Q3 2023 Commentary

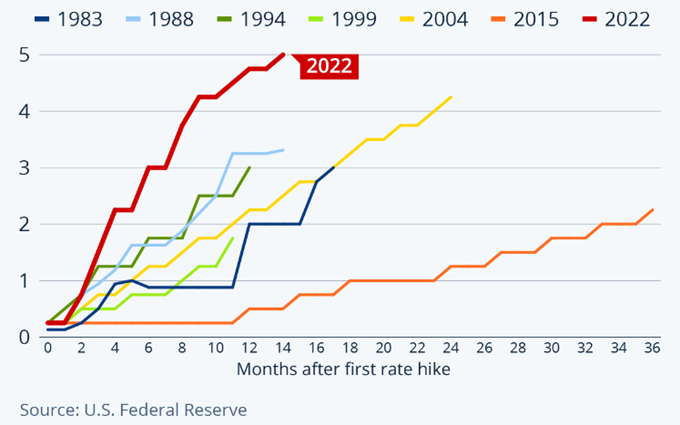

How much credence should investors put on history to try to understand and even predict the future? As Mark Twain said, “History never repeats itself, but it often rhymes”. Prognostication has been taking place since the beginning of time, but recently it seems historical comparisons are not rhyming as much as many pundits have predicted. Some recent instances that come to mind are the frequent comparisons between today’s elevated inflation levels and those of the 1970s. Or when the last rate-hiking cycle was cut short by the 2018 taper tantrum. Many pundits thought the same would happen for today's tightening cycle, which so far has not occurred. Perhaps as humans, we find it tough to accept uncertainty and therefore construct narratives in an effort to feel more comfortable about the world around us.

While it is appropriate (and we often) look to the past to help us understand how similar events may play out in the future, maintaining a disciplined investment process tethered to well-established core principles is the best recipe for long-term investment success.

Equity & Fixed Income Markets Review:

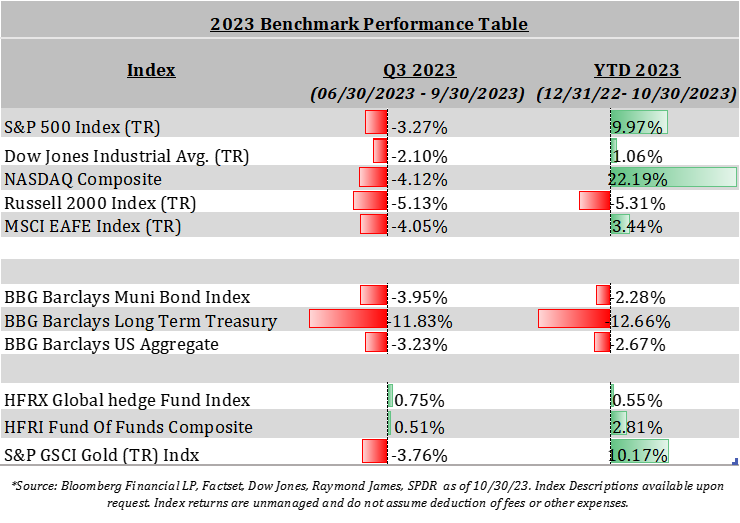

Given the current headwinds of higher rates, decreasing earnings expectations, and the geo-political uncertainty surrounding the Middle East and Eastern Europe, equity markets remained resilient in Q3. But the +11.7% gain in the S&P 500 through the first three quarters of the year paints a rosier picture than reality. Positive performance was dominated by large cap tech stocks, with the contribution from the 10 largest technology companies accounting for 100% of the gain in the S&P 500 while the average was up just 0.3% through the end of September. S&P 500 Q3 earnings have so far remained intact, with the current blended earnings reported (combining both actual and expected earnings figures) up year-over-year by 2.7%1.

Fixed income markets have continued to take a beating this year, especially at the longer end of the curve, as rates have moved up significantly. Corporate credit spreads are still relatively muted but have recently widened as the higher-for-longer interest rate thesis becomes the base case for market expectations, creating opportunities for fixed income investors to find value in longer duration assets. 10-year Treasury yields are not only above levels not seen since 2008’s Great Financial Crisis but are also higher than the combined dividend plus buyback yield of the equity market. This creates not only a compelling valuation but also a potential hedge for a slowing economy.

