, elevated interest rates, and geopolitical risks. In the U.S., market leadership was once again highly concentrated, with returns driven primarily by the “Magnificent Seven”. These companies benefited from strong balance sheets, durable earnings growth, and accelerating investment in artificial intelligence. Sector-wise, information technology and communication services were the top performers, while industrials also showed strength amid reshoring trends and infrastructure spending.

International equities delivered notably stronger results than in recent years, led by developed markets in both Asia and Europe. Increases in geopolitical tension nudged much of Europe into increasing spending across industries, including areas such as defense. This catalyst created a positive backdrop for investors after many years of international markets lagging the U.S. markets. Low valuations, improving earnings trends in select industries, and a backdrop that favored cyclicals and value-oriented areas relative to the U.S.’s more growth-concentrated leadership materialized with a 2025 EAFE performance of 31.23%. Showing that leadership in global equities broadened meaningfully beyond the U.S.

Gold Rally Continues:

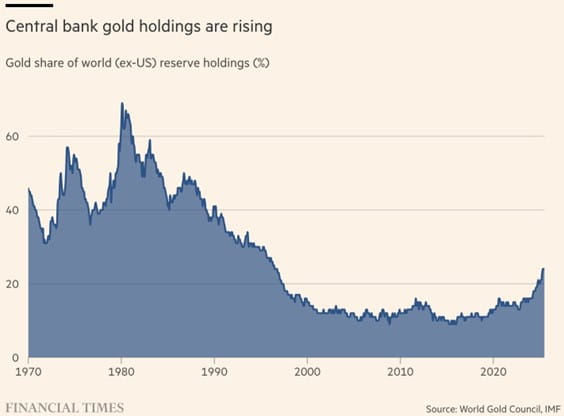

Gold proved to be a strong diversifier in 2025, supported by persistent inflation concerns, geopolitical tensions, and expectations that global central banks are nearing the end of their tightening cycles. That, paired with increasing geopolitical tensions and instability, caused both institutional and retail demand. Central bank purchases also remained robust, reinforcing gold’s role as a strategic reserve asset. While gold does not generate income, its ability to preserve purchasing power and hedge against monetary instability made it a valuable component of diversified portfolios.

Federal Reserve Policy and Bonds:

The Federal Reserve maintained a moderately restrictive policy stance for much of the year, emphasizing a data-dependent approach to rate cuts as inflation gradually moderated. Markets spent much of the period recalibrating expectations around the timing and magnitude of future rate cuts. As inflation trends improved and economic growth showed signs of slowing, and forward-looking markets increasingly priced in potential easing. This shift led to declining long-term yields towards year-end.

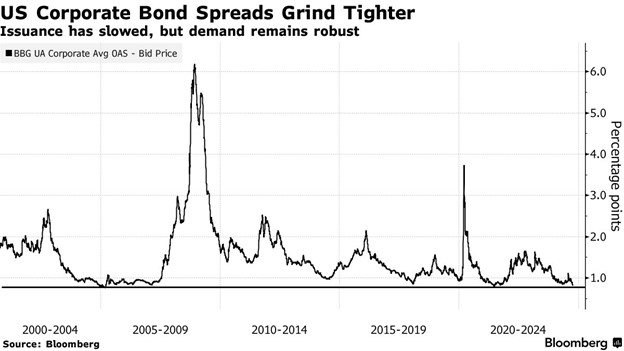

Long-duration bonds, which faced significant headwinds during the rate-hiking cycle, began to regain their role as portfolio stabilizers in 2025. Corporate bond spreads continued their trend downward from 2024 to reach historically low levels. Strong balance sheets and weaker issuance continued to be the backdrop for higher quality corporate paper. Municipal bonds had moments of dislocation from having a higher issuance year, with total return predominantly materializing from interest income.

Private Markets:

Private credit continued to attract capital as higher interest rates translated into compelling yields, particularly for senior secured floating-rate strategies. Investors increasingly favored private credit for its income potential and structural protections, especially as traditional banks pulled back from certain lending activities. However, the year also highlighted the importance of rigorous underwriting and manager due diligence noted by the Tricolor default and few other distressed names.

These developments reinforced that while private credit can offer attractive risk-adjusted returns, outcomes are highly dependent on manager expertise, conservative leverage, and robust risk controls—making diversification and due diligence essential components of successful private market investing.

Private equity markets provided a mixed bag of performance shaped by macroeconomic headwinds and structural industry dynamics. Fundraising remained muted, with global capital commitments declining as high interest rates, geopolitical uncertainty, and competition from public markets weighed on investor appetite, leaving dry powder elevated but gradually coming down from their highs. Deal activity was bifurcated with lower transaction figures, larger and strategic buyouts seeing renewed interest, and financing conditions modestly improved driving up valuations. Exits also improved relative to the last few years, offering some impetus for distributions, though extended holding periods and liquidity challenges persisted. Against this backdrop, private equity continued to emphasize operational value creation over leverage, with specialized strategies and secondary markets gaining traction, setting the stage for cautious optimism heading into 2026 as interest rates stabilized and dealmaking confidence gradually improved.