Interest Rates:

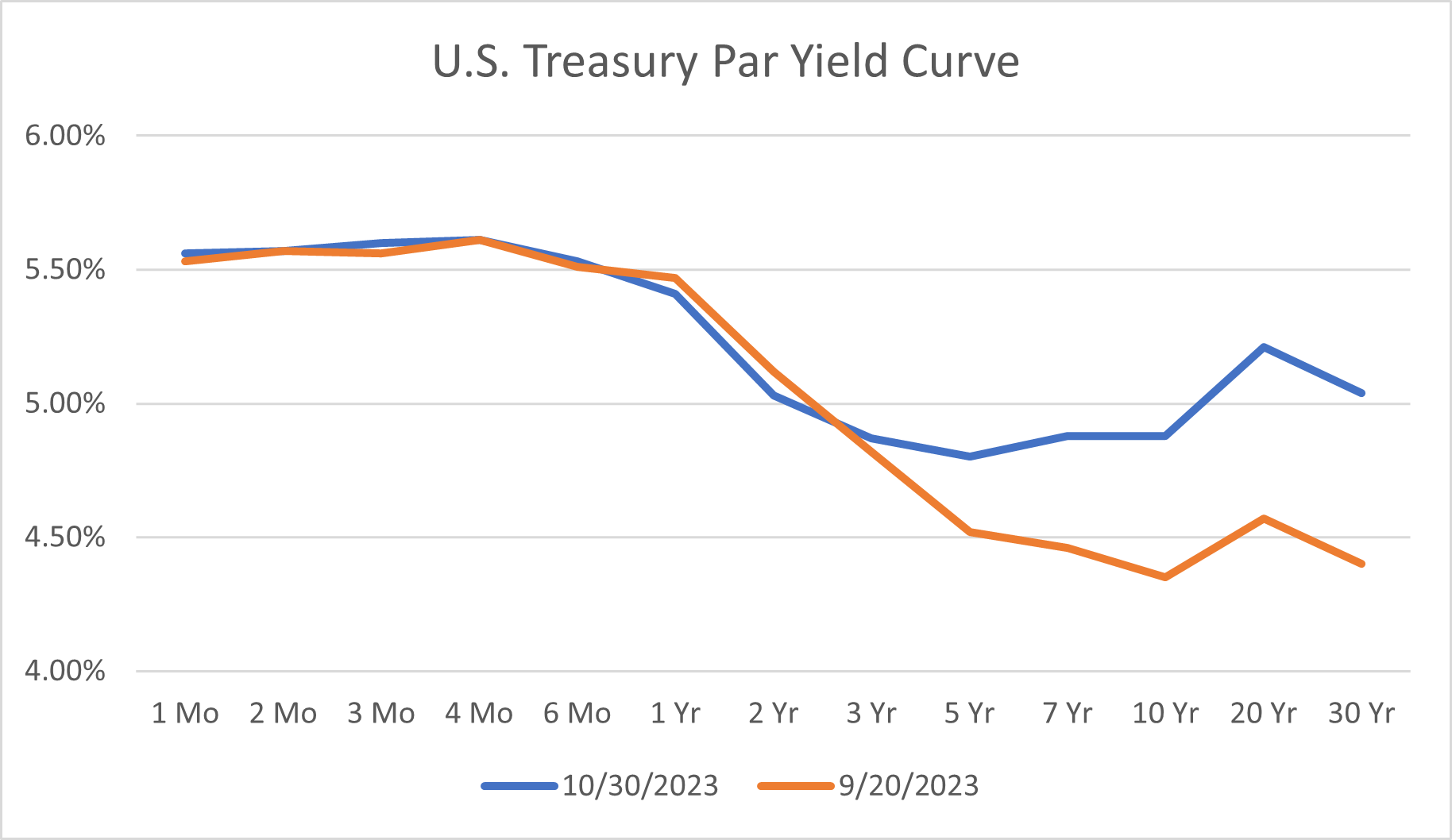

Since the latest cycle of rate increases began in March of last year, the Federal Reserve has raised the Fed Funds Rate to 5.50%, marking the fastest rate hike cycle in history. We may be coming close to the end of the tightening cycle, as the last five increases have been made in smaller increments of 0.25% each. Until recently, many market analysts believed that there would be rate cuts beginning in 2024, with expectations that inflation would abate, and economic growth would soften enough to make it safe to do so without reigniting inflation. However, this expectation was dashed after Federal Reserve Chair Jerome Powell recently remarked that there would be a pause to rate hikes but that they would be held where they are for the foreseeable future, coining a new term called the "bear pause." This has fueled a dramatic increase in the long end of the treasury curve in the last few weeks, with the 20-year treasury moving well past the 5% rate, and now bringing it within throwing distance of the Fed Funds 5.5% target rate.

Another potential headwind to further increases in interest rates could come from the $7.6 trillion of U.S. government bond maturities coming due in 2024. With foreign purchases down on the year and below-average treasure auctions, the question becomes who will absorb all the new treasury issuance.

Lastly, recent economic data has not provided a compelling argument for rate cuts. The latest Job Openings and Labor Turnover (JOLTs report) showed a five-standard deviation move to the upside, with 9.6 million available jobs, above the 8.8 million estimates. Jerome Powell's focus on reducing this figure to keep wage inflation at bay shows no sign of improvement yet. Alongside JOLTs are the non-farm payroll figures, with September's figures showing a monthly increase of 366,000 jobs, the highest since January of this year.