2026 Outlook:

Markets continue to grapple with a regime where long-term interest rates may remain structurally higher, even as near-term policy eases. Persistent U.S. fiscal deficits, elevated Treasury issuance, and uncertainty around inflation expectations increase the risk of a steeper yield curve. At the same time, corporate credit spreads remain historically tight, offering limited compensation for downside risk at a point when growth uncertainty and refinancing risks are rising. This combination leaves us broadly less positive on corporate bonds and reinforces a preference for high quality, lower duration bonds, where portfolios can better manage interest-rate sensitivity while avoiding asymmetric credit risk.

Gold’s role has been reinforced not only as a hedge against inflation and real-rate volatility, but also as part of a broader structural shift in global reserve management. Continued U.S. deficit spending and rising debt levels have coincided with a steady trend toward de-dollarization, as a growing number of countries diversify reserves away from the U.S. dollar. Official-sector gold purchases have surged to multi-decade highs, with recent government-reported data showing sustained net buying well above historical averages. Importantly, gold’s strong performance over the past two years does not preclude further upside. If fiscal credibility continues to erode, geopolitical fragmentation accelerates, or real rates remain volatile, gold could remain a strong performer into 2026, supported by persistent central-bank demand and its role as a hedge against monetary and geopolitical risk.

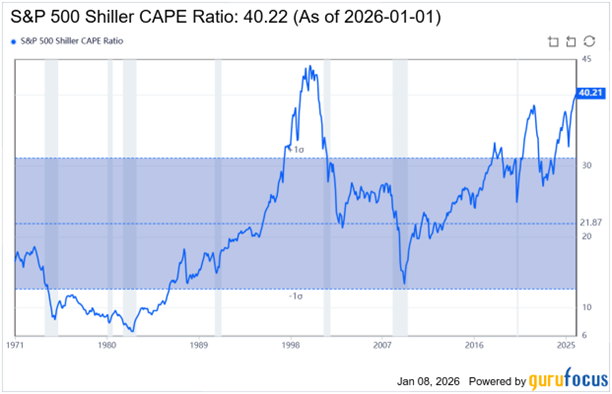

Some equities in the U.S. are becoming more expensive, as strong earnings growth and multiple expansion continue to be concentrated in a narrow group of mega-cap stocks. While valuations are elevated, supportive liquidity and resilient corporate fundamentals suggest there can still be room for markets to go higher from here. That said, the growing dominance of the “Magnificent Seven” highlights increasing concentration risk, especially as passive flows continue to funnel capital into the largest names, reducing effective diversification and increasing downside sensitivity should leadership falter. The Shiller CAPE ratio, which adjusts the market for 10-year inflation growth, has edged higher, suggesting a lower potential return moving forward.

This current market dynamic could lead to new opportunities to pick up more attractive valuations by deploying capital into other high-quality names outside of the MAG-7 and across different market capitalization sizes. We have seen some short-term evidence of this trend with the Russell 2000 outperforming both the S&P500 and NASDAQ by mid-single digits to start the year, meaning capital may be diversifying into more value orientated and smaller market capitalized names.

Another area that we’re tracking closely is developed international equities, which could extend its rally from last year. Relative valuations remain more attractive than in the U.S., currencies are less stretched, and growth initiatives like increases to military spending could support selective opportunities across developed and emerging markets. Diversification outside U.S. mega-caps may become increasingly valuable if leadership broadens or domestic valuations compress.

Private credit remains appealing in a higher-rate environment but warrants caution. While elevated base rates have improved income potential, dispersion in outcomes is likely to widen as economic conditions normalize, making manager selection paramount. Recent high-profile issues mentioned earlier, with the likes of Tricolor, underscore the importance of transparency, rigorous underwriting, and robust operational controls, reinforcing that private credit is not a monolithic asset class and that outcomes will increasingly diverge based on manager quality.

Certain areas within real estate could have a rebound year if economic growth continues, and the consumer remains strong. Distressed multi-family assets look appealing as new builds are becoming prohibitively expensive. Furthermore, with rates broadly stabilizing, there’s less guess work for future deal flow, helping managers to more prudently structure deals. If lending rates do come down in 2026, it could be a strong opportunity to pick up assets at a discount.

Finally, geopolitical risks continue to rise, with the United States’ recent action in Venezuela adding another layer to already strained international relations. This includes additional tension with China as they have invested heavily into Latin America hoping to benefit from resources while also trying to establish a new geological footprint that’s in closer proximity to The United States. This could lead to China further using its dominance in rare earth elements and critical minerals to exert strategic pressure on the U.S., reinforcing the importance of supply-chain security and highlighting how resource geopolitics are becoming a central driver of long-term economic and market outcomes. This means that last year’s top performing mining sector, can continue to rally in the new year and possibly broaden as China looks to potentially increase the use of this lever.

As always, thank you for your continued confidence and support. Thanks for taking a look!

|

Josh L. Galatzan, CIMA® |

Kirk Price |

|

Chris J. Popso |

Brian J. Noonan, CEPA |

|

Meagan Moll, CIMA®, CFP®, CPWA® |

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.