Although the tightening cycle could be over, longer-dated rates still have some catching up to do which could prove to be a challenging time for companies to raise capital, as banks continue to pull back from lending due to higher perceived risks from underwriting higher interest rate loans. Furthermore, the liquidity issues some banks experienced earlier this year could resurface. Rather than individuals withdrawing money out of banks to invest in higher-yielding vehicles, it could manifest in doing it to cover student loans and pay off mounting credit card debt. While these are some of the effects of raising interest rates, it will take time for markets to fully digest this higher yield environment.

CPI Data:

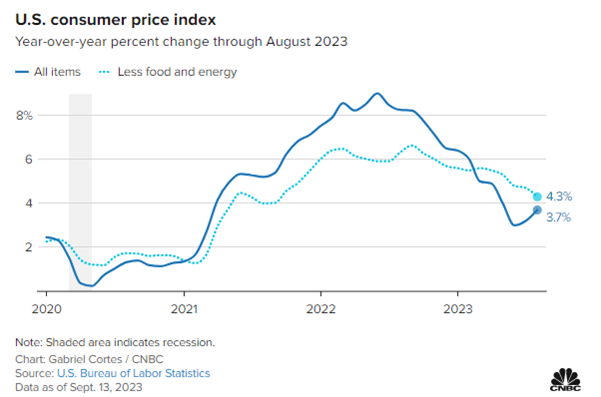

CPI has declined to +3.7% annually, with the latest August figure posting a 0.6% increase, showing some persistence in elevated inflation, predominantly from energy, which came in at 5.6% month-over-month. Core CPI, which excludes food and energy, is currently annualized at 4.3%. The base case is that inflation continues to trend downward, but it might be a bumpy road down, at least for the first half of next year, as some inflationary risks persist. OPEC+ has continued to cut oil production, and the U.S. strategic reserve has hit another recent low. Workers are looking for salary increases in real terms, which could cause a wage spiral and supply-side inflation. One notable example is the unprecedented United Auto Workers strike against three major automotive companies: General Motors, Ford, and Stellantis. This is the first time the union has gone against all three automakers simultaneously, and these three companies make up approximately 40% of all U.S. car manufacturing, which could impact production and elevate car prices. However, given the recent increases in long-term rates and continued reduction in The Federal Reserve balance sheet trends, it would take some major exogenous shock for there to be a major upward tick in inflation.

Israel/Hamas Conflict:

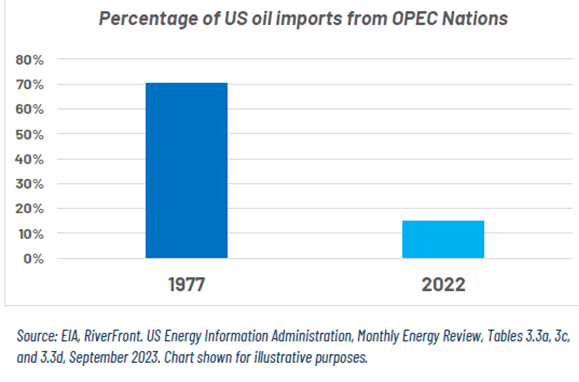

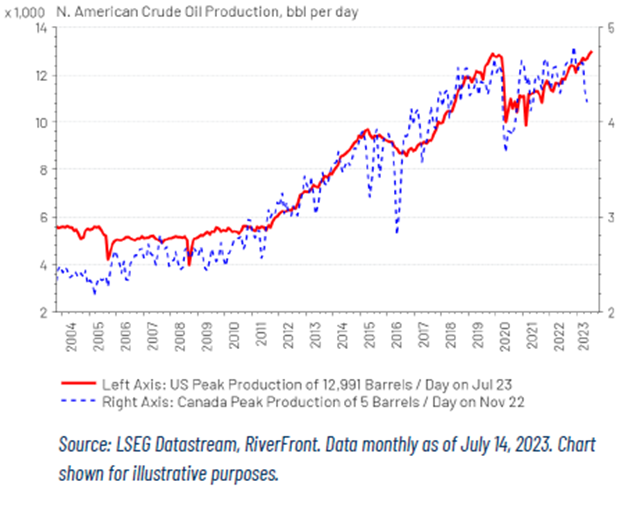

The horrifying Hamas attack on Israel and Israel's subsequent declaration of war have not only caused political unrest and humanitarian concerns, but also elevated geo-political implications from an investment perspective. Some say this conflict is akin to the Yom Kippur War of 1973, where oil prices tripled in three months and remained elevated throughout the embargo that ended in 1974. Although there are some inherent risks of higher oil prices and their negative spillover effects on broader markets, things are structurally different today compared to the 1970’s. In 1973, the US was the world’s largest petroleum importer and relied very heavily on Arab nations to supply them. So invariably when sanctions were levied on the U.S., oil prices went hyperbolic. Today, the U.S. is much better positioned from the “shale revolution” which provides technological advancements in drilling and has helped unlock more onshore oil in places like the Texas Permian Basin. This has led the U.S. to become a net exporter for the first time since the 1940s, providing us with much more leverage than in the past. The charts below help prove this thesis of less reliance on outside sources for oil and more onshore drilling.

The conflict has so far remained contained between Israel and Hamas and over the past years, Israel’s relations with Saudi Arabia and the UAE have strengthened. This could help insulate negative market impacts but if Iran and its proxies decide to support Palestine, oil prices could rise, albeit not to the same effect as the 1970’s.

Regardless of direct energy implications, the uncertainty and geo-political risks of the conflict are likely to weigh negatively on financial assets. However, historically the negative impact of such conflicts has been relatively short lived.

Looking Ahead:

As we turn our attention to the year-end, it is challenging to see how this market cycle plays out. Thus far in October yields have remained elevated while equities have continued their slide from the July peak, with the S&P 500 off nearly 9% over the last three months. With limited positive news or data to point to, investor sentiment remains negative and uncertainty heading into the end of the year remains elevated.

The current backdrop highlights the importance of having a well-diversified, disciplined portfolio. We can look to the past to see how it aligns with current events, but I like to keep in mind what Mike Tyson said, “Everyone has a plan 'till they get punched in the mouth." If history does not end up rhyming, owning a portfolio of high quality, diversified assets anchored in a disciplined approach mitigates the potential for emotional reactions to volatility and negative news, ultimately increasing an investor’s chance of success over the long term.

|

Josh L. Galatzan, CIMA® |

Kirk Price |

|

Chris J. Popso |

Brian J. Noonan, CEPA |

|

Meagan Moll, CIMA®, CFP®, CPWA® |

The content of this publication should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Information presented should not be construed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. Content is derived from sources deemed to be reliable. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. All investments have the potential for profit or loss. Past performance does not ensure future investment success.

Index returns do not represent the performance of Meridian Wealth Advisors or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment advisory fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that an investor’s portfolio will match or outperform any particular benchmark.

Meridian Wealth Advisors, LLC is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

2 https://www.statista.com/chart/28437/interest-rate-hikes-in-past-tightening-cycles/